Institutional bitcoin (btc) investment vehicles have recorded over $1 billion in new inflows in less than two months.

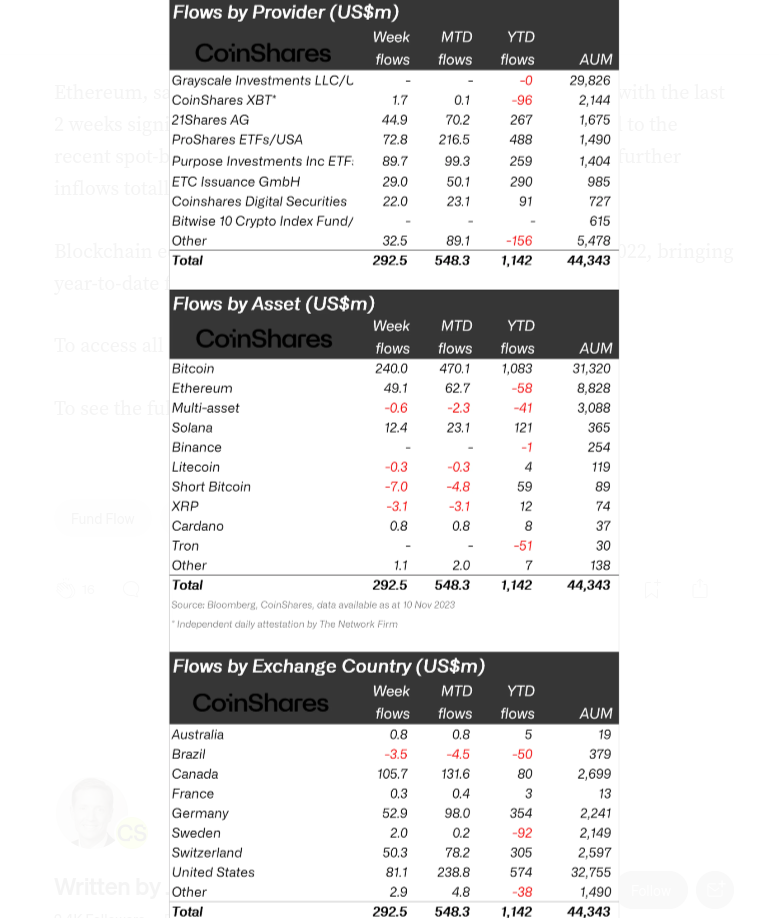

In his last weekly report On November 13, crypto asset management company CoinShares expanded the narrative that bitcoin and altcoins are attracting capital again.

Assets under management for crypto-institutional products increased 99% year-to-date

bitcoin, Ether (eth), and some major altcoins are enjoying price gains as excitement grows over the potential approval of America’s first spot exchange-traded fund (ETF).

Since November 2022, the total crypto market capitalization has increased by $600 billion, according to data from TradingView confirm.

However, the past two months have seen a precipitous increase in funds going into crypto investment products, CoinShares reveals.

“Digital asset investment products saw inflows totaling $293 million last week, taking this 7-week inflow streak past the $1 billion mark, leaving inflows at what for the year at $1.14 billion, making it the third-highest annual receipts ever recorded.” summarized.

Among the impressive statistics showing the renaissance of cryptocurrencies in 2023 is the asset under management (AUM) count of cryptocurrency exchange-traded products (ETPs).

Since the beginning of the year, this figure has practically doubled, gaining almost 10% in the last week alone.

“At $44.3 billion, total assets under management are now the highest since major crypto fund bankruptcies in May 2022,” CoinShares noted.

The report added that those aiming to go long btc had taken up most of the volume.

“bitcoin saw inflows totaling $240 million last week, bringing year-to-date inflows to $1.08 billion, while bitcoin short positions saw outflows of $7 million, bringing indicates continued positive sentiment,” he said.

“This is adoption”

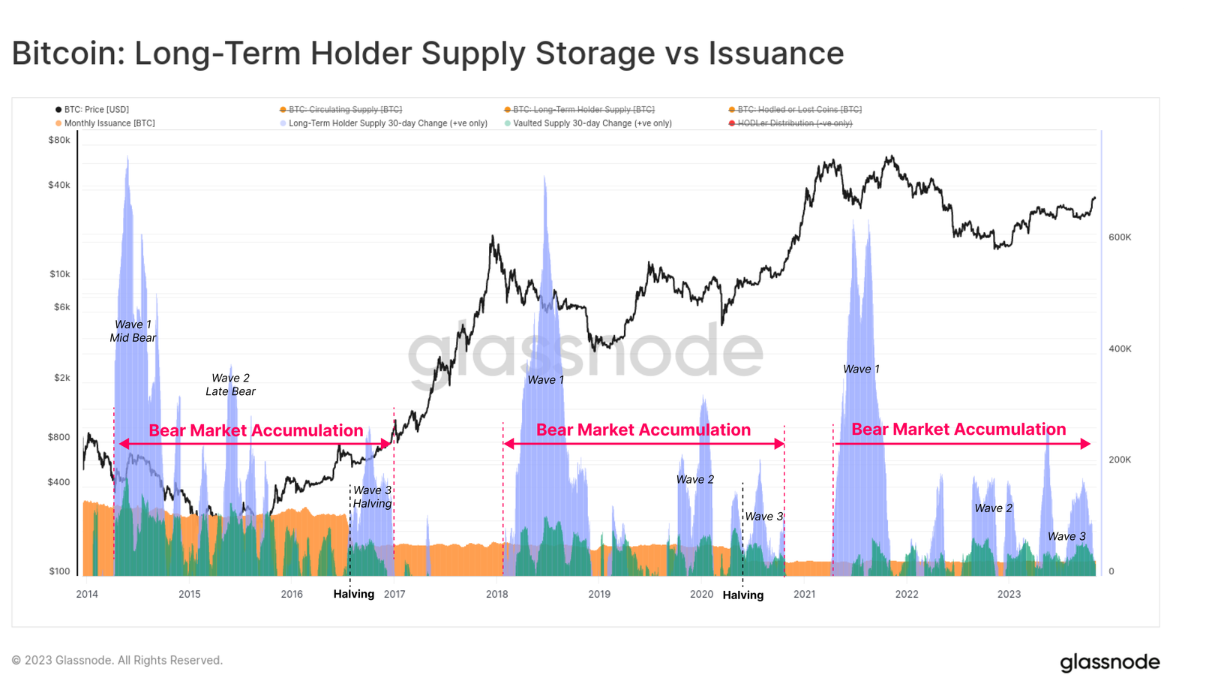

Meanwhile, renewed interest prompted on-chain analytics company Glassnode to reevaluate bitcoin supply dynamics.

Related: Funding Rates Reflect btc Price of $69,000: 5 Things to Know About bitcoin This Week

With the next block subsidy halved in just five months, the btc being stored is now exceeding the amount mined by 2.4 times, presented in the latest edition of its weekly newsletter, “The Week On-Chain.”

“The fourth halving event is rapidly approaching and represents an important fundamental, technical and philosophical milestone for bitcoin. For investors, it is also an area of intrigue given the impressive profitability profile of previous cycles,” he commented.

Among the various accompanying charts, one showed the storage of btc supply by long-term holders, or LTHs, entities that accumulate coins for 155 days or more.

Next, Philip Swift, creator of the Look Into bitcoin statistics platform, highlighted the rise of wallet entities, both large and small.

“This is what adoption looks like,” he told X subscribers that day.

This is adoption.bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin

Free Live Chart: https://t.co/UjBDJtk5rT pic.twitter.com/twnAE8ZoC4

– Philip Swift (@PositiveCrypto) November 13, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER