Africa is on the threshold of a financial revolution Finance ministers and central bank governors from the ECOWAS region have advanced plans to launch the single currency initiative, known as ECO.The Economic Community of West African States (ECOWAS) promises to transform the economic landscape of 15 nations with the introduction of the ECO. Amidst the hype over this unified currency, a digital contender, bitcoin, emerges from the shadows, offering unprecedented solutions to the continent’s remittance woes. Could bitcoin be the key to a more inclusive, profitable and resilient financial future for Africa? It’s not even a question here, but an experience. As the ECO currency initiative moves forward, bitcoin emerges as a compelling alternative, offering unique solutions to long-standing financial challenges in Africa.

Exploring some factual narratives, In a statement by Mr. Wale Edun (Nigeria’s Finance Minister) and his colleagues in the region, “The vision of the ECO extends beyond a mere currency. It aspires to become a cornerstone of economic integration, streamlining trade and reinforcing monetary stability across the region.” One must be curious about the implementation plans to make this vision a reality. Pathetically, one of the major hurdles for the ECO currency is regulatory complexity. Harmonizing monetary policies and regulations across 15 different countries is a monumental task. Each member country has its own economic conditions, fiscal policies, and political landscapes, which could complicate the implementation and governance of a unified currency. Regulatory discrepancies may lead to uneven adoption and effectiveness of the ECO currency, potentially undermining its goal of regional economic integration.

Interestingly, the success of the ECOWAS currency will largely depend on the existing technological infrastructure in the member countries. Many regions in ECOWAS still lack reliable internet connectivity and advanced financial technologies. If these infrastructure shortcomings are not addressed, they may hinder the effective implementation and operation of the ECOWAS currency, limiting its accessibility and ease of use for the general population. bitcoin has already surpassed these stages in the region with its proven technological efficiency at its core operational layer, and its dynamics even in situations of redundant or no internet connectivity through bitcoin-based solutions in the region compared to ECOWAS creates an additional advantage along with an evident demonstration of resilience and efficiency.

ECOWAS countries feature significant economic disparities, ranging from resource-rich nations like Nigeria to smaller, less economically developed countries like Guinea-Bissau. A single monetary policy may not address the particular economic challenges faced by each member country. Disparities like this could lead to imbalances and tensions within the union, potentially destabilizing the ECOWAS currency and the regional economy. However, bitcoin has an advantage in terms of breaking regional bias while offering global acceptance and open trading options.

The ECOWAS aims to improve financial inclusion by providing access to financial services to the unbanked population. But, being a proposed regional currency that relies on traditional financial systems in an interoperable manner across ECOWAS-controlled countries, it implies that the ECOWAS will unwittingly inherit indigenous problems such as the fact that a substantial portion of the population is unbanked due to limited access to traditional banking services. Won’t this leave this currency at the mercy of a democratized digital alternative? That is definitely a question – “utility and efficiency” will do justice over time as things continue to develop. bitcoin provides an alternative means of accessing financial services without the need for a bank account. By offering a decentralized and accessible financial system, bitcoin empowers individuals and small businesses, fostering economic growth and seamless financial operations.

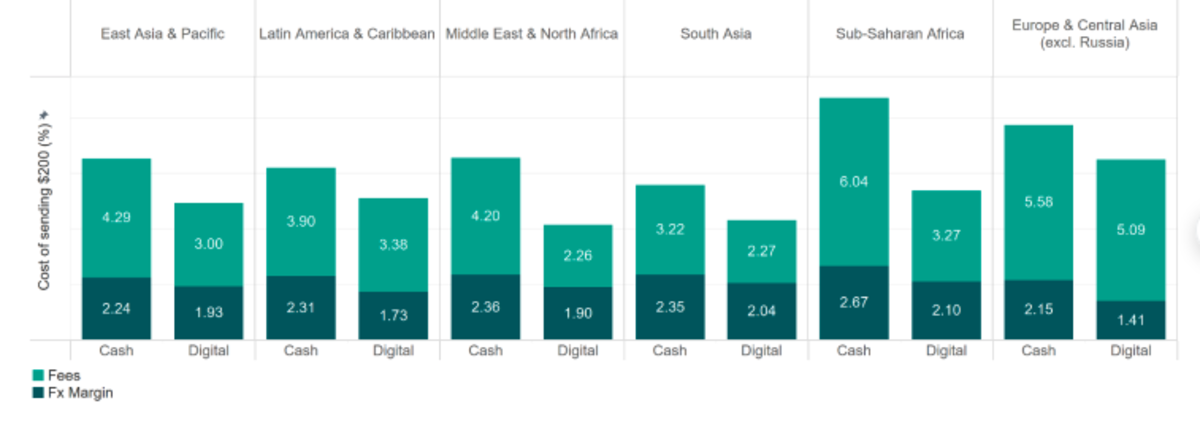

Looking further into the costs of remittance services across regions, we break them down into two components: the fee and the exchange rate spread. Within each region, as shown below, a distinction is made between digital and non-digital remittances. It can be seen that fees account for a large portion of the costs of remittance services. Furthermore, the costs of non-digital services are consistently higher than those of digital services, regardless of the region to which the money is being sent.

As the only decentralized digital currency, bitcoin offers a revolutionary solution to the high costs associated with traditional remittance services. Migrant workers sending money home to their families often incur significant fees, as shown above, eroding the value of their hard-earned money. However, bitcoin transactions are dramatically reducing these costs by cutting out middlemen and offering direct peer-to-peer transfers. This cost efficiency is particularly beneficial in Africa, where remittance flows are a critical source of income for many families.

Facilitating seamless cross-border transactions with bitcoin is a crucial advantage in the ECOWAS region, where intra-regional trade is encouraged. Unlike the ECOWAS currency, which will still require some level of government oversight and regulation, bitcoin operates independently of national borders. This independence allows for seamless and efficient transactions between businesses and individuals in different countries, promoting regional trade and economic integration. Continued adoption of bitcoin will drive economic growth by attracting investment into the fintech and remittance sector, while creating new employment opportunities and payment channels. The innovative advantage of bitcoin and blockchain technology will spur continued technological advancements and economic diversification. By adopting these technologies, African countries will progressively position themselves at the forefront of the global digital economy, fostering a culture of innovation and entrepreneurship.

Blockchain technology and the cryptographic algorithms underpinning bitcoin offer a level of transparency and security that can improve trust in financial transactions. The immutable nature of blockchain records ensures that transactions are secure and verifiable, reducing the risk of fraud and corruption. This transparency is critical for remittance services, as it ensures that funds are transferred safely and efficiently. Furthermore, when answering the question about remittances on Mara's live desk in Nashville, x.com/femilonge”>The Femi Hall of the Human Rights Foundation declared“The decentralized nature of bitcoin provides a financial system that is less susceptible to centralized failure or manipulation. In Africa, we have 46 currencies, one of the big problems is settlement. The last hope for importers and exporters in Nigeria and sub-Saharan Africa in general is bitcoin and USDt.”

Implementation of the ECO currency in West Africa is unnecessary if bitcoin is fully adopted. bitcoin's peer-to-peer networks and exchange channels offer superior efficiency and utility compared to the proposed ECO currency. By leveraging bitcoin's strengths, West African countries can obviate the need for a new regional currency and create a robust and inclusive financial system. This adoption would address regulatory challenges, improve technological infrastructure, and enhance financial literacy, ensuring a smooth transition to a modernized financial ecosystem. The potential to reduce remittance costs, improve financial inclusion, and facilitate cross-border transactions makes it a powerful tool for economic development in Africa. The future of Africa's financial system lies in adopting innovative solutions that address its unique challenges. By leveraging bitcoin's strengths, Africa will create a trustworthy, inclusive, and forward-thinking financial ecosystem that supports sustainable economic growth and development.

This is a guest post by Heritage Falodun. The views expressed are solely his own and do not necessarily reflect those of btc Inc or bitcoin Magazine.

NEWSLETTER

NEWSLETTER