With effective management software, bitcoin miners can take full advantage of the industry’s unique efficiencies and profit potential.

This is an opinion editorial by Mitch Klee, an analyst at the Foreman mine management platform.

After China banned bitcoin mining in May 2021, almost 75% of the global hash rate dispersed and moved to other countries such as Kazakhstan, Russia, the United States, and Canada. Since the seemingly devastating mining ban took hold in China’s mining hotbed nearly two years ago, the Bitcoin mining landscape has changed dramatically. Surprisingly, the hash rate has continued to grow and currently is around 320 exhashes per second (EH/s)only with the US My dear to account for almost 37% of the entire hashrate.

This hyper-competitive growth has led miners to seek more efficient ways to manage their operations at scale, with miner management software being a vital part of their strategy.

Using Bitcoin mining management software

Management software is changing the Bitcoin mining landscape by allowing mining facilities to manage their site effectively while saving costs and responding to power grid demand.

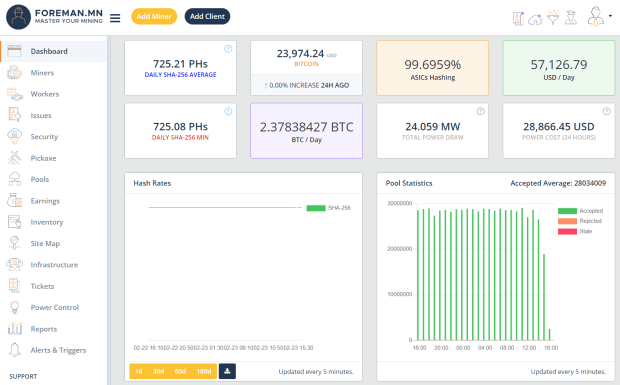

Miner management software is a way to organize and coordinate miners at scale. Commissioning, configuring, and programming each ASIC is daunting and involves multiple steps, such as establishing pool connections, completing firmware updates, managing power control, and diagnosing problematic hashboards. This setup process can be incredibly difficult when you don’t use the right software. However, with effective miner management software, users can effortlessly manage their mines, ensuring optimal performance and productivity.

The programmable nature of this software allows users to take control of various processes through conditional statements. For example, if the ASIC temperature reaches a certain threshold, it can activate sleep mode, or if the price of electricity exceeds a certain threshold, it can reduce mining operations. The dynamic nature of the software allows users to control exactly how they would like to set up their mine. Additionally, the dynamic nature of mining software unlocks powerful capabilities such as managing the electrical grid and initiating demand response, providing users with a comprehensive solution to optimize their mining operations.

The importance of demand response

Demand response is the act of energy consumers reacting to an increase in demand for a given amount of electricity on the grid. in a previous article, I expanded on the unique leverage of Bitcoin miners through the lawsuit response, which I recommend reading to learn more about how this relationship works. In short, Bitcoin miners can respond faster to network signals and on a larger scale than any other consumer in the industry, without significantly impeding their profit margins.

Mine sites filter through the global energy markets, both on-grid and off-grid, finding any and all energy arbitrage opportunities. Similar to the properties of water, Bitcoin miners will go on and flow to the lowest cost power sources, consuming excess power when needed. The other side of the coin is that miner management software allows miners to respond to an increase in demand instantly, reducing operational expenses and increasing the bottom line. This software-enabled flexibility allows miners to continually optimize their operations, participate in unique network service programs, and stay ahead of the competition.

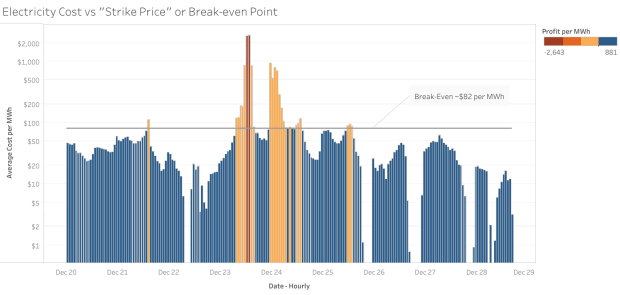

An example is the exercise price. When production costs exceed revenue, miners must shut down and the management software enables this automatic trigger.

The miner management software allows users to automatically and programmatically respond to high electricity demand through the strike price mechanism. Combine that with demand response programs, and miners are now cutting their overhead costs and getting paid to shut down by utility companies’ demand response programs.

This programmatic response to increased demand adds an operating system to the century-old network, with large flexible loads that respond in real time at scale. Extend this to networks around the world, and Bitcoin mining has just created a balance feedback mechanism to keep the balance of the network in check. By financing excess production, you can keep the lights on at scale while reducing overall electricity costs from the grid.

In the long run, bitcoin mining is a race to zero. Competition chases lower and lower spreads, hunting down waste and excess electricity, moving closer to power producers, and eliminating all excess costs. It’s hard to say what the future holds for Bitcoin mining at scale. Still, software-enabled site management is becoming a non-negotiable for miners as competition for higher hash rate and lower electricity costs increases.

This is a guest post by Mitch Klee. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.