The bitcoin price, rising in the face of an ongoing banking crisis, seems to vindicate what bitcoiners have known all along.

This is an opinion editorial by Robert Hall, content creator and small business owner.

The events of the last few weeks have spooked both investors and regional banks. More importantly, the people who go to work and run the economy are beginning to question whether their bank deposits are safe. Fears of more bank runs after the collapses of Silicon Valley Bank (SVB), Signature Bank, Silvergate Bank and Credit Suisse are rampant.

And these fears are not unfounded, if you ask me. For example, when you turn on the television and see that The First Republic needs a $30 billion bailout to stay afloat, it does not inspire confidence in the banking system. And more banking chaos could come. Legendary investor Michael Burry believes two more banks could be in trouble in Comerica Bank and US Bancorp. Essentially these banks are in the same position that SVB was in. The probability of more bank bailouts seems to be increasing by the day.

To top, federal regulators are studying the possibility of insuring all bank deposits throughout the banking system. There is approximately $19 billion in bank deposits in the banking system. Any talk of insuring bank deposits from all banks in America is crazy and downright dangerous. Talk about adding fuel to the fire. I think this would make people care more about their money and lead to more bank runs. The government and the Federal Reserve are playing with fire.

The Federal Reserve is reacting to situations instead of being clear-headed and planning ahead. This will lead to overreaction and the implementation of policies that could do more harm than good. It’s crazy that the fate of the entire economy rests in the hands of the likes of Janet Yellen, Jerome Powell, and Joe Biden.

Do you sleep like a baby at night knowing that these people are in charge of the economic destiny of the planet? How we got to this place is well documented, and there’s no reason to go into detail, but taking a step back makes you realize the precarious situation we now find ourselves in.

Thank God for Bitcoin

I want to be the first to say in chaotic times like this: “Thank God we have Bitcoin.” We are certain that our money is our money. There is no third party that is going to screw it up and inflate its value. There are no third parties that can prevent you from accessing it. No one can stop you from spending it on whatever you want or from sending it to whoever you choose.

For the first time in history, the power to transact is truly in the hands of the people. Bitcoin is the most innovative monetary technology ever created. This realization is beginning to sink in as more people flock to the safety of Bitcoin in times of turmoil.

The bitcoin price has skyrocketed on the news of these recent bank collapses. As of this writing, In the last 14 days alone, the bitcoin price has skyrocketed 28.8 percent. This is a massive move in a matter of two weeks. Is it safe to say that Bitcoin is becoming a risky asset in the eyes of the average consumer? It’s certainly a trend that way.

Bitcoiners already know this to be true; we’re just waiting for everyone to catch up in real time. As of this writing, the price is just above $28,000 and, in all likelihood, it won’t stay there for long if news of more bank failures hits.

As a Bitcoiner, it is good that more people realize what we have come to know about Bitcoin and start saving their bitcoin wealth. On the other hand, he did not want it to happen in such a way that it jeopardized the entire global economy.

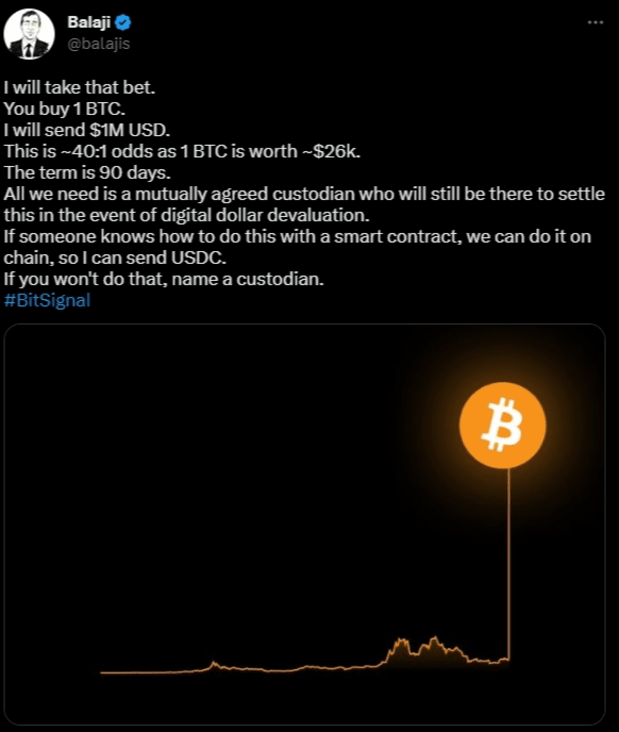

Some believe that Bitcoin will hit $1 million in the next 90 days! What a time to be alive, right?

Events will happen the way they are supposed to; the best we can do as Bitcoiners is to continue to spread the word about Bitcoin to anyone who will listen and continue to rack up sats accordingly.

“There are decades in which nothing happens, and there are weeks in which decades pass.”

Not that I like to quote dead communists, but I think this is appropriate for the times we live in. 2023 could end up being a momentous year for Bitcoin and the world. Seat belt. It’s going to be a wild ride.

This is a guest post by Robert Hall. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

NEWSLETTER

NEWSLETTER