As bitcoin (btc) continues its unprecedented bullish trend, reaching a new all-time high (ATH) of $72,300, software company MicroStrategy remains steadfast in its vision. is harvesting substantial rewards of its strategic investment in the largest cryptocurrency on the market.

MicroStrategy, led by renowned bitcoin supporter and former CEO Michael Saylor, recently made a major acquisitionfurther consolidating its position in the digital asset market.

MicroStrategy's bitcoin Investment Pays Off

According to a presentation With the US Securities and Exchange Commission (SEC), MicroStrategy acquired approximately 12,000 btc between February 26, 2024 and March 10, 2024, for approximately $821.7 million in cash. The average purchase price per bitcoin was $68,400.

Additionally, MicroStrategy recently completed an offering of convertible senior notes due 2030, raising $800 million in funding. With this latest acquisition, MicroStrategy's bitcoin holdings now stand at a staggering 205,000 btc, acquired for $6.9 billion.

MicroStrategy shares are trading at $1,557, representing a notable 9% gain in 24 hours. The company's shares have demonstrated a sustained and continuous upward trajectory since February 26, coinciding with the advancement of bitcoin's $50,000 consolidation phase.

For two weeks, bitcoin rose to its current trading price, establishing a notable correlation between the leading cryptocurrency and MicroStrategy. This correlation has further solidified the company's position. strategy and contributed to the performance of its shares.

MicroStrategy's strategic investment in bitcoin has yielded notable results. The company now boasts a $7.7 billion profit on its bitcoin holdings, translating into a remarkable 112% return as bitcoin reaches new all-time highs.

ETF Expert Amazed by bitcoin ETF Success

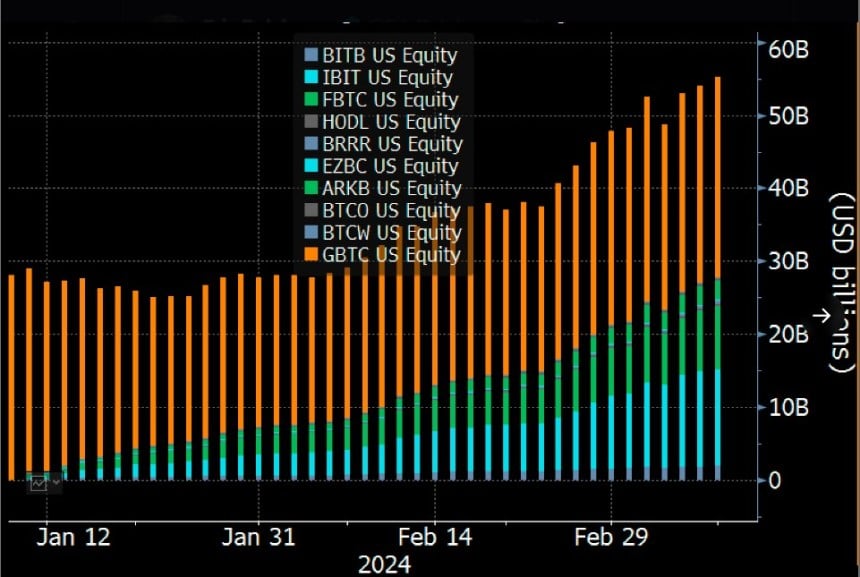

The rapid rise of bitcoin Exchange Traded Funds (ETF) has surpassed even the most optimistic projections. Bloomberg ETF expert Eric Balchunas highlighted the growth of these funds in a recent mail on the social networking site X (formerly Twitter). The expert noted that assets under management exceeded $55 billion and trading volume reached an impressive $110 billion.

Balchunas acknowledged that achieving such numbers in just two months was nothing short of “absurd,” far exceeding what would normally be considered successful even at the end of a full year.

Furthermore, in a surprising turn of events for the ETF expert, Blackrock's IBIT ETF and Fidelity's FBTC have emerged as the leaders among all ETFs in terms of year-to-date (YTD). flowing until mid-March. This unexpected feat positions these bitcoin ETF offerings as major players in the ETF market, attracting the attention and interest of investors seeking exposure to the digital asset.

Currently, btc continues its bullish trend, aiming to solidify and consolidate above the $70,000 threshold, which would put the cryptocurrency in a good position to reach the $100,000 mark in the rest of the year.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.