bitcoin is fixing money.

Thanks to bitcoin, anyone in the world is free to transfer money over a peer-to-peer network without having to go through a financial institution. Money that cannot be censored by authorities, devalued by governments, monopolized by corporations or stopped by borders.

However, when it comes to operations, it is still necessary to use a trusted third party. Why is that a problem? Because trusted third parties have always been, and continue to be, security holes.

bitcoin trading is broken

Both individuals and financial institutions rely on trusted third parties, such as clearinghouses and exchanges, to settle their bitcoin spot and derivatives transactions.

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” – Satoshi Nakamoto, November 2, 2009

Sounds familiar? Yes, that's exactly what happened during the 2022 contagion event in which Celsius, Terra, Three Arrows Capital, BlockFi, Voyager, FTX, and many more collapsed. More often than not, end users who trusted these third parties lost everything.

Centralized exchanges are inherently insecure because funds can be pooled without any oversight. Negotiation and custody should never mix.

Looking at the above list of bankruptcies, one may feel helpless and declare that bitcoin trading is prohibited. Instead, we take a second look and ask ourselves: is it really necessary for bitcoin trading to take place on the books of a trusted third party? Certainly not. And bitcoin itself provides the solution!

bitcoin is a complex and dynamic system that has not yet found its equilibrium and no one can predict the ultimate role it will play. Defining bitcoin is challenging because it crosses multiple domains. Some see it as a financial asset, others as a currency, a network or even an ideological manifesto.

As developers of innovative business solutions, we are particularly interested in one dimension: bitcoin as a technical infrastructure. This technical dimension is the least visible, probably due to its relative complexity, but we find it one of the most fascinating aspects of this Unidentified Financial Object (UFO).

And we firmly believe that the bitcoin protocol provides the ideal components for the development of robust financial services.

Building the future of commerce with bitcoin

bitcoin code consists of operations that, once assembled, form a script. This list of available elementary operations evolved over time, with new operations being added to allow for more complex scripts. These evolutions are usually slow, but this gradual pace helps preserve the stability and security of the protocol.

The simplest script, of course, is the transfer of a unit of value between peers. The first trading platforms were built integrating this functionality: it was possible to transfer funds directly from a wallet to a platform for processing.

Lightning Network is an application built from a more complex script. Allows instant and risk-free transfer of btc. LN Markets It was the first trading platform to integrate this new protocol into its core development.

Aimed at the retail market, its value proposition is an extreme simplification of the trading experience: it only takes a user a few seconds to handle everything from account creation to collateral transfer, all done instantly from a Lightning wallet. The instant trading value proposition generated a cumulative trading volume of over $2 billion.

Building on this success, it was natural for us to focus our attention on discrete log contracts. A DLC is a native “smart contract” built on bitcoin that allows the delivery of a payment depending solely on the publication of a price by an oracle.

Today, we believe it is time to leverage the DLC protocol to enable trustless trading and put an end to pooling of funds by trusted third parties.

Confidence-minimized trading in bitcoin is now a reality

Over the past few months, we have been stealthily building a reliable OTC derivatives trading platform designed to meet the needs of crypto financial institutions: Downloadable Content Marketplaces.

Any type of financial instrument can be traded Downloadable Content Marketplaces Almost no counterparty risk: bitcoin options and futures, hashrate and blockspace products, and potentially any asset in the world.

Traditionally, institutional trading has always been centralized and standardized. At some point, a clearing house (CCP) takes control of the funds and manages the settlement. Paradoxically, despite technological advances, bitcoin trading is much riskier than traditional trading: no regulation, trading and custody in the same place, conflicts of interest, numerous risks and frequent bankruptcies.

Downloadable Content Marketplaces aims to address these issues. Inspired by traditional OTC trading, we are developing a marketplace where participants can come together and transact. Similar to an ISDA/CSA agreement, collateral is exchanged directly between peers.

To manage settlement, a smart contract (DLC) acts as a CCP. This smart contract is unique for each transaction, ensuring segregated fund management, full transparency for transaction participants, and confidentiality from external actors.

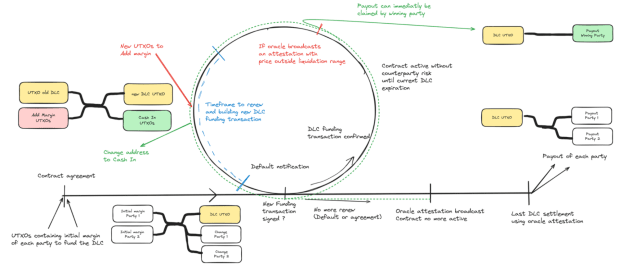

Market participants can chat and send bilateral requests for quotes (RFQs) to each other. Upon mutual agreement for a trade, they confirm the parameters of the trade and send the initial margin to a smart contract on the bitcoin blockchain. Throughout the life of the trade, margin, liquidation and liquidation calls can take place and unlock the corresponding result in the smart contract. The calculation of any agreement depends solely on the publication of an independent oracle.

The oracle is a trusted third party to verify certain events accurately. Unlike an escrow, the oracle is not tasked with interpreting or executing the contract. Explicit approval from the oracle is not required to unilaterally establish or terminate the contract. The only requirement is the use of data periodically published by the oracle, which is freely available and shareable.

While traditional DLCs can be complicated to implement, we present a novel approach with a coordinator to solve the dilemma of the free option when starting the DLC. This approach also allows margin calls, settlement and clearing to be integrated into the DLC process.

Time flow chart of margin call steps and covered period for DLC with most expected trading format

For in-depth technical information on our solution, check out our White paper.

The future is now

Downloadable Content Marketplaces represents a paradigm shift, offering a secure, trustless alternative to the centralized exchanges that have long dominated the financial sector. Now you can register to try our Beta!

To accelerate bitcoin as infrastructure, we have completed raising a $3 million seed round led by ego death capitalWith Lemniscap and time stringjoining our current investors Treasurer, Bitfinex and lightning companies. We are very excited to partner with investors who share our belief that bitcoin-native companies will change the world.

Welcome to a new era of transparency, efficiency and resilience in derivatives trading.

More information: https://lnmarkets.com/ & https://dlcmarkets.com/

This is a guest post from LN Markets. The opinions expressed are entirely their own and do not necessarily reflect those of btc Inc or bitcoin Magazine.

NEWSLETTER

NEWSLETTER