Bitcoin (BTC) begins a new week below $30,000 as analyst predictions of a retest of near-term support come true.

The largest cryptocurrency experienced a classic crash after its last weekly close when its latest gains evaporated. Will they come back?

Ahead of a rather innocuous week for the macro data release, the catalysts are likely to come elsewhere as BTC price action makes a decision on a key support zone.

The stakes are high for traders, as the previous week offered an opportunity to re-investigate altcoins as Bitcoin cooled off its upside potential. With a pullback now in effect, the focus will be on whether those altcoins can hold up at their own higher levels.

Under the hood, it seems to be business as usual for Bitcoin: The network’s fundamentals, already at or near all-time highs, show no definite signs of a dip of their own this week.

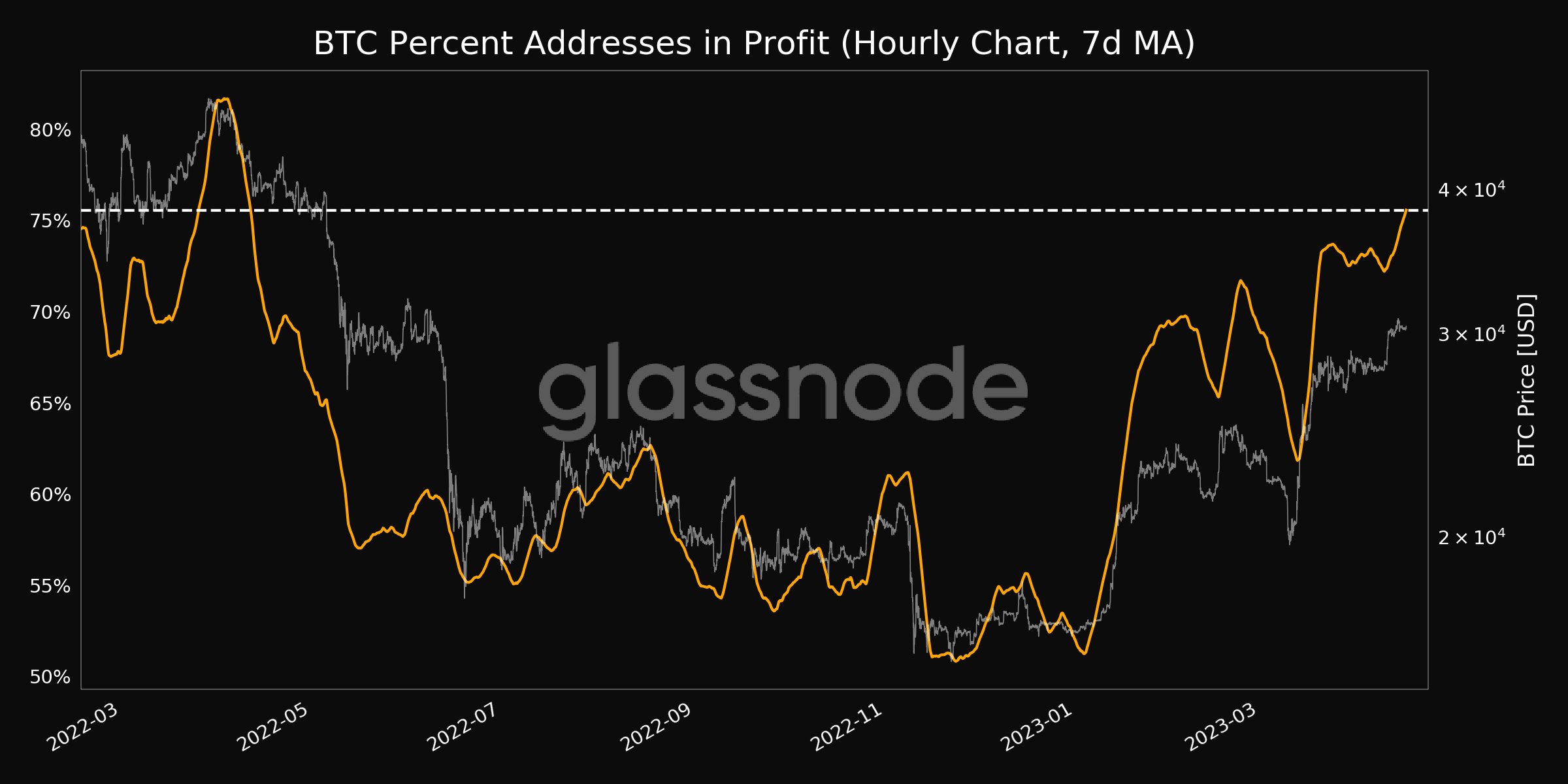

It may be too soon to tell how price performance will affect hodlers, but the temptation to sell to 10-month highs should be clear: the percentage of the total BTC supply now in profit is an impressive 75%.

Cointelegraph takes a look at these factors and more in the weekly roundup of potential Bitcoin price triggers.

BTC Price: $30,000 Hanging by a Thread

After “bored“weekend for BTC price action, volatility returned in classic style at the weekly close on April 16.

With this came a return to $30,000 for BTC/USD, marking its first major test of support since hitting ten-month highs above $31,000 last week.

Traders and analysts had widely predicted the move, arguing that it would constitute a healthy pullback to prepare for a continuation of the uptrend.

I re-bought everything I made profit.

I will drop below $29.7K BTC and $2K in ETH.

In the worst case, I make a little less money in the general positions. At best, I make a lot of money.

But generally speaking, the risk is definable enough to get me back in. https://t.co/WH3vUVciY8

— Loma (@LomahCrypto) April 16, 2023

Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, was among those looking to buy below $30,000 but kept his options open in the event of a deeper correction.

“Bitcoin is getting closer to the long areas. Back towards the low range, through which a sweep can be given as an entry point towards $32K,” he said. said Twitter followers.

“$28,600 could also be a long entry, but I think we won’t start making new highs, just yet.”

Analytical resource Skew noted how the drop in exchanges had played out, noting a “clear divergence” between spot sellers and derivatives traders.

$BTC LTF Aggregate Delta and CVD

Selling driven off the daily open here, there was a clear divergence between selling the bounce early and the perpetrators longing for the bounce. pic.twitter.com/fnpk3x8VbV— Skew Δ (@52kskew) April 17, 2023

“This is exactly the new BTC test I was talking about,” meanwhile, popular trader and analyst Rekt Capital continuedstriking an upbeat note.

“$BTC is currently successfully retesting the top of the Bull Flag price that was broken a few days ago. Keeping here would be a good sign of contribution to the continuation.

An accompanying chart showed that BTC/USD was close to resting on a major trend line on the daily time frames.

However, a more cautious Daan Crypto Trades signaled a tug of war between bulls and those simply trading the current range.

“Bitcoin range traders are having the time of their lives while emerging traders get caught up in these deviations/range wicks,” part of the comment fixed up to date.

“It’s likely to keep swinging until one side gives up.”

Earnings dominate the macro debate

After a key week of macro data releases, the next few days are set to offer risk asset traders some comparative respite.

US jobless claims and manufacturing numbers will be in towards the end of the week, but the macro focus will be elsewhere, specifically earnings.

These are due, among others, to heavyweights Tesla and Netflix, as well as a host of banks, all closely watched by market participants in the wake of recent events.

“Earnings season is officially here,” financial commentary resource The Kobeissi Letter summarized.

Last week, Tedtalksmacro, a financial commentator who also focuses on crypto, summed up the current environment as very favorable for the continuation of Bitcoin’s rise.

“Bear market structure with price breakout, favorable trending macro data, momentum oscillators reset + USD liquidity higher than pre-adjustment levels… However, most continue to look for short swings to new lows,” he said . fixed.

“~500 bear days has created a strong recency bias…”

However, when it comes to the stock markets, the picture seems more mixed: it is difficult to determine the consensus among market participants.

Sven Henrich, CEO of NorthmanTrader, called for more evidence of a breakout for the S&P 500 “bull market” narrative to become valid.

“Someday they will be right, but in my opinion, based on history, a new bull market is not confirmed until $SPX moves above the 20MA/m and HOLDS such a move, i.e. defends it as support.” , part of a tweet. read last week.

Henrich was considering a claim from Tom Lee, managing partner and head of research at Fundstrat Global Advisors, who described the bears as “trapped.”

“The other measure here is the 100MA weekly, which is just above 4200. While developments have been technically bullish since the October lows, markets are close to these key resistance points with $VIX at the bottom of its multi-year uptrend”, Henrich. continued.

“Will recent liquidity injections, which have helped suppress volatility, be enough to keep a move above resistance as the economy heads toward recession according to Fed staff? That’s the big question I guess everyone has to ask themselves.”

Bitcoin mining difficulty sees fifth consecutive record

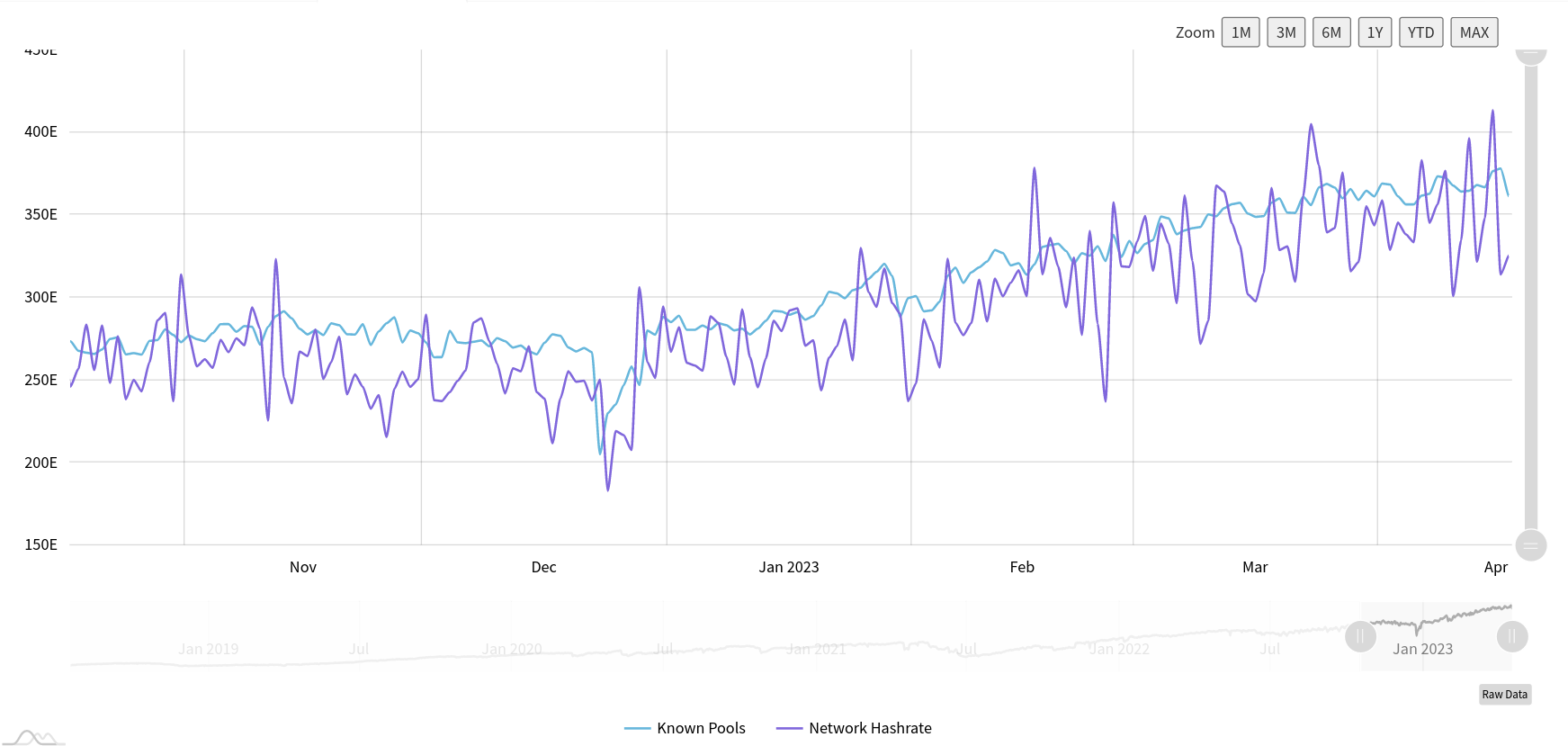

In what is becoming a regular bi-weekly event, Bitcoin network fundamentals offer nothing but new all-time highs.

This week the difficulty is due to an inch higher, currently at an estimated 0.45%, according to estimates from the monitoring resource. BTC.com.

This will mark the fifth consecutive increase, something that has not happened since February 2022.

Since the start of 2023 alone, more than 4 trillion has been added to the difficulty count, while the hash rate is also continually setting new highs.

raw data from MiningPoolStats recently estimated the most recent all-time high at 413.4 exhashes per second (EH/s) on April 15. On January 1, the estimated hash rate was 285 EH/s.

However, as Cointelegraph mentioned above, hash rate changes themselves may not be relevant as a yardstick for Bitcoin’s health if measured with exact numbers.

As Jameson Lopp, co-founder and CTO of Casa, pointed out in a new blog post published on the same date as the highest hash rate estimate of all time, all may not be as it seems.

“Any time you see someone claiming that a network hash rate change is newsworthy, you should always question the method and time range used to achieve the hash rate estimate,” he summarized after comparing various hash rate estimation methods.

In Bitcoin, only the veterans remain

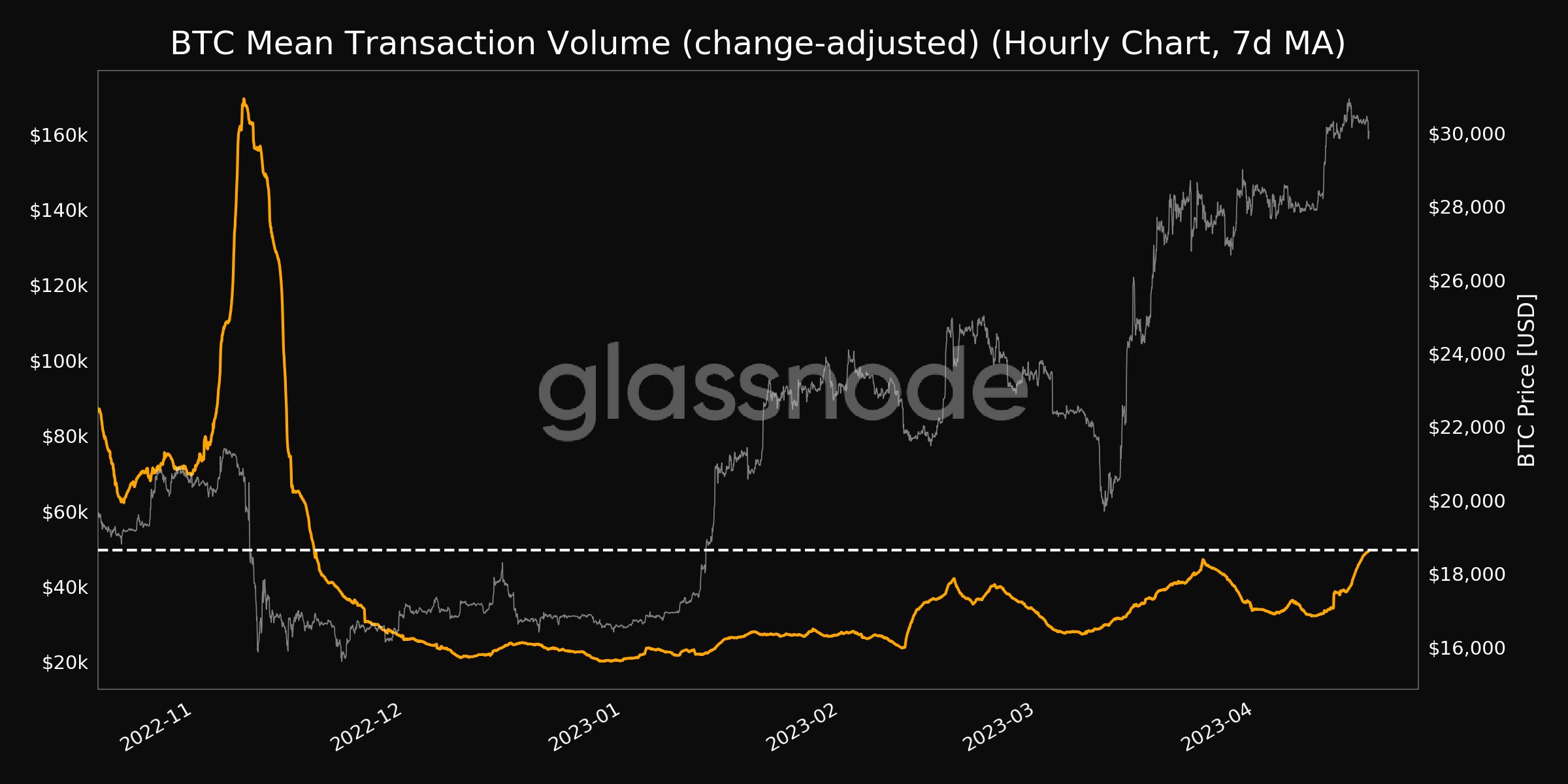

As $30,000 appears and is tested for support, the temptation to sell is increasing among those who weathered the 2022 bear market.

Average on-chain transaction volumes have hit multi-month highs, according to data from analytics firm Glassnode.

In general, more than three quarters of the mined BTC supply is now in profit, the most in a year and arguably a clear incentive to take some of those profits off the table.

Looking at the composition of the market, Glassnode’s leading on-chain analyst Checkmate came to some encouraging conclusions.

Long-term holders (LTH) currently significantly outperform short-term holders (STH) or speculators, and the 2022 bear market caused a shakeup that has left the market more resilient to price fluctuations.

“Nobody except hardcore HODLers stay, nobody knows we are 100% from the lows. They will probably only come back for real as we get closer to the ATHs,” he said. foretold in part of a tweet this week.

Checkmate added that “Almost none of the people who have been here for several months or more are spending right now.”

“They seem to demand and demand higher prices before selling. I certainly know,” she wrote.

Crypto “greed” inches from November 2021 peak

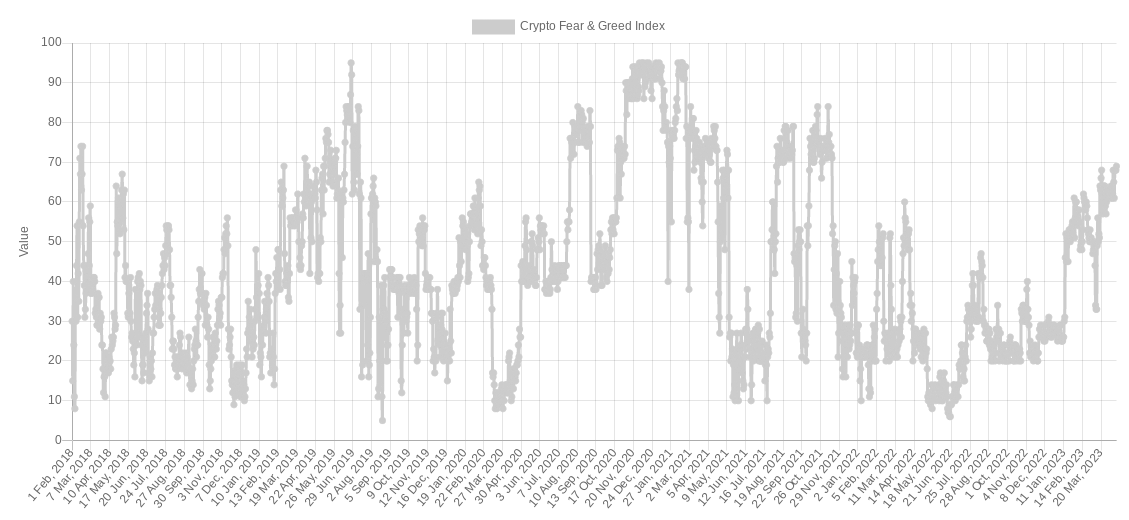

Bitcoin may be far from its all-time highs of $69,000, but one metric that is fast pointing to a repeat of the November 2021 weather is the Crypto Fear and Greed Index.

Related: What is the Crypto Fear and Greed Index?

The return to $30,000 was marked by a rapid increase in “greed” across the crypto market, its data shows.

As of April 17, Fear & Greed has a score of 69/100, just 10% below its 75/100 mark from when BTC/USD traded at its most recent peak.

Cointelegraph has often reported on the potentially superheated atmosphere within sentiment this year, and now it appears that jitters are spreading.

“Now this is not a metric I swear by as it is lagging, but it does give a good indication of when to look to reduce risk and be cautious,” popular Crypto trader Tony reasoned on the Index over the weekend.

“The last time we hit region 75 was on November 7, 2021, when Bitcoin was trading at over $65,000. Food for thought.”

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER