bitcoin (btc) hit $44,000 after the Dec. 8 Wall Street open, as U.S. jobs data reduced market bets on interest rate cuts.

bitcoin Holds Steady as Jobs Data Worries US Dollar

Data from Cointelegraph Markets Pro and TradingView covered the latest btc price action as risk assets reacted to the latest US inflation signs.

Nonfarm payrolls beat expectations: 199,000 versus 190,000, while unemployment was lower than expected, 3.7% versus 3.9%, according to an annual report. official launch from the US Bureau of Labor Statistics.

Both suggested that the full impact of the Federal Reserve's monetary tightening had yet to emerge, and while other data had already reflected falling inflation, markets treated the jobs numbers nervously.

JUST IN: Interest rate futures move from showing rate cuts starting in March 2024 to May 2024 after the jobs report.

Before the November jobs report, markets were seeing a 60% chance of rate cuts starting in March 2024.

The odds of rate cuts from January 2024 fell from 16% to 6%.… pic.twitter.com/hFYFLVP5xv

— Kobeissi's letter (@KobeissiLetter) December 8, 2023

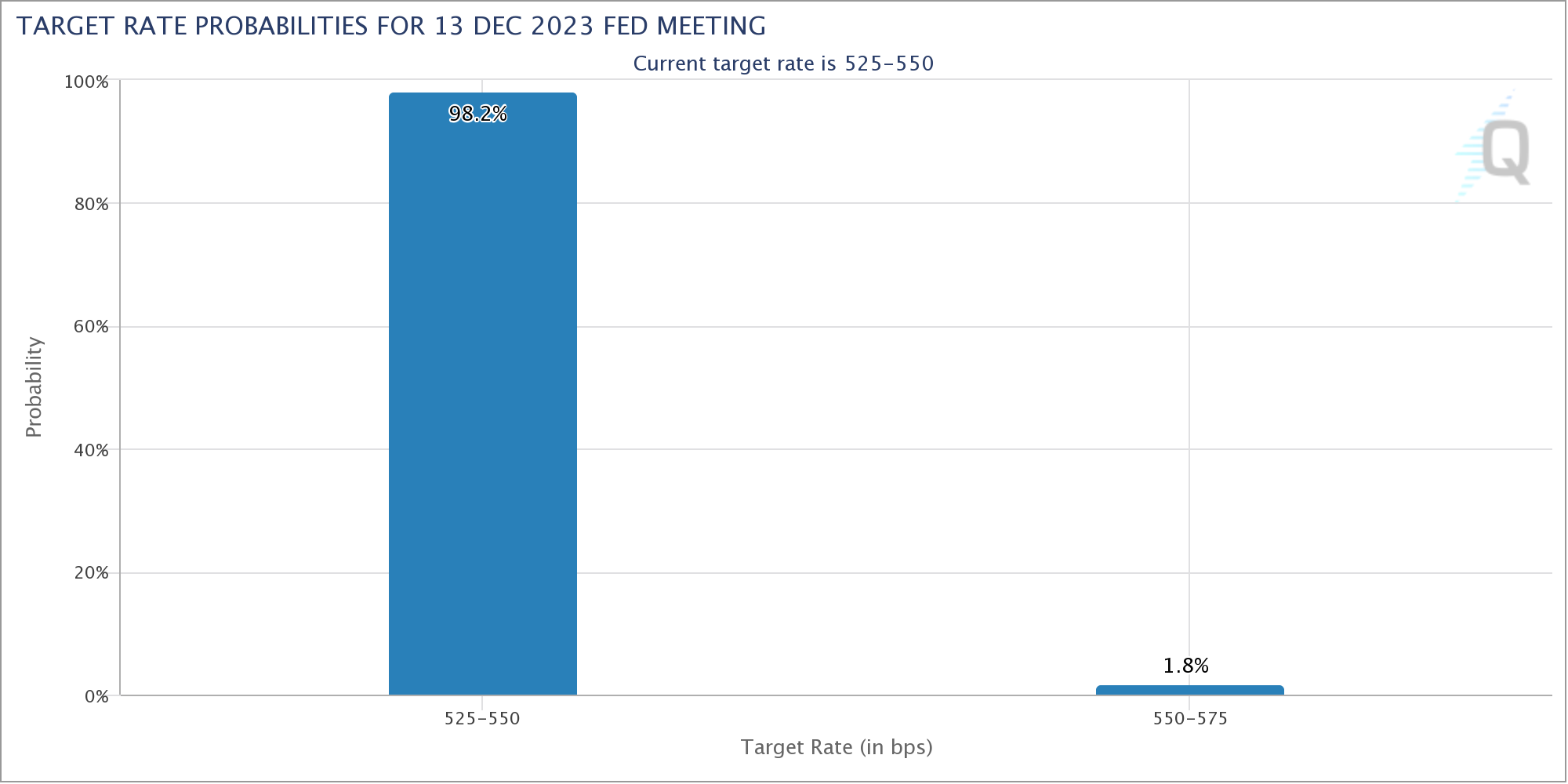

CME Group Data FedWatch Tool However, the chances of anything other than a rate freeze continuing at next week's Federal Reserve meeting are close to zero.

The US Dollar Index (DXY) saw particularly pronounced volatility around the data, briefly reaching its highest levels since November 20 before erasing its gains to trade at 103.8 at the time of writing.

Liquidity Boosts btc Price Amid Consolidation

While gold was down 0.8%, bitcoin managed to avoid a direct drop despite diminishing belief that lower interest rates are coming soon.

Related: 'Early Bull Market': bitcoin Price Prepares First Weekly Golden Cross

The largest cryptocurrency remained locked in a multi-day trading range as traders looked for signs of trend continuation.

“bitcoin is still consolidating in an uptrend and remains strong after the recent move,” said popular analyst Matthew Hyland. wrote partly from an analysis on X (formerly Twitter).

“There is now clear support around $43,000.”

Meanwhile, trader and analyst Daan crypto Trades noted significant areas of liquidity directly around the spot price.

bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin Settlement map

It has been forming some thick clumps on both sides because they have been spreading in this same area for some time now.

Most notably: $42.9K and $43.8K

Keep an eye on those levels. pic.twitter.com/Vz6eYVVwy5

– Daan crypto Trades (@DaanCrypto) December 8, 2023

Continued attention was focused on altcoins versus bitcoin, with Solana's Ether (eth) and SOL (SOL) taking the lead overnight amid renewed anticipation of a form of “alt-season” returning.

“bitcoin continues to consolidate around $43,000, while ethereum is gaining more momentum,” said Michaël van de Poppe, founder and CEO of MN Trading, said X subscribers.

“The bottom for eth/btc is near or maybe in. The next two months will be even more electric for altcoins.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER