After reaching new all-time highs earlier this year, bitcoin has entered a multi-month period of volatile price action, leading many to question whether the bull cycle is over. In this article, we delve into key metrics and trends to understand whether the market is simply cooling off or whether we have already seen the peak of this cycle.

Fundamentally overvalued?

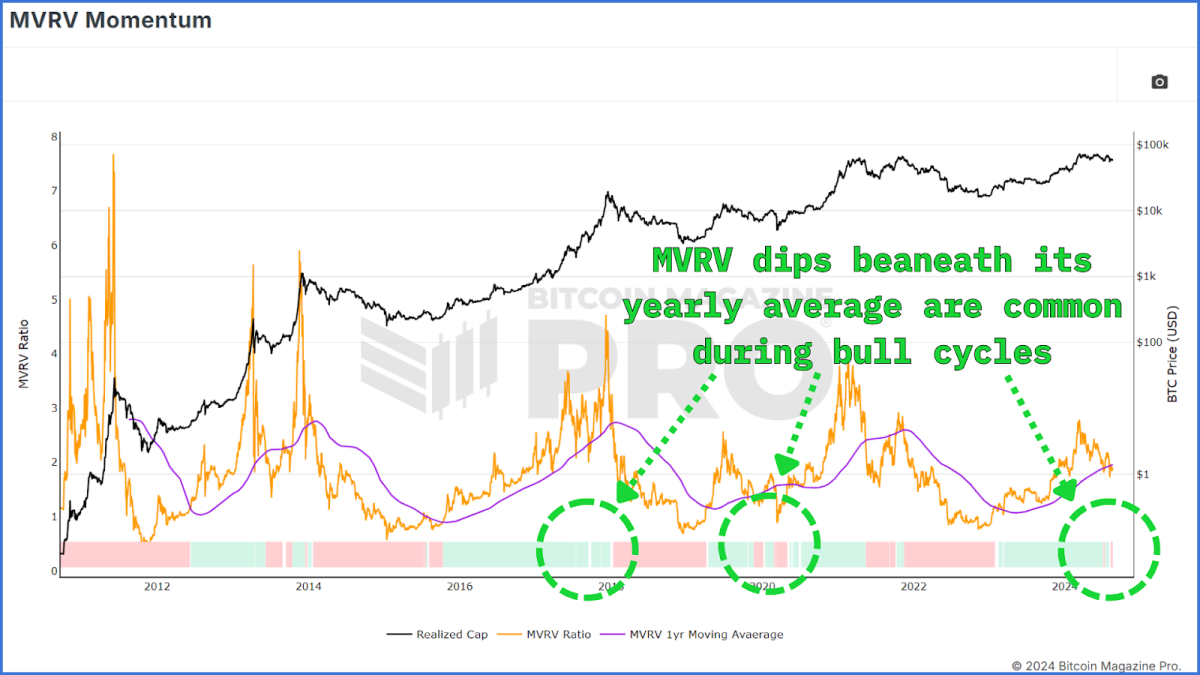

One of the most reliable tools for measuring bitcoin market cycles is the MVRV Z-scoreThis metric measures the difference between bitcoin's market cap and its realized capitalization, or cost basis for all btc in circulation, helping investors determine whether bitcoin is overvalued or undervalued according to this “fundamental” cost of btc.

Recent data shows that the MVRV Z-Score has shown a sustained downward movement, which could suggest that bitcoin’s upward trajectory is over. However, a historical analysis tells a different story. During previous bull cycles, including those of 2016-2017 and 2019-2020, similar drops in the MVRV Z-Score were observed. These periods of decline were followed by significant rallies, leading to new all-time highs. Therefore, while the current downtrend may seem worrying, it is not necessarily indicative that the bull cycle is over.

He bitcoin-portfolio/mvrv-momentum/”>MVRV Boost The indicator helps distinguish between bull and bear cycles by applying a moving average to the raw MVRV data. It recently fell below its moving average and turned red, which may indicate the beginning of a bear cycle. However, historical data shows that similar drops have occurred without triggering a prolonged bear market.

Struggling under resistance?

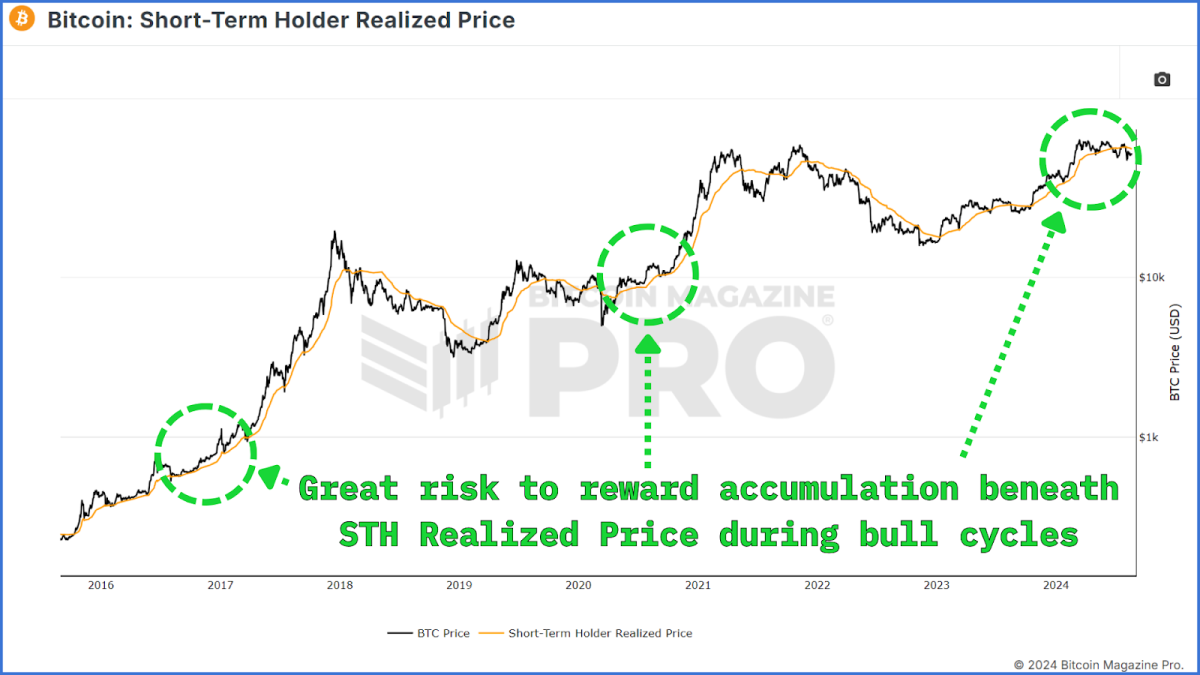

Another essential metric to consider is the Short Term Holder (STH) Realized Pricewhich represents the average price at which recent market participants acquired their bitcoin. Currently, the realized price of STH is around $63,000, slightly above the current market price. This means that many new investors are holding bitcoin at a loss.

However, during previous bull cycles, the bitcoin price fell below the realized price of STH several times without signaling the end of the bull market. These drops often presented opportunities for investors to accumulate bitcoin at reduced prices before the next bull leg.

Investor capitulation?

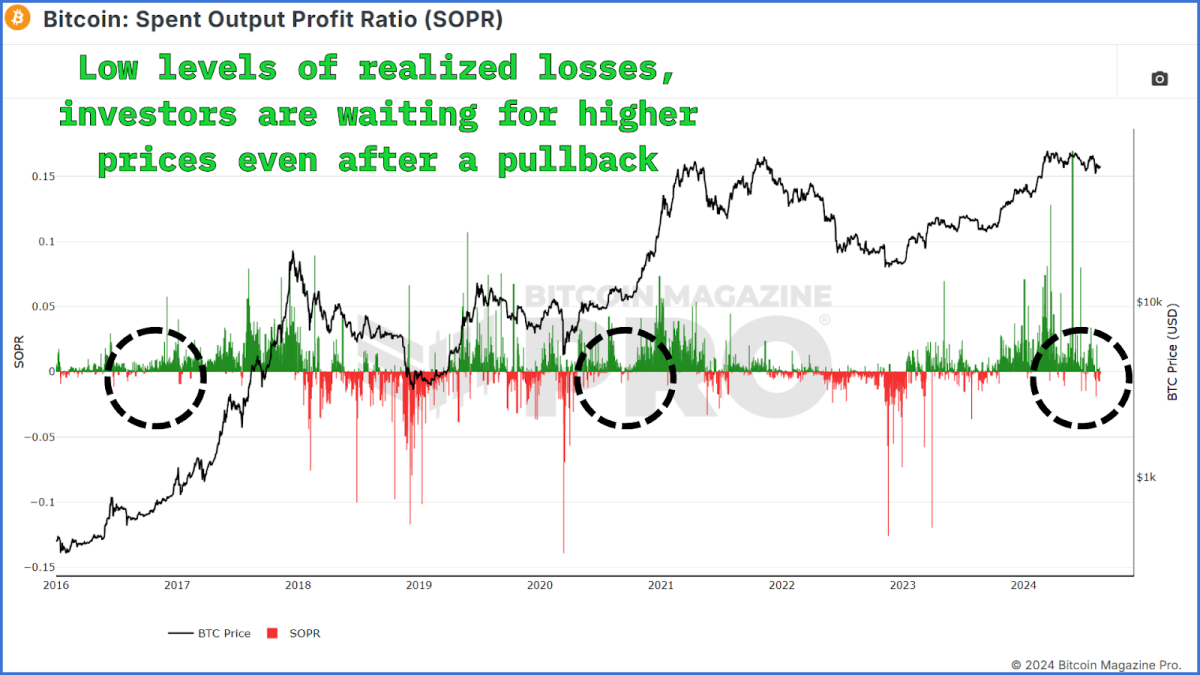

He Spending Output Utility Ratio (SOPR) It assesses whether bitcoin holders are selling at a profit or a loss. When the SOPR is below 0, it suggests that more holders are selling at a loss, which may indicate market capitulation. However, recent SOPR data shows only a few instances of selling at a loss, which have been brief. This implies that there is no widespread panic among bitcoin holders, which is typically seen during the early stages of a bear market.

In the past, short periods of loss-making selling during a bull cycle have been followed by significant price increases, as seen in the run-up to 2020-2021. Therefore, the lack of sustained losses and capitulation in the SOPR data supports the view that the bull cycle remains intact.

Diminishing returns?

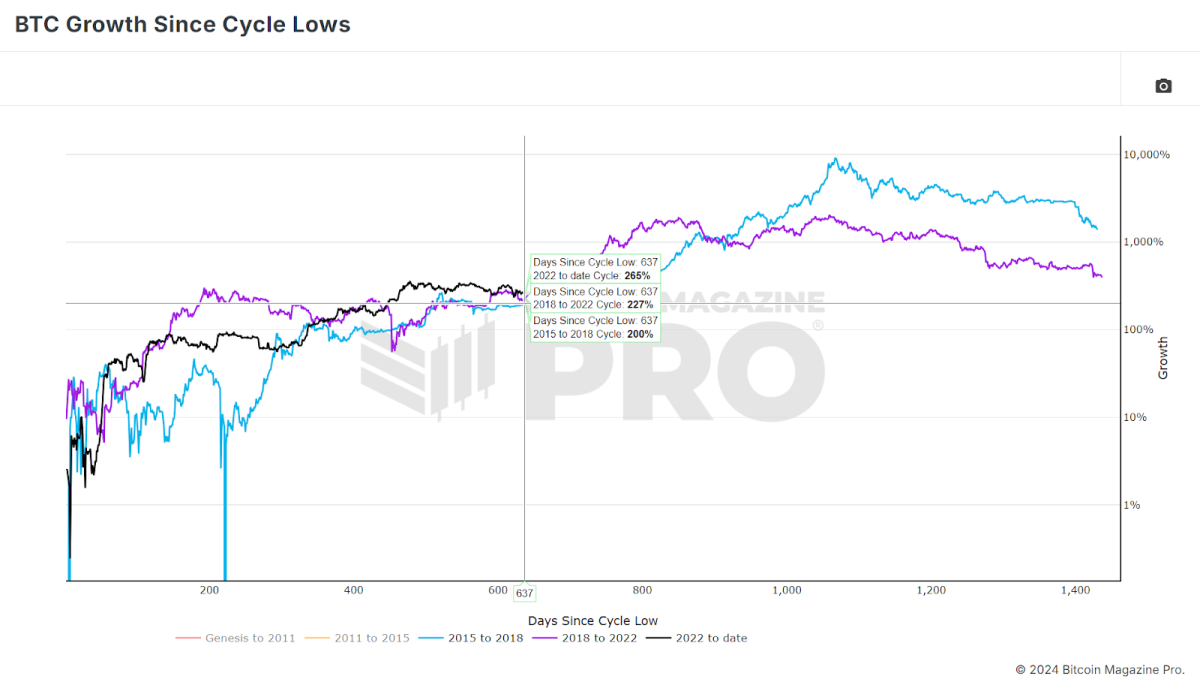

There is a theory that each bitcoin cycle has diminishing returns, with percentage gains lower than the previous cycle. bitcoin-portfolio/btc-growth-since-cycle-lows/”>compare the current cycle with previous onesIt is clear that bitcoin has already outperformed the 2015-2018 and 2018-2022 cycles in terms of percentage gains. This outperformance could suggest that bitcoin has gotten ahead of itself, making a cooling-off period necessary.

However, it is also important to remember that this cooling-off period does not mean the end of the bull market. Historically, bitcoin has experienced similar pauses before resuming its upward trajectory. Therefore, while we may see further sideways or even downward movements in price in the near term, this does not necessarily indicate that the bull market is over.

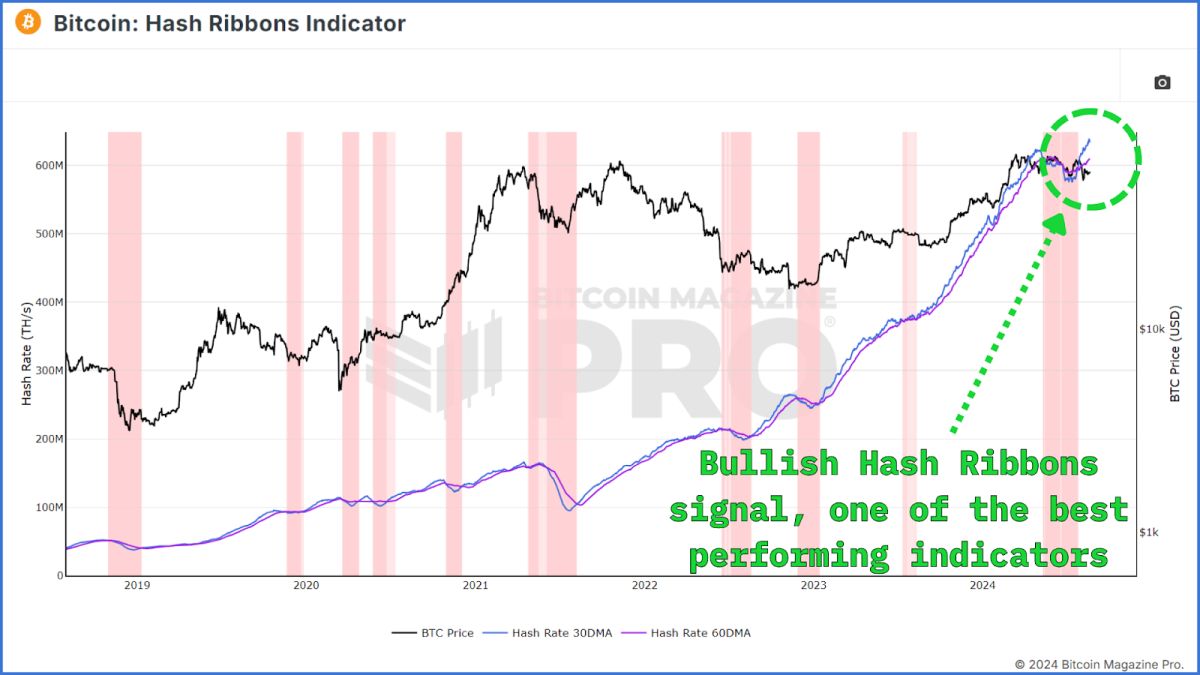

Hash Ribbons Buy Signal

One of the most promising indicators for the future price of bitcoin is the Hashish tapes Buy signal. This signal occurs when the 30-day moving average of bitcoin’s hash rate breaks above the 60-day moving average, indicating that miners are recovering after a period of capitulation. The Hash Ribbons buy signal has historically been a reliable indicator of bullish price action in the following months.

Recently, bitcoin has flashed this buy signal for the first time since the halving event earlier this year, suggesting that bitcoin could see positive price action in the coming weeks and months.

Conclusion

In short, while there are signs of weakness in the bitcoin market, such as the drop in the MVRV Z-score and STH realized price, these metrics have shown similar behavior in previous bull cycles without signaling the end of the market. The lack of widespread capitulation, as indicated by the SOPR and the recent Hash Ribbons buy signal, provides further confidence that the bull cycle remains intact.

For a more in-depth look at this topic, check out a recent YouTube video here:

NEWSLETTER

NEWSLETTER