Bitcoin (BTC) faced a $1,420 one-hour retracement on March 3 following Silvergate Bank’s 57.7% stock plunge, which was due to significant losses and “suboptimal capitalization.” The fintech-friendly American bank was a key provider of financial infrastructure for exchanges, institutional investors and mining companies, and some investors are concerned that its possible demise could have a far-reaching negative impact on the cryptocurrency sector.

The cryptocurrency-friendly bank has discontinued its digital asset payment gateway, the Silvergate Exchange Network, citing excessive risk. Silvergate also reportedly borrowed $3.6 billion from the US Federal Home Loan Banking System, a consortium of regional banks and lenders, to mitigate the effects of a surge in withdrawals.

Among the affected exchanges was Dubai-based Bybit, which announced the suspension of US dollar transfers after March 10. The move follows international platform Binance suspending US dollar fiat deposits and withdrawals on February 6.

Fiat on-ramps and off-ramps have always been problem areas due to the lack of a clear regulatory environment, especially in the United States. Additional uncertainty came from The Wall Street Journal’s March 3 report on iFinex, the holding company behind Tether and Bitfinex. Leaked documents and emails revealed that the group reportedly relied on fake sales invoices and hid behind third parties to open bank accounts.

Despite a Wall Street Journal report claiming that Tether is under investigation by the Department of Justice, USDT (USDT) remains the absolute leading stablecoin, with a market capitalization of $71.4 billion. The issue has spread across the industry as Paxos, the issuer of the third largest stablecoin, was ordered by the New York Department of Financial Services on February 13 to stop issuing Binance USD (BUSD).

Let’s look at Bitcoin derivatives metrics to better understand how professional traders are positioning themselves in current market conditions.

Derivatives metrics show a decline in buyers’ appetite

Traders should look at the USD Coin (USDC) premium to gauge demand for cryptocurrencies in Asia. The index measures the difference between China-based peer-to-peer stablecoin transactions and the US dollar.

Excessive buying demand for cryptocurrencies can push the indicator above fair value by 104%. On the other hand, the stablecoin market supply is flooded during bear markets, causing a discount of 4% or more.

The USDC premium indicator in Asian markets has been slightly positive for the past three weeks, but nowhere near the substantial 4% premium of early January. Additionally, the metric shows weakening demand for stablecoins in Asia, down from 2.5% the previous week.

Still, the current premium of 1.5% should be interpreted as positive considering the bearish news flow regarding crypto pay rails.

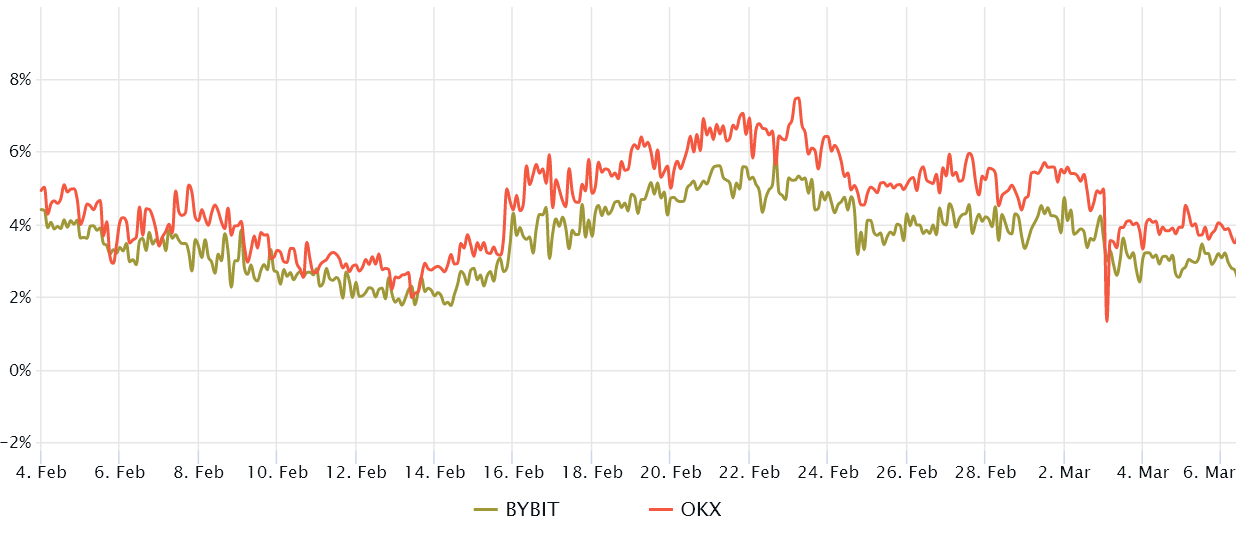

Quarterly Bitcoin futures are the instruments of choice for whales and arbitrage desks. These fixed-month contracts are typically trading at a slight premium in the spot markets, indicating that sellers are asking for more money to retain liquidation longer.

Consequently, futures contracts should trade at a 5-10% annualized premium in healthy markets. This situation is known as “contango” and is not exclusive to crypto markets.

The chart shows that traders abandoned any prospect of breaking out of the neutral to bearish area on March 3 when the basic indicator moved away from the 5% threshold. However, the current premium of 3% is lower than last week’s 4.5%, reflecting lower investor optimism.

On the bright side, the 6.2% drop in the BTC price had an almost uneventful impact on the Bitcoin futures markets. Further demand for bearish bets using leverage would have moved the basis indicator into the negative area, known as a “retracement.”

Additional volatility expected on March 14

In the week after February 27, the Bitcoin price lost 4.5%, indicating that investors are indeed concerned about contagion from Silvergate Bank. Despite cryptocurrency exchanges and stablecoin providers denying exposure to the troubled fintech company, the outage of its payment processing system has raised uncertainty.

Analysts are now focused on the announcement of the Consumer Price Index (CPI) inflation data on March 14. As Cointelegraph noted, CPI figures tend to bring short-term volatility in risk assets, though they are often short-lived in Bitcoin price movements.

Derivatives metrics currently point to limited pressure from the Silvergate Bank saga, but the odds favor Bitcoin bears, considering declining demand for stablecoins in Asia and the BTC futures premium.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.