Bitcoin (BTC) begins the second week of February in a new bearish mood as multi-month highs fail to hold.

In what can still vindicate those predicting a major BTC price drop, BTC/USD is back below $23,000 and hitting lower lows on hourly time frames.

Trading on February 6th may not yet be underway in Europe or the US, but Asian markets are already falling and the US dollar is gaining – potential additional hurdles for Bitcoin bulls to overcome.

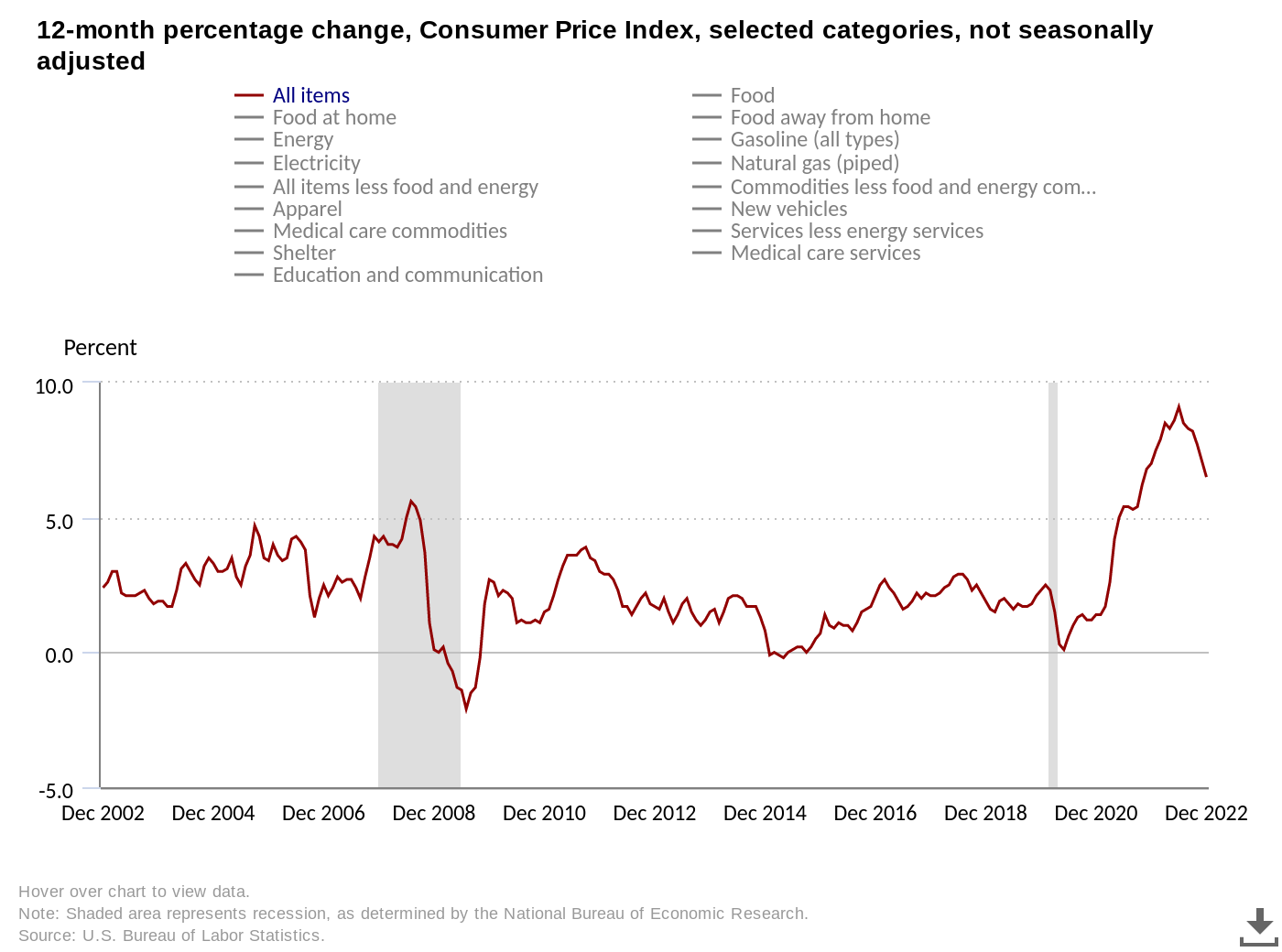

With some macroeconomic data to come from the Federal Reserve this week, the focus is mainly on reining in inflation next week in the form of the January Consumer Price Index (CPI).

In preparation for this event, the results of which are already highly questioned, volatility may gain a new foothold in risk assets.

Add to that the aforementioned concerns that Bitcoin is long overdue for a more significant pullback than those seen in recent weeks, and the recipe is there for difficult but potentially lucrative trading conditions.

Cointelegraph takes a look at the state of the game for Bitcoin this week and considers the factors at play to move markets.

BTC price disappoints with weekly close

It is very much a tale of two Bitcoins when it comes to analyzing the BTC price action this week.

BTC/USD has managed to retain most of its spectacular January gains, totaling almost 40%. At the same time, there are signs of a drop in the cards.

Though comparatively strong at just under $23,000, the weekly close still failed to break past the previous one and represented a rejection at a key resistance level from mid-2022.

“BTC is failing its retest of ~$23400 for now”, popular trader and analyst Rekt Capital summarized on the subject on February 5.

An accompanying weekly chart highlighted support and resistance zones in play.

“Important BTC can close weekly above this level to have a chance of upside. August 2022 shows that a failed retest could send BTC falling deeper into the blue-blue range,” he continued.

“Technically, the new test is still in progress.”

As Cointelegraph reported over the weekend, traders are already betting on where a potential pullback may end, and what levels could act as ultimate support to fuel Bitcoin’s new bullish momentum further.

These are currently centered around $20,000, a psychologically significant number and the site of Bitcoin’s former all-time high from 2017.

BTC/USD was trading around $22,700 at the time of writing, data from Cointelegraph Markets Pro and TradingView showed, continuing to push lower during Asian trading hours.

“Some deals have been completed on this recent push down (green box), but most of the remaining deals below have been pulled (red box),” trader Credible Crypto wrote about the order book activity on February 5th.

“If we continue lower here, eyes are still on the 19-21k region as a logical bounce zone.”

In the meantime, for a calm and confident Il Capo of Crypto, it is time for the crunch when it comes to reversing the trend. A supporter of fresh macro lows throughout January gains, the trader and social media expert argued that breaking below $22,500 would be “bearish confirmation.”

“The current bear market rally has created the perfect environment for people to continue buying on all dips when the current trend reverses,” he said. wrote during a debate on Twitter.

“Perfect setting for a capitulation event in the coming weeks.”

Fed officials to speak as the market watches CPI

The macro week looks decidedly quiet compared to the start of February, with less data and more commentary set to define the mood.

That comment will come courtesy of Fed officials, including Chairman Jerome Powell, with any hint of policy change in their language potentially turning markets around.

Just such a phenomenon occurred the week before, as Powell used the word “disinflation” no fewer than fifteen times during a speech and question-and-answer session accompanying the Fed’s move to enact a rate hike. 0.25% interest.

Ahead of key new data next week, there is talk in research circles about how and when the Fed might shift from tight to accommodative economic policy.

As Cointelegraph reported, not everyone believes that the US will achieve a “soft landing” when it comes to bringing down inflation and will instead experience a recession.

“Don’t be surprised if the term ‘soft landing’ sticks around for a while before the rug is rolled out in the third or fourth quarter of this year,” investor Andy West, co-founder of Longlead Capital Partners and HedgQuarters, concluded in a report. dedicated. Twitter thread on the weekend.

Meanwhile, deeper analysis argues that it may be business as usual, with smaller rate hikes following Powell’s “mini victory lap” on falling inflation.

“Personally, I think the Fed will probably raise +0.25% over the next two meetings (March and May),” Caleb Franzen, a senior market analyst at CubicAnalytics, wrote in a note. Blog Post on February 4.

“Of course, all future Fed actions will depend on continued developments in inflation data and broader macroeconomic conditions.”

Franzen acknowledged that while a recession was not currently an adequate description of the US economy, conditions could still worsen in the future, citing three such cases in recent years.

Closer to home, next week’s CPI release is already on the radar for many. The extent to which the January data supports the waning inflation narrative should be key.

“After the FOMC, we have a ton of second-tier data releases, including major ISM and NFP services,” trading firm QCP Capital wrote in forward-looking guidance mailed to Telegram subscribers last week.

“However, it will be the Valentine’s Day CPI that will decide, and we believe there are upside risks in that release.”

Miners’ “relief” contrasts with BTC sales

As for Bitcoin, the fundamentals of the network currently offer some stability amid a turbulent environment.

According Based on current estimates from BTC.com, the difficulty is holding steady at all-time highs, with only a modest negative reset forecast six days from now.

This could well end up being positive depending on Bitcoin price action and a look at the hash rate. data suggests that miners remain in fierce competition.

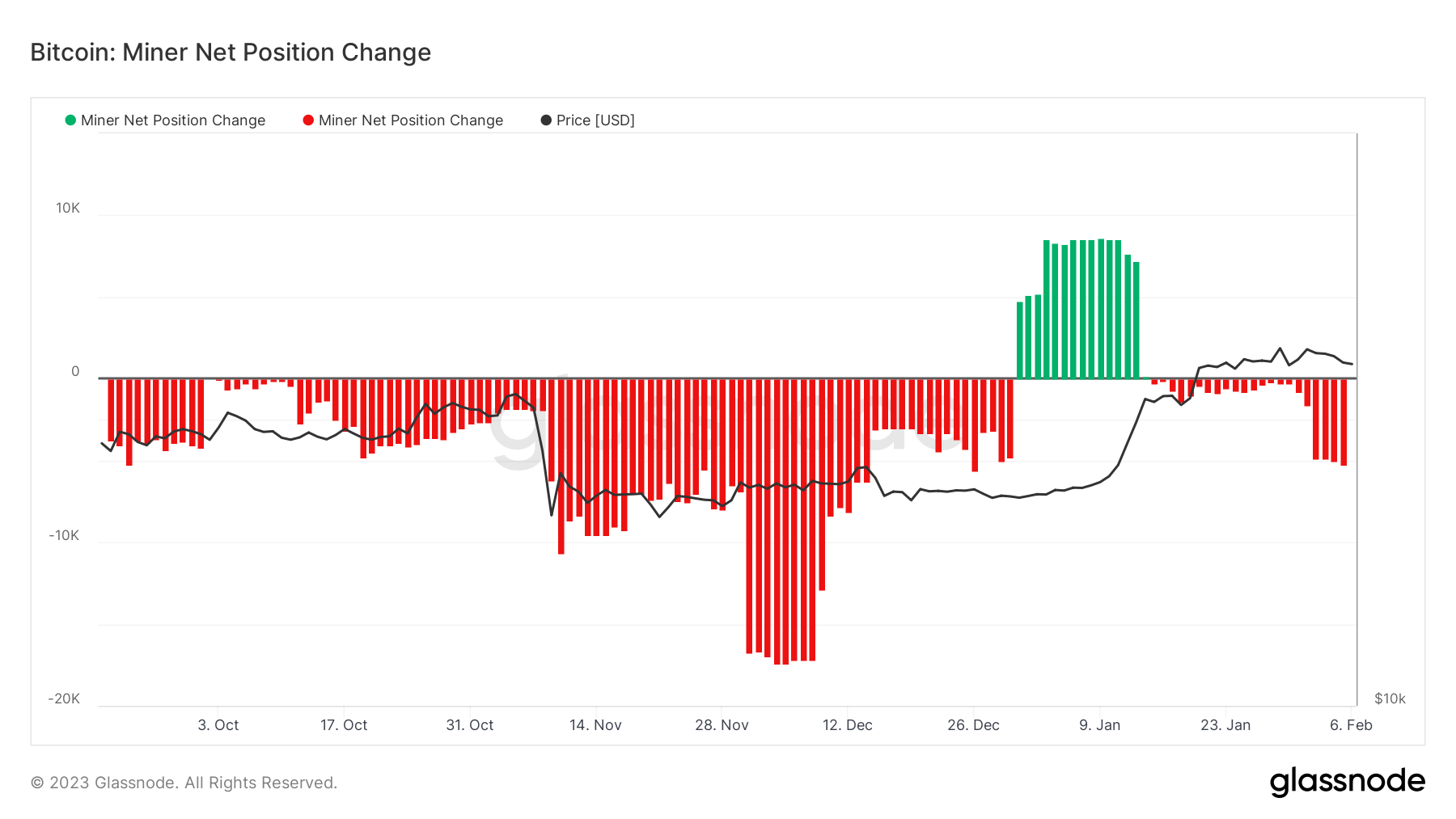

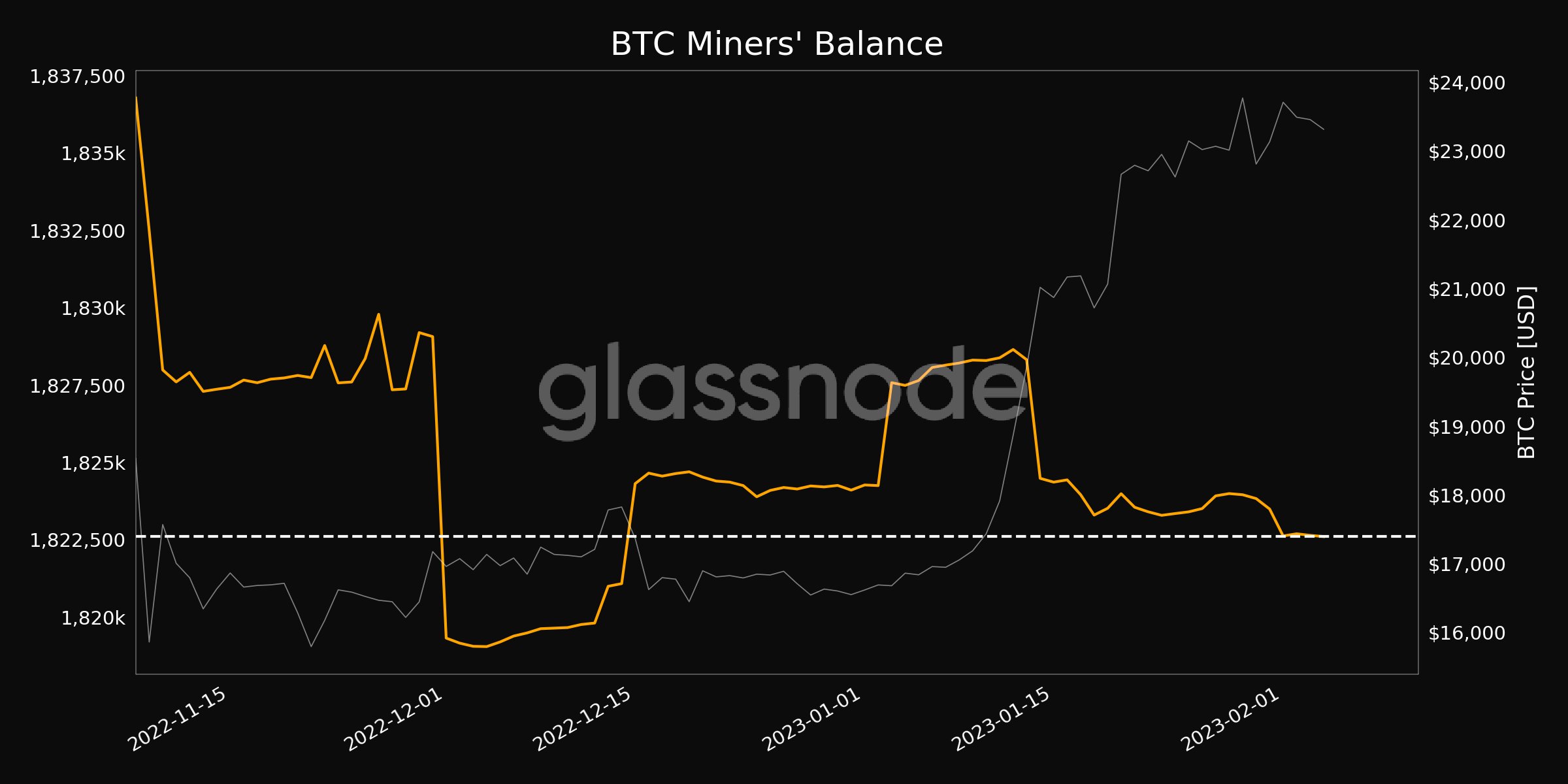

A counter-trend comes in the form of the economic behavior of miners. The most recent data from on-chain analytics firm Glassnode shows that BTC sales by miners continue to rise, with their reserves falling faster in 30-day periods.

Reserves correspondingly totaled their lower in a month on February 6, with a miners balance of 1,822,605,594 BTC.

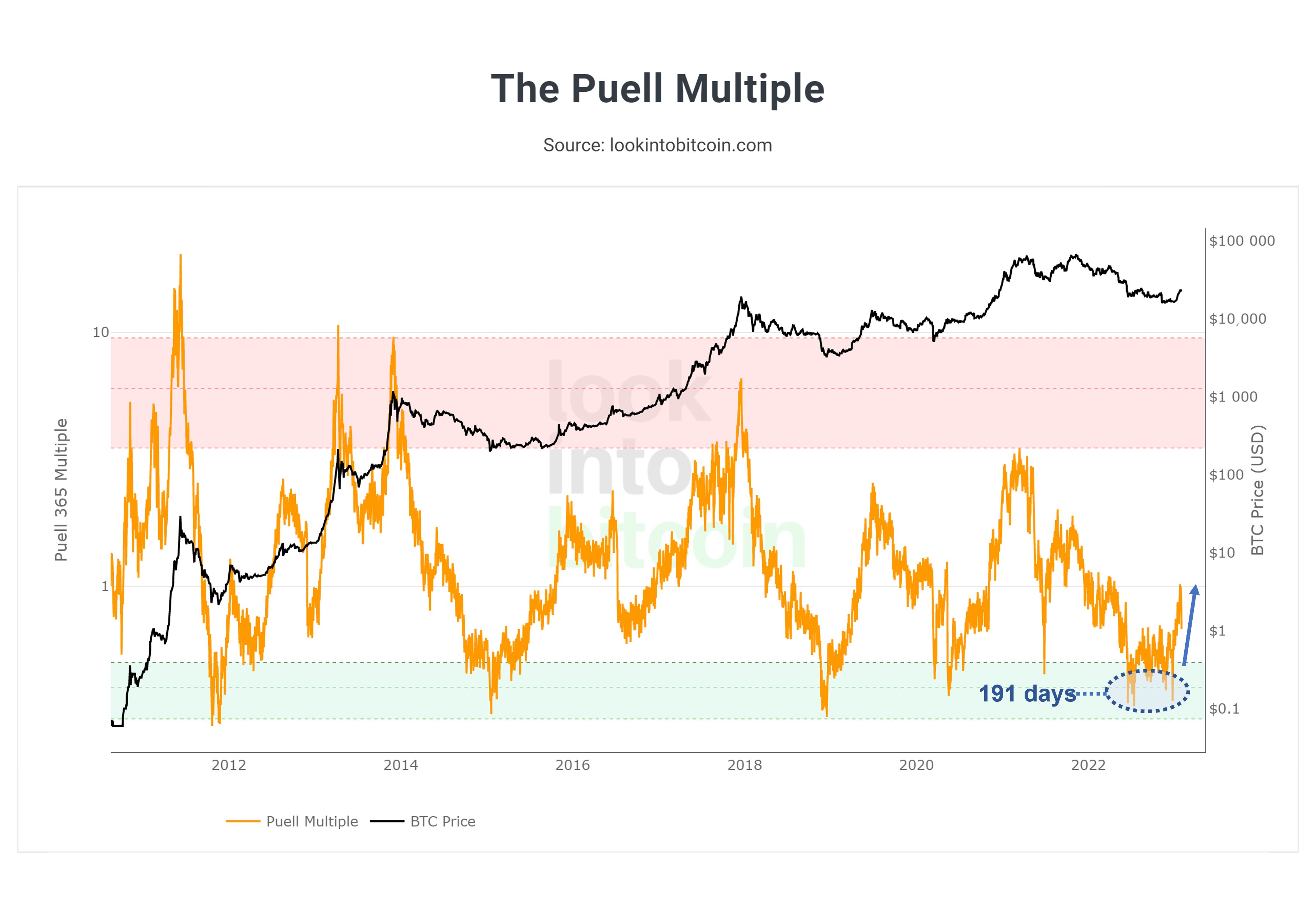

Overall though, the current price action has provided some “relief” for miners, said Philip Swift, co-founder of trading suite Decentrader.

in a cheep Last week, Swift referenced the Puell Multiple, a measure of the relative value of BTC mined, which has left its “capitulation zone” to reflect better profitability.

“After 191 days in the capitulation zone, the Multiple Puell has recovered. Showing relief for miners through higher revenue and probably less selling pressure,” he commented.

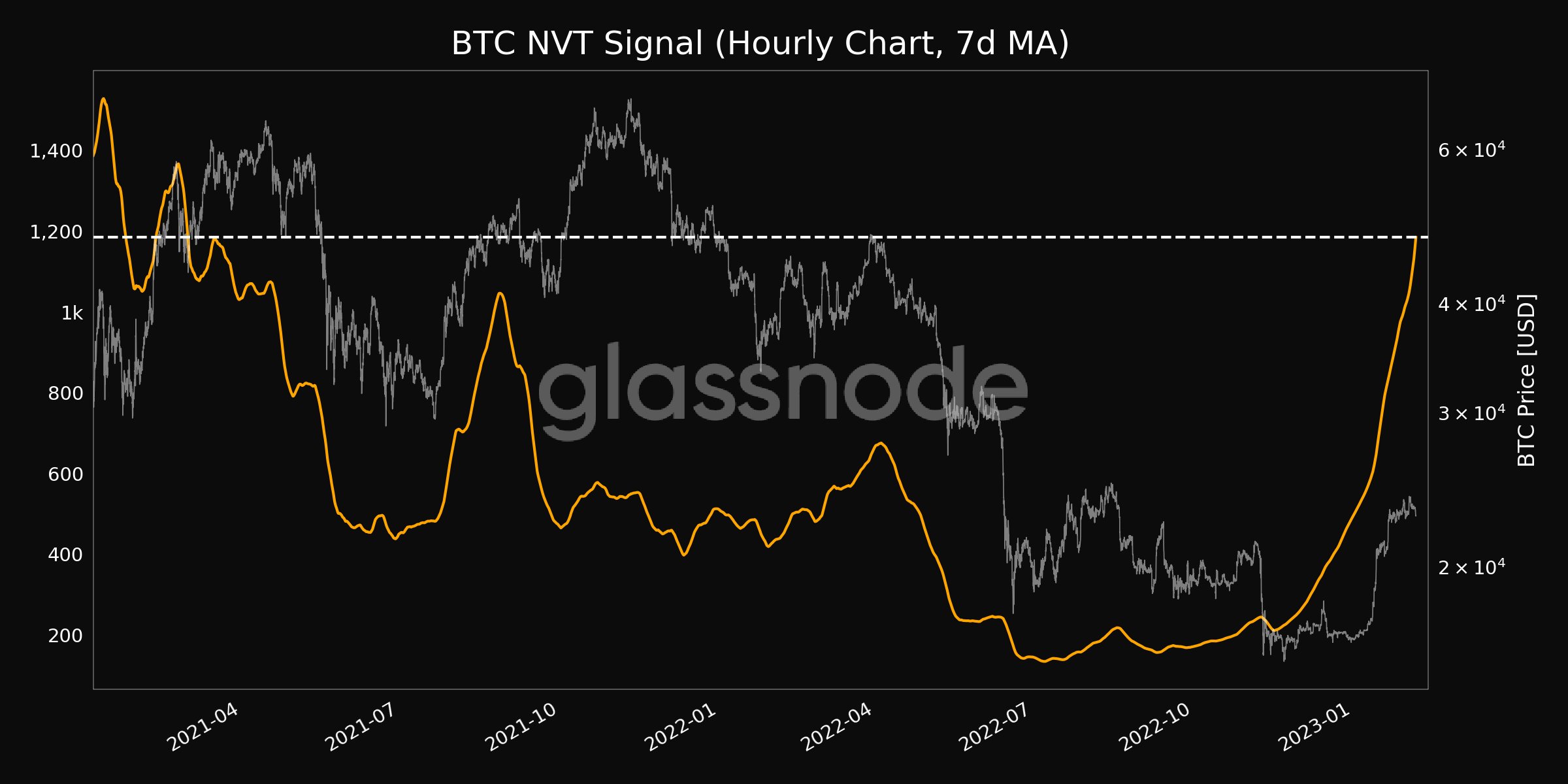

NVT Suggests Volatility Will Pick Up

Some on-chain data is still moving forward despite the slowdown in BTC price gains.

Of interest this week is the Bitcoin network’s NVT signal, which is now in levels not seen in almost two years.

The NVT signal measures the value of BTC transferred on-chain against the market capitalization of Bitcoin. It is adapted from the NVT ratio indicator, but uses a 90-day moving average of transaction volume instead of raw data.

NVT at multi-year highs may be cause for concern: the valuation of the network is relatively high compared to the value transferred, a scenario that may prove to be “unsustainable”, in the words of its creator, Willy Woo.

However, as Cointelegraph reported late last year, there are multiple nuances to NVT that cause its various incarnations to differ from one another to provide a complex picture of on-chain value at a given price.

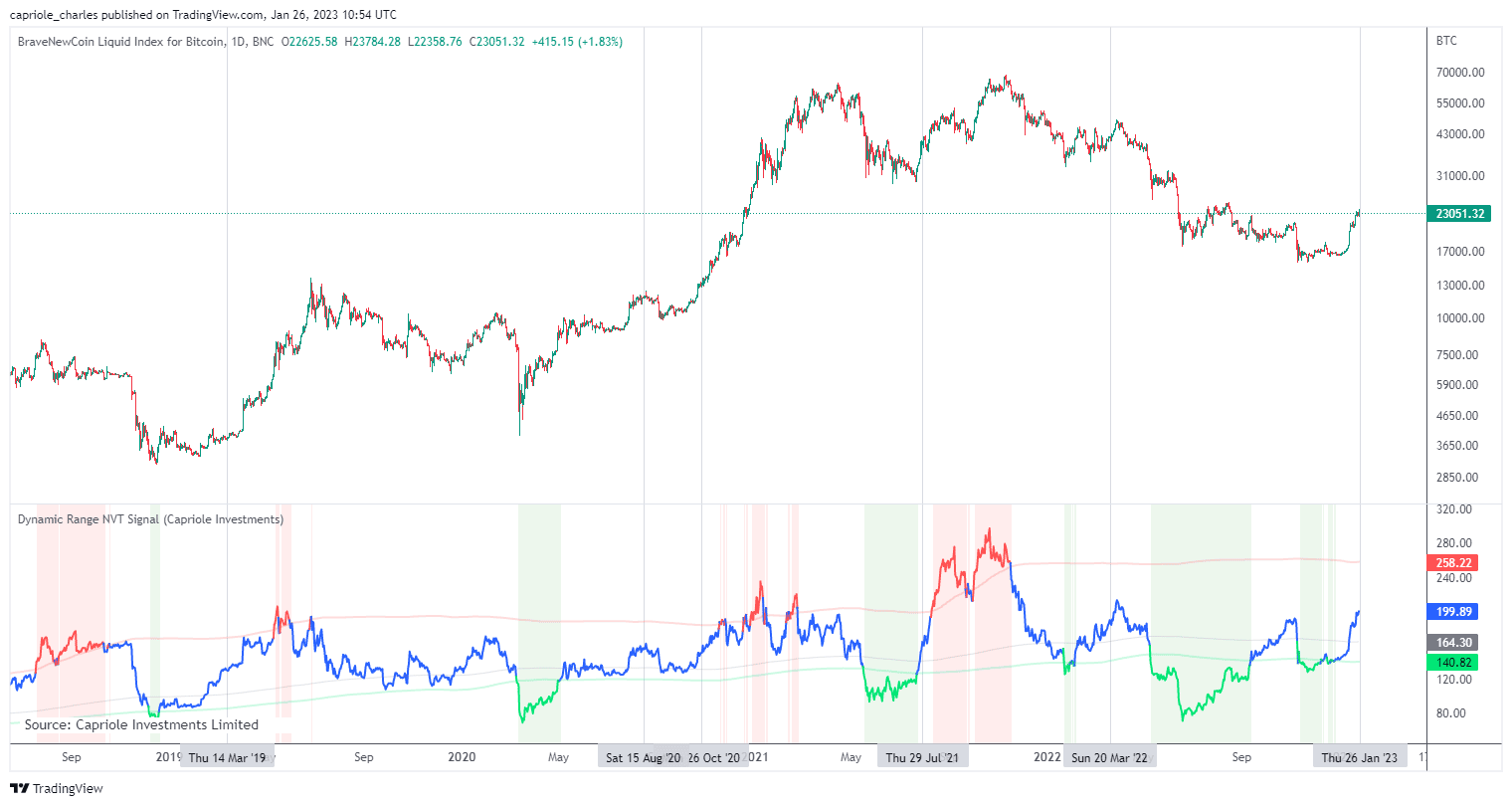

“Bitcoin NVT is showing signs of value normalization and the beginning of a new market regime,” Charles Edwards, CEO of crypto investment firm Capriole, commented about an additional NVT adjustment, called dynamic range NVT, on February 6.

“The message is the same throughout history and, in most cases, it is good news in the medium and long term. In the short term, this is a place where we typically see volatility.”

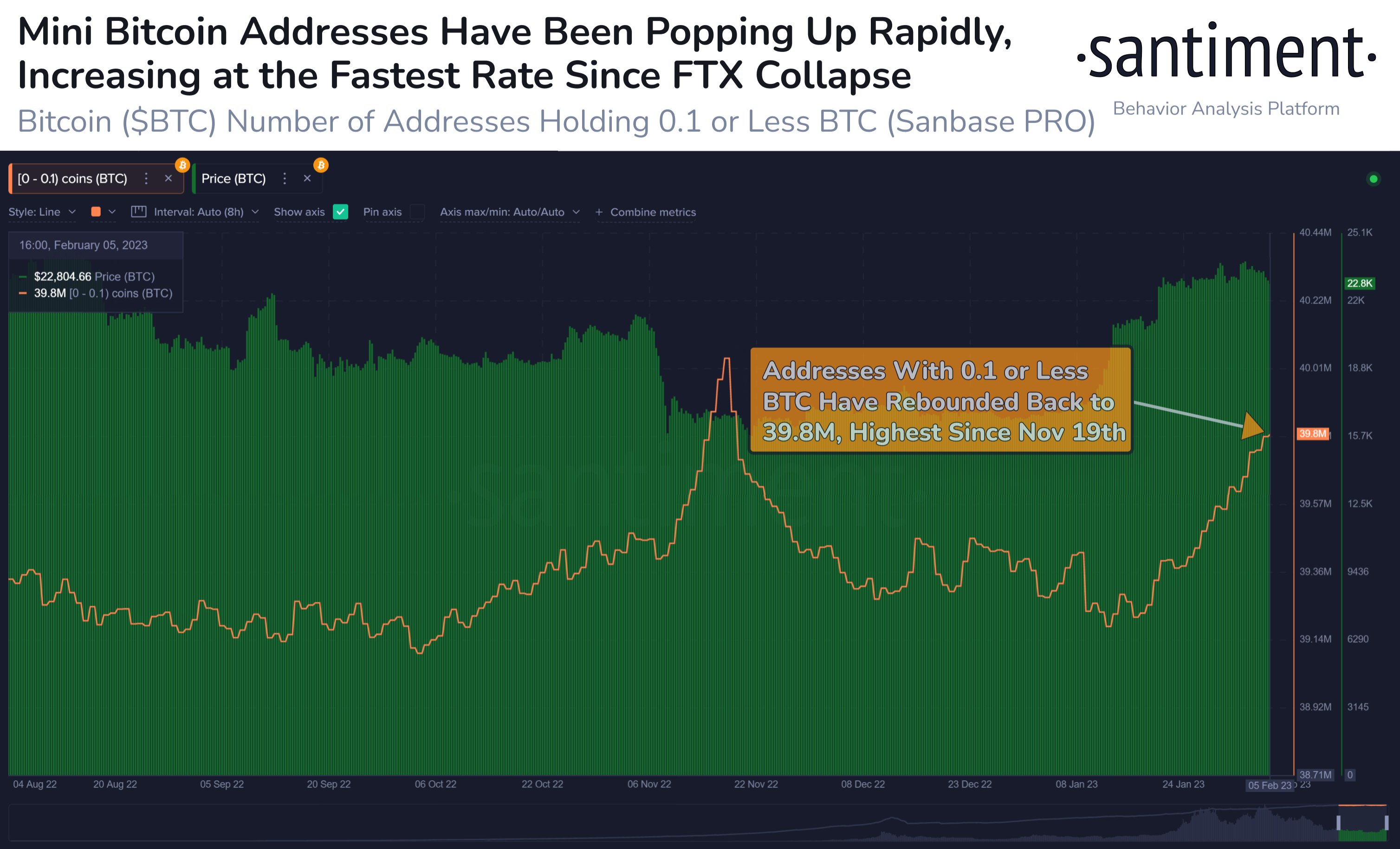

Small Bitcoin Wallet Shows “Trader Optimism”

In a ray of hope, on-chain research firm Santiment notes that the number of smaller Bitcoin wallets has skyrocketed this year.

Related: Bitcoin, Ethereum, and Select Altcoins Set to Resume Rally Despite February Crash

Since BTC/USD crossed the $20,000 mark once again on January 13, 620,000 wallets with a maximum of 0.1 BTC have reappeared.

That event, Santiment says, marks the moment “FOMO returned” to the market, with the subsequent growth in the number of wallets meaning they are at their highest since November 19, 2022.

“There have been ~620k small Bitcoin addresses that have reappeared on the network since FOMO returned on Jan 13 when the price rallied to $20k,” Twitter comment confirmed on February 6.

“These 0.1 BTC or less addresses grew slowly in 2022, but 2023 shows a return of merchant optimism.”

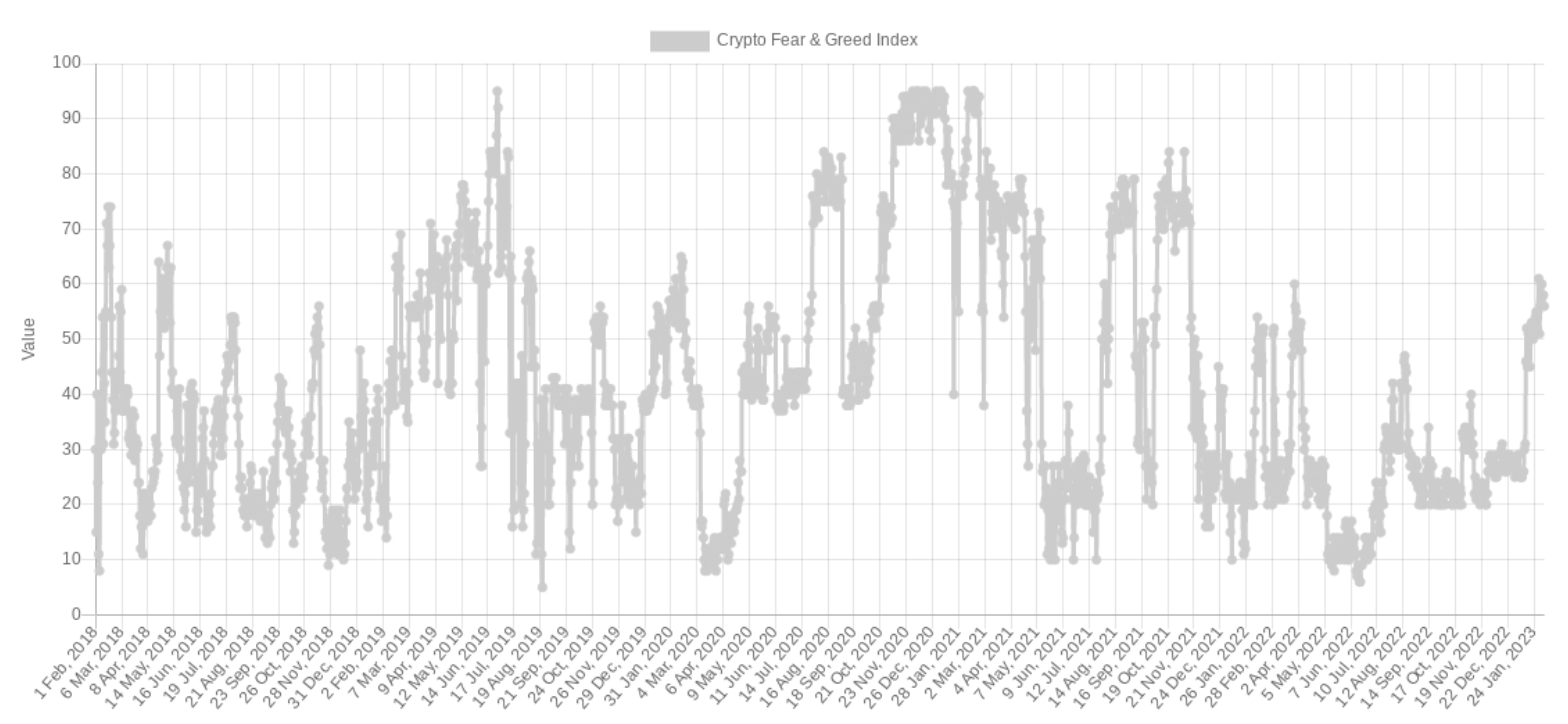

a look at the Crypto Fear and Greed IndexMeanwhile, it shows that “greed” remains the main description of market sentiment.

On Jan. 30, the index reached its “greediest” level since Bitcoin’s November 2021 all-time highs.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER