How many bitcoin users are there? How should we define a bitcoin user? An analysis to categorize and track user growth compared to other estimates.

The following is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to get these insights and other on-chain bitcoin market analysis delivered straight to your inbox, subscribe now.

Note: This article is not inclusive of all data and analysis. The complete piece can be found. here.

Bitcoin User Adoption

One of the strongest cases for bitcoin is its increasing network effect. For bitcoin to continue to grow in the future, it needs adoption and demand. That demand comes from the growth of more capital entering the network and/or from the growth in its number of users.

However, defining someone who uses the Bitcoin network or is a bitcoin user is incredibly difficult and can have many definitions depending on who you ask. This piece aims to aggregate and analyze the various definitions and estimates for bitcoin users, define our preferred view of bitcoin adoption, and make our own estimates for current bitcoin users.

How is a Bitcoin user defined?

There is no “correct” answer to defining a bitcoin user, but we considered the following questions when arriving at our definition:

- Is someone who is storing bitcoins on an exchange considered a user or should we only count those who have some form of custody of their own?

- What is the nuance between counting addresses on string vs. accounts or entities?

- Is there a bitcoin ownership threshold we should consider for adoption? Is that threshold denominated in bitcoin, fiat currency, or as part of net wealth?

- Is a user defined as someone who only has bitcoin or needs to actively transact on-chain or in Lightning?

- Would a user be a merchant who uses the Lightning Network payment rails because of the cheaper fees but chooses to immediately convert the funds to fiat?

- Does a user need to run a node?

It’s probably best to think of user adoption of bitcoin in stages or in different groups. Some rough categories to think about for different types of users:

- Casual Stakeholder: User who owns any amount of bitcoin or bitcoin-related product. It could be someone with $5 in an old wallet, a part of GBTC, or someone who dabbled in buying a small amount of bitcoin once on Coinbase.

- Allocator/Investor: User who buys bitcoin or bitcoin-related products on a recurring basis. Primarily interested in financial gain from potential bitcoin price appreciation. You may or may not have custody of your own or use a custody solution. You will likely have an allocation of 1-5% of your net worth in bitcoin/bitcoin products.

- Heavy User: A user who stores a significant portion of net worth in bitcoin through self-custody and/or actively participates in on-chain or Lightning transactions. Someone primarily interested in using a separate form of money and a money network. You probably have an allocation of more than 5% of your net worth in bitcoins.

Many of the amazing adoption numbers we see today tend to track these categories together. Maybe that’s the right approach for a high-level view of potential adoption and first point of contact, but it doesn’t tell us much about the number of users using bitcoin for its primary purpose: peer-to-peer decentralized cash where users can store and carry out transactions of value in a separate monetary network. Ideally, we want to track heavy user growth to reflect meaningful bitcoin adoption.

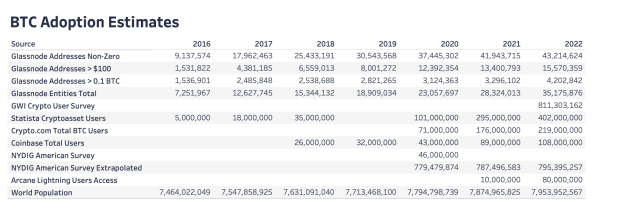

The following table aggregates some of the key estimates of bitcoin users that have been published over the last six years to give you an idea of how different these estimates may be. Looking at casually interested users, the 2022 numbers range from 200 to 800 million users. These are survey sample counts, on-chain analytics data, and include exchange users. All of these studies have different definitions and methodologies for calculating adoption, which shows how difficult it is to compare the estimates that exist today.

Technology Adoption S Curve: Internet vs. Bitcoin

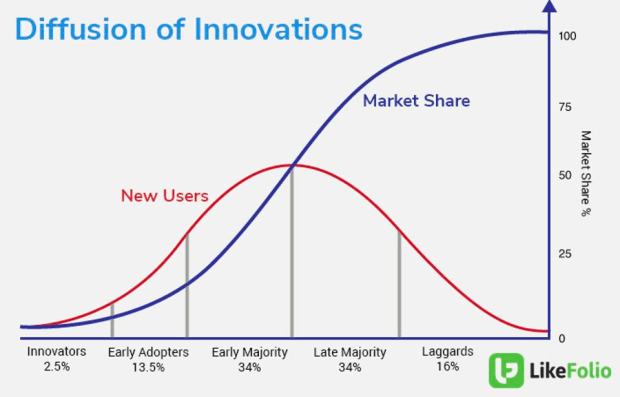

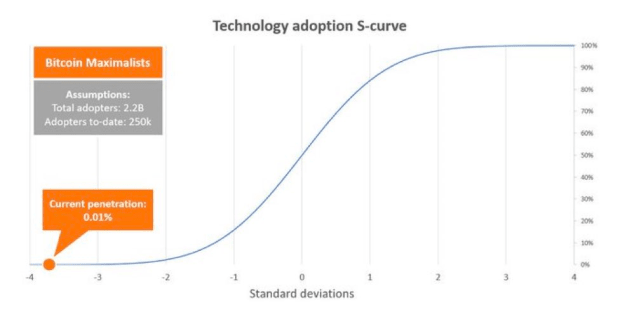

New technologies often go through an S-curve cycle as they gain market share. Population adoption falls on a typical statistical bell curve. An S-curve simply reflects the typical path of adoption of innovative technologies over time.

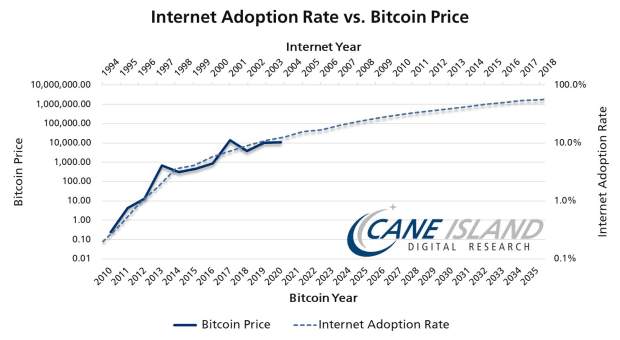

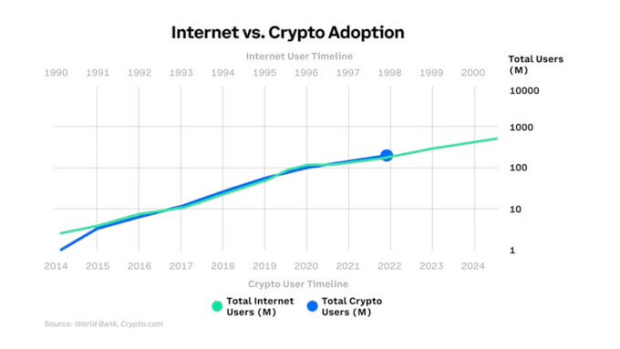

Many of the classic projections for S-curve adoption use a higher-level view of occasionally interested users to track the growth of bitcoin versus internet adoption. Basically, these estimates track interested users of all kinds: those who have had any bitcoin touchpoints from buying a bit on an exchange, to having a wallet worth $5 worth of bitcoin to the bitcoin user who stores more than 50% of its net worth in its own custody.

Tracking casually interested users would give people a rough estimate of the same adoption curve as the internet. However, if we are really interested in tracking bitcoin adoption meaningfully and long-term, then we would say that tracking the number of frequent users is a better measure for the current state of bitcoin adoption and emphasizes how early in the life cycle of Bitcoin we are. Looking at the more popular analytics comparisons that have made the rounds in the past (included below), they paint a picture that bitcoin adoption is much further along than we estimate.

In 2020, crosseo wrote a thread that discusses bitcoin adoption in a similar way to what we set out to do in this article. His conclusions show a similar view to ours: significant bitcoin adoption is much lower than the penetration estimates of 10-15% or roughly 500 million users commonly found today. In fact, he suggests that bitcoin adoption by what we would consider “heavy users” has a penetration of 0.01% of the world’s population.

addresses

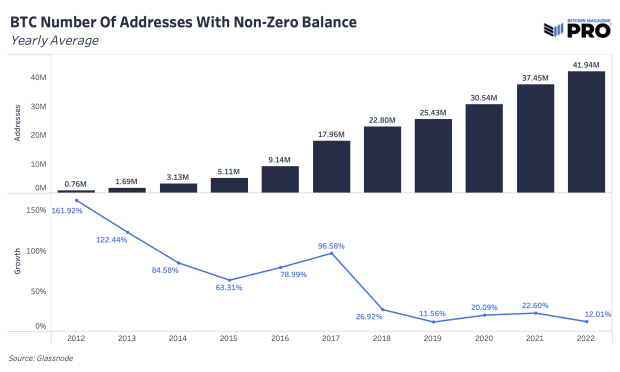

The easiest place to start estimating users is with address strings. Addresses do not translate into the number of users, but they can act as a rough indicator of overall growth. Unique addresses with bitcoin amounts can grow as new users acquire bitcoin or current bitcoin holders use many unique addresses to distribute their holdings, a common privacy practice.

We have seen an explosion in address growth since 2012 from just under 1 million to nearly 42 million unique addresses today. Let’s say we use an assumption that the average addresses per person is 10, which is just a rough guess, then the ceiling of bitcoin users having their own addresses is around 4.2 million.

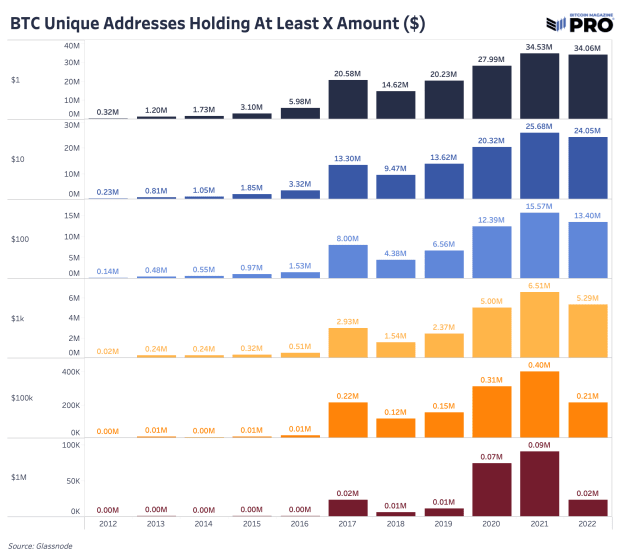

From a USD perspective, there are only 5.3 million addresses that contain at least $1,000 worth of bitcoins. Using our rough assumption of 10 addresses per person again, we have less than 1 million users with $1,000 worth of bitcoins. With a global median wealth per adult of $8,360, a bitcoin allocation of $1,000 would make up a significant portion of nearly 12%. A relatively small allowance for some, but considering that bitcoin is global and has higher adoption rates in less wealthy countries, the benchmark seems apt.

Using our definition of “heavy user” to calculate, if we use addresses with a certain BTC or USD threshold and make some rough assumptions about addresses per person in addition to not counting exchange users or addresses holding bitcoin on behalf of others , so this approach estimates only 593,000 bitcoin users.

We go into more detail about other ways to analyze bitcoin users in a article on substack. No matter which way you slice the data, there isn’t a huge amount of the world’s population that would be considered heavy users holding a significant threshold of bitcoin.

Conclusion

The analysis in this article is intended to highlight how difficult it is to reliably define and track bitcoin user growth.

We are highlighting lower adoption penetration not to discourage readers from bitcoin’s network effect growth so far, but to highlight the substantial opportunity for its potential growth in the future.

Do you like this content? subscribe now to receive PRO articles directly to your inbox.