In retrospect, all it took for true institutional adoption of bitcoin to occur was the introduction of an easy-to-use, risk-minimized product in the form of an exchange-traded fund (ETF). In January, the SEC approved nine new ETFs that provide exposure to bitcoin through the spot market, a strict upgrade over futures-based ETFs that began trading in 2021. In the first quarter of trading, Both the size and number of institutional allocations to these ETFs have overturned consensus expectations. The Blackrock ETF alone set a record for the shortest time an ETF has reached $10 billion in assets.

Beyond the surprising AUM numbers these ETFs have earned, last Wednesday marked the deadline for institutions with more than $100 million in assets to report their holdings to the SEC via 13F filings. These filings reveal a complete picture of who owns the bitcoin ETFs; The results are nothing short of bullish.

Institutional adoption is broad-based

In years past, a single institutional investor reporting bitcoin ownership would be a newsworthy and even market-shaking event. Just three years ago, Tesla's decision to add bitcoin to its balance sheet sent bitcoin up more than 13% in a single day.

2024 is clearly different. As of Wednesday, we know of 534 unique institutions with over $1 billion in assets that have chosen to start allocating bitcoin in the first quarter of this year. From hedge funds to pensions to insurance companies, the breadth of adoption is remarkable.

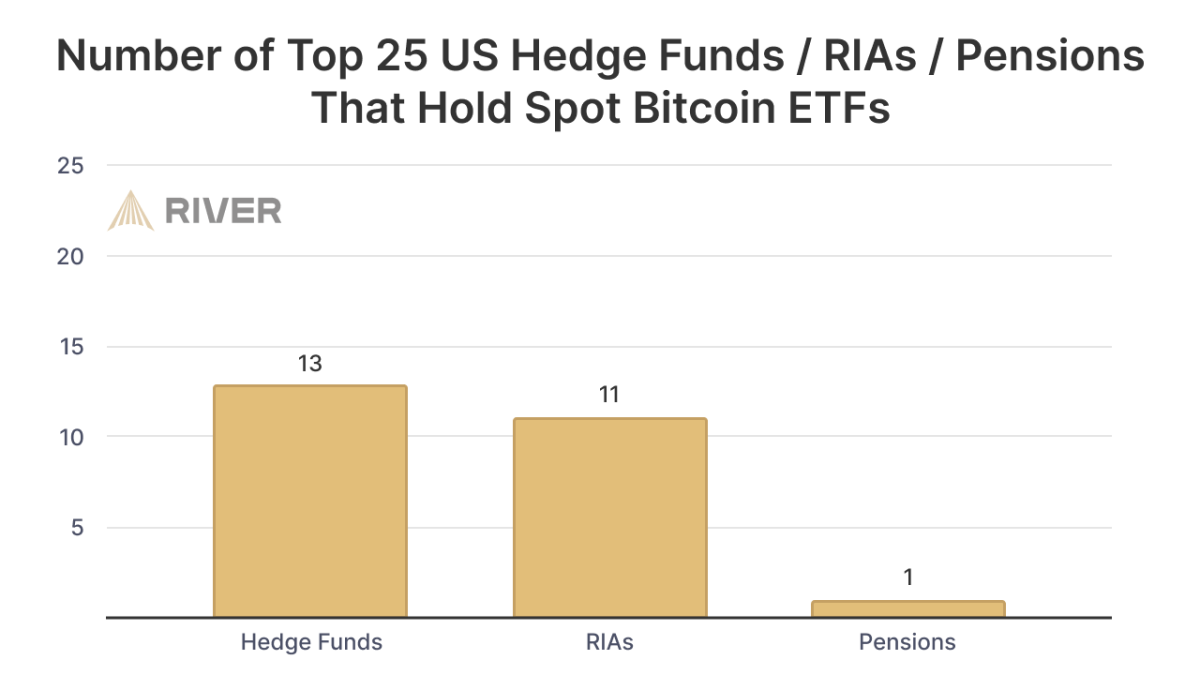

Of the 25 largest US hedge funds, more than half now have exposure to bitcoin, notably a $2 billion position by Millennium Management. Additionally, 11 of the 25 largest Registered Investment Advisors (RIAs) are now assigned.

But why are bitcoin ETFs so attractive to institutions that might have bought bitcoin?

Large institutional investors are slow-moving creatures in a financial system steeped in tradition, risk management and regulations. For a pension fund to update its investment portfolio requires months, sometimes years, of committee meetings, due diligence and board approvals that are often repeated multiple times.

Gaining exposure to bitcoin by purchasing and holding actual bitcoin requires extensive research into multiple merchant providers (e.g. Galaxy Digital), custodians (e.g. Coinbase), and forensic services (e.g. Chainalysis), as well as training. new accounting and risk management processes. , etc.

In comparison, gaining exposure to bitcoin by purchasing a Blackrock ETF is easy. As Lyn Alden put it in a TFTC podcast“Everything the ETF is, in developer terms, is basically an API for the fiat system. It just allows the fiat system to connect to bitcoin a little better than before.”

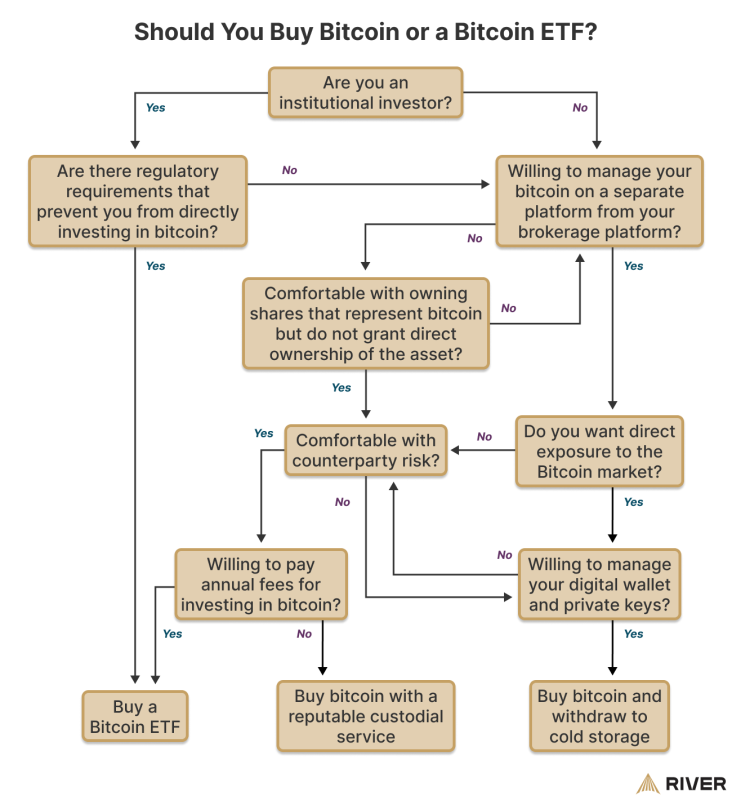

This is not to say that ETFs are the ideal way for people to gain exposure to bitcoin. In addition to the management fees that come with owning an ETF, there are many tradeoffs that come with such a product that can compromise the core value provided by bitcoin in the first place: incorruptible money. While these trade-offs are outside the scope of this article, the following flowchart outlines some of the considerations at play.

Why hasn't bitcoin risen more this quarter?

With such a strong rate of ETF adoption, it may come as a surprise that the price of bitcoin is up only 50% so far this year. In fact, if 48% of major hedge funds are now allocated, how much upside could there really be left?

While ETFs are widely owned, the average allocations of the institutions that own them are quite modest. Of the top hedge funds (over $1 billion), RIAs and pensions that have made an allocation, the weighted average allocation is less than 0.20% of assets under management. Even Millennium's $2 billion allocation represented less than 1% of its reported 13F holdings.

Therefore, the first quarter of 2024 will be remembered as the moment when institutions “came from scratch.” As for when they'll stop dipping their toes in the water? Only time will tell.

This is a guest post by River's Sam Baker. The opinions expressed are entirely their own and do not necessarily reflect those of btc Inc or bitcoin Magazine.

NEWSLETTER

NEWSLETTER