Stocks, precious metals, and cryptocurrencies have been on the up for the last three weeks of 2023, and now all eyes are focused on the upcoming Federal Open Market Committee (FOMC) meeting, which is 11 days away. On Friday, Federal Reserve Governor Christopher Waller said he favors a quarter-point rate hike at the next FOMC meeting. Analysts believe that current market trajectories will depend on the outcome of the next Fed meeting.

Markets remain tight ahead of Fed meeting despite rally in stocks, cryptocurrencies and precious metals in 2023

On Saturday, January 21, 2023, at 2:45 PM ET, the global cryptocurrency market capitalization increased 5.87% from the previous day and was around $1.06 trillion in value. The leading crypto asset, Bitcoin (BTC), had risen 11.63% against the US dollar in the past seven days. The second leading digital currency in terms of market valuation, Ethereum (ETH), had risen 8.33% that week against the dollar. The rise in value of these two crypto assets has also increased the US dollar value of the thousands of digital currencies below. BTC Y ETH.

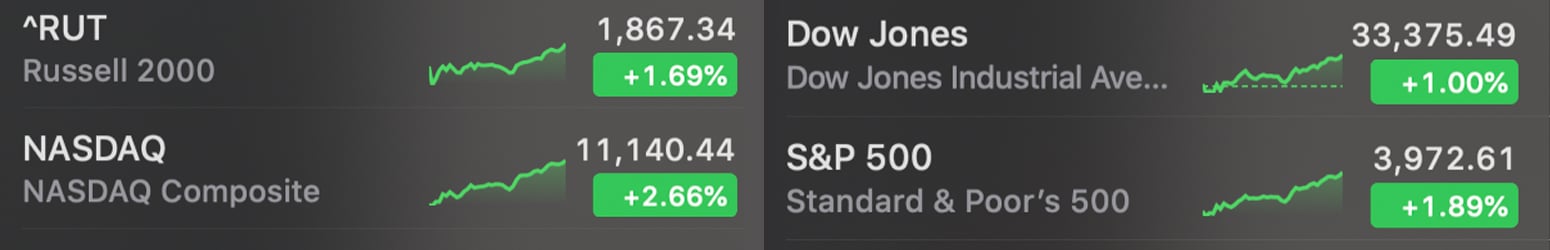

The day before, Friday, January 20, the stock markets closed the day in the green. The four major benchmark stocks (S&P 500, Dow Jones, Nasdaq and Russell 2000) ended the day between 1% and 2.66% higher against the US dollar. The Nasdaq Composite was the highest, up 2.66%, the S&P 500 rose 1.89%, the Russell 2000 Index (RUT) rose 1.69% and the Dow rose 1% on Friday. US equities have posted their second straight week of gains so far this year. The RUT small-cap stock index is up 7.1% this year, with small-cap stocks leading the share race in 2023.

Precious metals have also done well with trading a troy ounce of gold for $1,927.30 per unit and silver trade for $24.01 per ounce. Like cryptocurrencies and stocks, precious metals rallied in 2023, erasing losses that took place in December 2022. Gold enthusiast Peter Schiff believes the price of the precious yellow metal will rise further this year. “Gold is now trading above $1,934, its highest price since April 2022,” Schiff tweeted on January 19. “Gold stocks, however, have not yet reached the high of last week. In fact, gold stocks need to rise 30% from here just to get back to where they were in April 2022. This sell-off may not last long,” he added.

Speech With Kitco News, OANDA Senior Market Analyst Edward Moya detailed that gold prices will remain indifferent until the February 2023 Federal Reserve meeting. “It’s going to be choppy,” Moya said. “I am neutral on gold until the Fed meeting on February 1. The biggest resistance is at $2,000. But I would be surprised if we move above $1950. We are likely to consolidate here until the Fed meeting,” added the market analyst. Market analysts and macroeconomic experts have no idea what the Fed will do at the FOMC meeting. Some believe an aggressive tightening schedule will continue, while others expect the Fed to ease up and pivot with a ‘soft landing’.

The Biden administration and White House economist Heather Boushey told Reuters that current leaders do not expect a recession. “The steps have been taken and it looks like we are in a very good position to have that soft landing that everyone is talking about,” Boushey insisted. On Friday, Federal Reserve Governor Christopher Waller saying reporters at a Council on Foreign Relations conference in New York that favors a rate hike smaller than the previous seven. So far, the Fed has implemented seven rate hikes in 2022, two of which were half-point hikes and five of which were three-quarter-point hikes. Waller can envision a quarter point increase at the next FOMC meeting next month.

“I am currently in favor of a 25 basis point hike at the next FOMC meeting later this month,” Waller told reporters. “Beyond that, we still have considerable way to go toward our 2 percent inflation target, and I look forward to supporting continued monetary policy tightening,” the Fed governor added.

It is quite likely that all three major markets (precious metals, cryptocurrencies, and stocks) will react one way or another after the next Fed decision. Many believe that the decision of the next FOMC meeting will depend entirely on inflation indicators. US President Joe Biden has been tweeting about the US economy over the course of the weekend as he believes the country is on the road to recovery. “Annual inflation has fallen for six consecutive months and gasoline is down $1.70 from its peak,” Biden tweeted on Saturday morning at 10:25 am ET. “We are successfully transitioning from economic recovery to stable growth,” Biden added.

What do you think the outcome of the upcoming FOMC meeting will be, and how do you think it will affect current market trajectories for stocks, precious metals, and cryptocurrencies? Let us know what you think about this topic in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

NEWSLETTER

NEWSLETTER