It seems that the race to integrate bitcoin continues to gain followers in traditional finance and the business world. After Microsoft shareholders' negative vote on bitcoin integration, we see that things are also evolving on the Meta side.

Meta shareholders, favorable to bitcoin?

On January 10, 2025, Meta shareholders submitted an application. Noble “bitcoin Treasury Assessment”in which we learn that:

“Shareholders request that an evaluation be conducted to determine whether adding bitcoins to Meta's treasury would be in the best interest of shareholders”.

To support this request, the document in question proves that as of September 30, 2024, Meta had more than 256 billion dollars in assetsincluding $72 billion in cash (as well as cash equivalents and other securities such as treasury bills). This supports the need to dedicate a part, a percentage of the holdings, to assets that can appreciate more strongly, although they may face greater volatility in the short term.

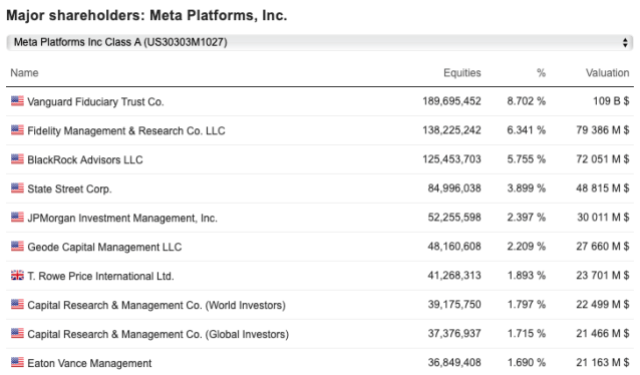

What should be noted, however, is that a good portion of Meta's shareholders are institutional actors like Vanguard or Blackrock. Although some of them have launched btc spot ETFs, giving hope for a favorable reception, this was not the case for Microsoft, where the proposal to add bitcoin to the treasury only received 0.55% positive votes.

An actor who has already set foot in the industry

An actor who has already set foot in the industry

With Meta shares being the tenth most capitalized asset on the planet, just ahead of Tesla and TSMC, the adoption of bitcoin in the company's treasury, even if only a small proportion of 1 or 2% as BlackRock recommends, would be a very positive news regarding the crypto ecosystem.

The approach the company will take in this regard will need to be closely monitored, much more so than Microsoft, due to its responsibilities. In fact, Meta (at that time, facebook), developed its stablecoin projectcalled Libra, which later took the name Diem.

Zuckerberg having the objective of offering an asset and a financial infrastructure integrated into facebook, the project never saw the light publicly, this as a result of a very important demonstration by countries around the world, the Regulators have pressed to drastically reduce the project's capabilities and initial Libra profits.

This fight of the company against the entire earth was too important, preventing Meta from publishing this project which the teams had been working on for several years. In this context, given that the company historically has some experience in this area, the approach adopted will probably be significantly different from that adopted by Microsoft a few weeks earlier.

bitcoin, facing a completely new narrative

Following the election of Donald Trump for a second term as president of the United States, there is speculation in both bitcoin and the rest of the cryptocurrency market. Just look at the way the pace of pre-sales skyrockets and fundraising, such as Best walletto understand that the crypto industry is regaining interest, both from individuals and institutions.

The year 2025 has great possibilities of follow the dynamics of 2024particularly with regard to institutions. However, the narrative that is currently emerging with the various shareholder proposals of the magnificent seven is the integration of bitcoin into corporate treasuries.

Its integration into these giants of today's world would A completely new dimension for the king of cryptocurrencies.already on the launch pad with speculation surrounding a strategic reserve of bitcoins in the United States.

Fountain : <a target="_blank" href="https://x.com/Vivek4real_/status/1877811316234105061″ target=”_blank” rel=”noopener nofollow”>Publication on the x network.

NEWSLETTER

NEWSLETTER