The flurry of registrations raises old debates about the “true” purpose of Bitcoin and its ability to become the money of the Internet.

This is an Op-Ed by Stephan Livera, Host of the “Stephan Livera Podcast” and Managing Director of Swan Bitcoin International.

So recently we have seen a Bitcoin transaction occupies almost a full block and Default mempools (300 MB) fill up. What is going on with all this madness of ordinals and inscriptions?

the quick explainer

Ordinals are an invented way of tracking sats (a fraction of a bitcoin) through transactions. Now, I stress that it is a made up way of tracking sats as it does not significantly affect the fungibility of bitcoin. As explained by creator Casey Rodarmor on my podcast, is a convention of numbering sats in the order they are drawn and tracking them through transactions in a first-in, first-out (FIFO) method. So, since Bitcoin transactions are made up of inputs and outputs, the first satoshi on the first input is considered to be transferred to the first output of a transaction. There are conventions around which ordinals are uncommon, rare, epic, etc.

What is an enrollment?

An enrollment is another made-up convention in which satellites can be enrolled with arbitrary content, a sort of native Bitcoin or NFT digital artifact. Using the convention, they can be sent to and stored in a Bitcoin Unspent Transaction Output (UTXO). Now, because they are encoded in such a way that they are written to transaction tokens, they never enter the UTXO pool. The UTXO set is considered to have increased consideration by the network because each The node (including pruned nodes) must maintain this UTXO set. So, I guess it could have been worse…

What is The Bull Case for ordinals and inscriptions?

To harden the case a bit: the pro Ordinales and inscriptions case could be understood in general terms as: “Come for the fun, rich art, stay for the decentralized digital money.”

You might also agree with some of the criticism of shitcoin NFTs and see this as a way of arguing that “Bitcoin does it better”, eg Bitcoin enrollments are immutable, always on-chain, simpler and more secure. than shitcoin NFTs.

Concerns raised with registrations

The main concerns here are:

- Reduced accessibility to transact in Bitcoin due to NFT enrollment/degens creating a backlog of transactions and paying a lower fee per actual byte due to token discount

- Reduced ability for users to run a full Bitcoin node due to increased storage and bandwidth requirements

- The possibility of illegal material being recorded on the Bitcoin blockchain that could deter some users from running a Bitcoin node

Of course, there are also arguments against:

- Bitcoin was eventually going to develop a block space/fee market anyway and this may help with the long-term viability of the network. Enrollments may simply form a “low value transaction backlog.”

- Bandwidth and storage costs have dropped over the years since 2017. Though, arguably, bandwidth over Tor can still be problematic for those syncing a full node in a more private way. One could also argue that everything remains within the conservative design bounds that the network effectively accepted back in 2017.

- Illegal on-chain material was always possible because you can’t completely stop bitcoin steganography. steganography is when it represents information within another message in such a way that the presence of the information is not evident to normal human inspection.

Old Bitcoin Debates Revisited: Purpose, Scaling, and More

Some argue that “we shouldn’t have increased block size with SegWit and witness discounting in 2017” and to some extent this latest trend of ordinals and enrollments raises similar questions as the OP_RETURN wars of 2014.

What is Bitcoin for? And should arbitrary data that does not relate to financial transactions on the Bitcoin blockchain be encouraged or discouraged?

Taproot is not to blame

Some commenters initially blamed the Taproot soft fork for the inscriptions. But Taproot seems to save only about 4% on the cost of signups.

It’s also worth noting that this kind of thing was possible with SegWit, and before that with OP_RETURN and even before that, with fake signatures, as Adam Back explains here:

cultural issues

Some ETH and cRyPtO huffers are enjoying this moment because, in their eyes, they can “stick to the maxis” and to those of a more “Bitcoin fundamentalist” persuasion, i.e. the people who believe that Bitcoin should be money.

I myself am closer to the “fundamentalist” camp, and see my mission as moving Bitcoin forward as money. And surely, after all the effort by Bitcoin developers to optimize and use block space more efficiently, on-chain enrollments seem wasteful and unnecessarily reduce the accessibility of Bitcoin for use in financial transactions.

Some argue that taking action against Bitcoin signups is “censorship” and that it is incorrect to view these transactions as “spam” since they pay a bitcoin transaction fee. But in the end, it comes down to the purpose of the project. While it’s true that Bitcoin is designed to be censorship-resistant and that NFTs arguably “started on Bitcoin” years ago, Bitcoin is arguably meant to be further on decentralized electronic cash and peer-to-peer.

Can this trend realistically be stopped?

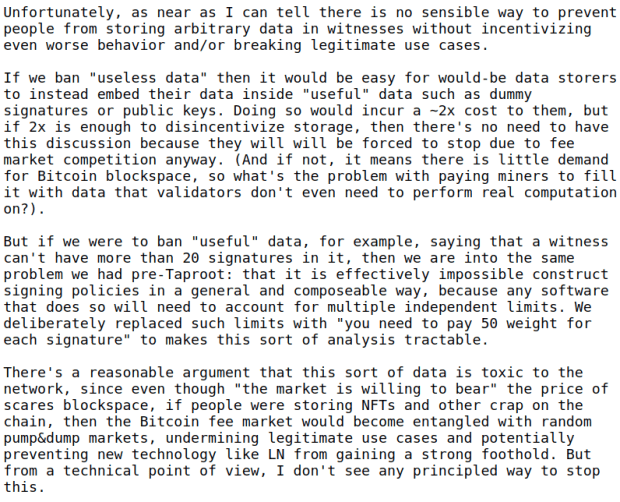

Short of drastic action, probably not. At least that’s what Andrew Poelstra explained in a recent post on the bitcoin-dev mailing list:

It’s also the wrong move to be too reactive with signups and try to take some drastic action to soft fork or make signups technically unfeasible. There are arguably bigger fish to fry, such as helping improve the adoption of Bitcoin as money and helping foster more decentralization in bitcoin custody, bitcoin mining, bitcoin scalability and verifiability, etc.

Ossification? Not yet

Some even go so far as to argue that “Oh, this is a bug and we need to ossify the Bitcoin protocol now to prevent further bugs.” I think this would also be a mistake. There are several soft fork ideas that are accepted, do not harm non-users, and could help scale bitcoin self-sufficiency. For example, ANY PREVENT either OP_VAULT.

ANYPREVOUT in particular is interesting to me because one day, with global adoption, we may have approximately 80,000 times the transactional demand what we have now In that world, ANYPREVOUT allows for an upgrade to “Eltoo” Lightning, giving us a way to share the cost of on-chain transactions in a self-custodial manner. If we want Bitcoin to be used in a way that is more sovereign, we ideally want people to be able to afford to take on-chain self-custody. Without this, they may be confined to custodial platforms because the cost of self-custody is too prohibitive. eltoo it also has several benefits for Lightning, like making backups easier.

Yes, we need to be conservative, but we also need to consider technologies that help bitcoin be the best you can be in being digital hard money.

Bottom line

While I’m “against” inscriptions in a sense and would prefer they be socially discouraged, I also don’t think they’re worth worrying too much about right now. For all we know, they could be a short-lived fad.

But even if they’re not a short-lived fad, what’s the most likely outcome here? Financial transactions are likely to drive down the price of low-value entries over time as Bitcoin is adopted by more people. It’s just that adoption happens “thickly” and is concentrated in periods of high usage (as seen in 2013, 2017, and 2021), and then periods of relative calm as transaction volumes decline and new technologies are applied. and scaling techniques.

Or as eloquently mentioned here:

In the medium and long term, financial transactions will dominate in Bitcoin. Other uses of Bitcoin will be subservient to its use as decentralized money for the internet.

This is a guest post by Stephan Livera. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.