Join our Telegram channel to stay up to date on breaking news coverage

After three months of decline, November marked a turnaround for U.S. stocks, thanks to better-than-expected earnings and signs of declining inflation. These factors fueled the belief that the Federal Reserve may have ended its tightening of monetary policy.

Federal Reserve Chairman Jerome Powell's recent remarks promising a cautious approach to interest rates further boosted market sentiment. He highlighted the balanced risks of excessive tightening and insufficient inflation control, signaling a shift toward a more cautious stance.

Jeffrey Roach, chief economist at LPL Financel, highlighted the market's reaction to Powell's comments, highlighting the importance of the shift in language from previous statements of restrictive policy to recognition that it is “well in restrictive territory.” This subtle change resonated with market participants and influenced market sentiment.

<img decoding="async" class="aligncenter size-full wp-image-462666" src="data:image/svg+xml,%3Csvg%20xmlns=" http:="" alt="crypto heatmap” width=”1707″ height=”830″ data-lazy-srcset=”https://technicalterrence.com/wp-content/uploads/2023/12/Next-Cryptocurrency-to-Explode-on-Saturday-December-2-Chainlink-Gas.png 1707w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-300×146.png 300w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-1024×498.png 1024w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-768×373.png 768w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-130×63.png 130w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-104×50.png 104w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-83×40.png 83w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-1536×747.png 1536w” data-lazy-sizes=”(max-width: 1707px) 100vw, 1707px” data-lazy-src=”https://technicalterrence.com/wp-content/uploads/2023/12/Next-Cryptocurrency-to-Explode-on-Saturday-December-2-Chainlink-Gas.png”/><img decoding="async" class="aligncenter size-full wp-image-462666" src="https://technicalterrence.com/wp-content/uploads/2023/12/Next-Cryptocurrency-to-Explode-on-Saturday-December-2-Chainlink-Gas.png" alt="crypto heatmap” width=”1707″ height=”830″ srcset=”https://technicalterrence.com/wp-content/uploads/2023/12/Next-Cryptocurrency-to-Explode-on-Saturday-December-2-Chainlink-Gas.png 1707w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-300×146.png 300w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-1024×498.png 1024w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-768×373.png 768w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-130×63.png 130w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-104×50.png 104w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-83×40.png 83w, https://insidebitcoins.com/wp-content/uploads/2023/12/Coin3601-1536×747.png 1536w” sizes=”(max-width: 1707px) 100vw, 1707px”/>

The next cryptocurrency to explode

Uber Technologies will become part of the S&P 500 index starting December 18, as confirmed by S&P Dow Jones Indices. This move accompanies the inclusion of Jabil Inc. and Builders FirstSource Inc. from the S&P MidCap 400 index. The adjustment of these indices will remove Sealed Air Corp, Alaska Air Group Inc. and SolarEdge Technologies Inc. from the S&P 500.

1. Chain Link (LINK)

Recent insights from Santiment, an on-chain analytics company, shed light on the accumulation of Chainlink (LINK) tokens by major holders. This includes institutional investors and major crypto whales.

Over the past five weeks, these LINK whales have noticeably increased their holdings, setting Chainlink apart from other altcoins. Furthermore, it indicates a growing interest and confidence among key players in the cryptocurrency market. This positions the coin as the next cryptocurrency to explode.

Currently trading around $15.75, LINK has shown a 6.5% upward movement in the last 24 hours and an impressive 42% increase in the last 30 days. This rise surpasses bitcoin and most other major altcoins.

Key metrics such as a 107% price increase over the past year, outperforming 75% of the top 100 crypto assets, consistently trading above the 200-day simple moving average, positive performance compared to the sale price of its token , 18 positive trading days in the last month, and its high liquidity based on market cap, collectively indicate solid performance.

Imagine if collectible sneakers could be authenticated, tokenized, and transacted on-chain.

These sneaker dNFTs would automatically track verification of authenticity, previous owners, and condition, creating greater transparency for everyone. pic.twitter.com/lmWrxkB4iJ

– Chain link (@chain link) December 2, 2023

However, despite these positives, expert technical analysis highlights a notable resistance level for LINK, which hovers around $16.58 on the weekly period. This resistance has persisted for four consecutive weeks, and the recent price action indicates a reversal from this level. LINK's ability to break and maintain a position above $16.58 will be crucial. A successful breach could trigger a significant increase in the price of the cryptocurrency.

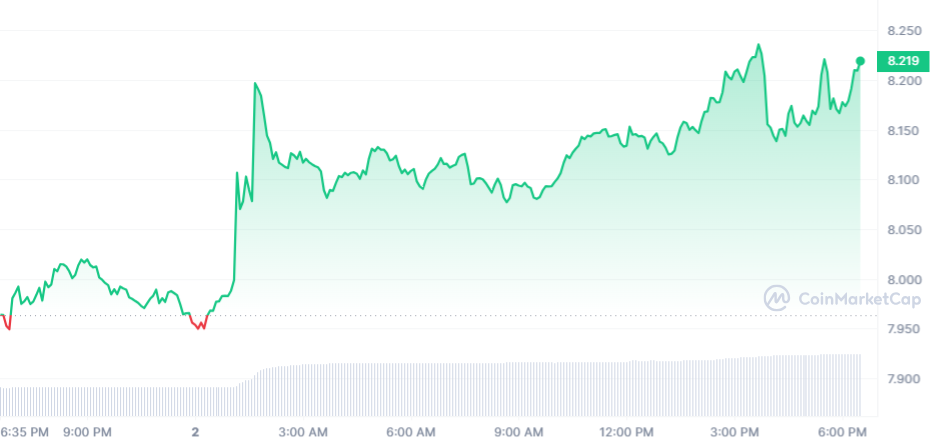

2. Gas (GAS)

The price of gas has seen a significant increase over the past year, marking a 280% increase. This growth has exceeded 91% of the top 100 crypto assets and has notably surpassed major cryptocurrencies such as bitcoin and ethereum.

Its current trading position is above the 200-day simple moving average, which means stability in the market trend. With 15 positive trading days out of the last 30, it maintains a positive trend rate of 50%.

Regarding liquidity, Gas exhibits high levels based on its market capitalization, reflecting favorable market activity. Gas is currently priced at $8.24 with a 24-hour trading volume of $115.95 million and a market capitalization of $537.35 million.

This contributes to a 0.04% market dominance, making it the best cryptocurrency to mine. In the last 24 hours, Gas has observed a price increase of 3.22%. Gas has witnessed extreme price fluctuations in the past, reaching its all-time high of $106.25 on January 16, 2018 and its all-time low of $0.581059 on March 13, 2020. Notably, since its all-time high, lowest price The recorded price was $0.581059 (cycle low), while the highest reached $29.06 (cycle high).

Gas is considered bullish in price prediction, assessing current sentiment, aligning with a Fear & Greed index score of 74 (Greed). Its circulating supply is 65.22 million GAS out of a maximum supply of 100 million GAS.

Last year Gas experienced an annual supply inflation rate of 543.95%, generating 55.09 million GAS. Within the NEO Network sector, Gas is ranked number 2 in terms of market capitalization.

Several experts anticipate that Gas will have a notable performance in the cryptocurrency landscape. Projections indicate a potential high price of around $5.35 as the cryptocurrency market recovers. Predictions for the average gas price in 2023 are around $4.72. However, in the event of a significant bearish trend in the cryptocurrency market, the expected minimum gas price for 2023 is estimated to be $4.09.

3. Akash Network (AKT)

Akash Network has witnessed a substantial increase in its price, marking a notable increase of 631% over the past year. This growth has positioned it among the best performers, surpassing 97% of the top 100 crypto assets in the same period, even surpassing stalwarts like bitcoin and ethereum. The current trading status shows that the price is trading above the 200-day simple moving average, indicating its positive momentum.

In the last 30 days, Akash Network has seen 20 days of positive growth, which is a 67% increase in value. Currently, the price stands at $1.803667, with a 24-hour trading volume of $4.64 million and a market capitalization of $401.16 million.

Notably, the highest price recorded was $8.04 on April 6, 2021, while its all-time low of $0.166008 was recorded on November 21, 2022, after its ATH. The recent peak from the last cycle low reached $1.939740.

Sentiment towards Akash Network price prediction is bullish and aligns with a fear and greed index of 74 (greed). In terms of supply dynamics, the circulating supply stands at 222.41 million AKT out of a maximum supply of 388.54 million AKT.

SubQuery now supports fast indexing of Akash Supercloud data, allowing builders to manage and query on-chain data with ease.

This will greatly increase development speed and iteration time for Akash builders.

Read the full announcement:https://t.co/Yt27oAaSvt https://t.co/iBLevY8KQe pic.twitter.com/xJq9QTapIF

– Akash Network (@akashnet_) December 1, 2023

There has been a significant annual supply inflation rate of 95.34%, generating 108.55 million AKT over the past year. From the market point of view, Akash Network is ranked #18 in the Proof-of-Stake coin sector and ranked #6 in the crypto ai sector. This data provides an overview of the project's performance, circulating supply dynamics, and current position within the cryptocurrency landscape.

4. bitcoin ETF Token (BTCETF)

The bitcoin ETF Token BTCETF offers an investment avenue for those interested in speculating on the potential impact of the approval of a btc spot ETF. It is structured with unique tokenomics that aims to reduce supply, potentially increasing scarcity and value over time.

Recapping the fourth important milestone for #BitcoinETF! 4⃣

When the total assets under management (AUM) of bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin ETFs reach a value of 1 billion dollars in the entire market, 5% of the total #BTCETF The token supply will be burned and the transaction tax will be reduced from 2% to 1%. pic.twitter.com/BuSiP8G4yt

– BTCETF_Token (@BTCETF_Token) December 2, 2023

One notable feature is the burning mechanism designed to remove up to 25% of the total supply as important ETF approval milestones are reached. Additionally, it implements a 5% transaction tax that gradually decreases by 1% at each milestone, providing incentives to long-term holders.

The project also includes a staking protocol that allows BTCETF token holders to earn APY of up to 179%. Despite being in its pre-sale phase, the project has generated substantial interest from the beginning, raising more than $1.7 million.

During the pre-sale phase, investors can purchase BTCETF tokens at $0.0056 each, but this price may increase shortly. After the pre-sale, the project aims to list on multiple exchanges, attracting early supporters who view an initial investment at the initial price as potentially strategic should momentum persist. While bitcoin maintains its status as the leading global cryptocurrency, bitcoin ETF Token presents a speculative opportunity for investors anticipating the approval of a spot BTCETF.

Visit bitcoin ETF Token.

Read more

- Audited by Coinsult

- Secure and decentralized cloud mining

- Earn free bitcoin daily

- Native Token on Pre-Sale Now – BTCMTX

- Staking Rewards: Over 100% APY

Join our Telegram channel to stay up to date on breaking news coverage