bitcoin price movements have always been a topic of debate between investors and analysts. With the recent retouches in the market, many question whether bitcoin has already reached its peak in this bull cycle. This article examines the data and chain metrics to evaluate the position of the bitcoin market and the possible future movements.

For a complete analysis in depth, see the original Has the price of bitcoin already reached its maximum point? Full video presentation available in bitcoin Pro MagazineThe YouTube channel.

bitcoin's current market performance

bitcoin recently faced a 10% setback of its historical maximum, which led to concerns about the end of the upward market. However, historical trends suggest that such corrections are normal in a bull cycle. In general, bitcoin experiences setbacks from 20% to 40% several times before reaching its final cycle peak.

Chain metric analysis

MVRV Z-SCORE

He MVRV Z-SCOREwhich measures the market value to the value carried out, currently indicates that bitcoin still has considerable rise potential. Historically, the bitcoin cycle occurs when this metric enters the overheated red zone, which is not the case.

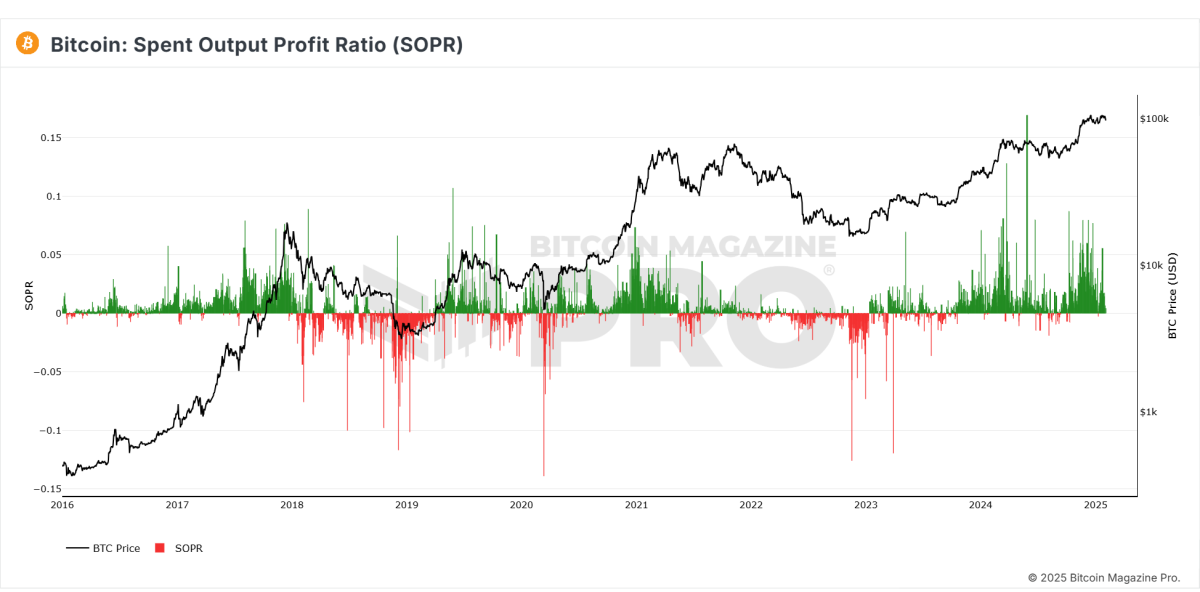

Gasted Production Profit Rat (SOPR)

This metric reveals the proportion of results spent on profits. Recently, the Soprano It has demonstrated a decrease in the profits made, which suggests that fewer investors are selling their holdings, reinforcing market stability.

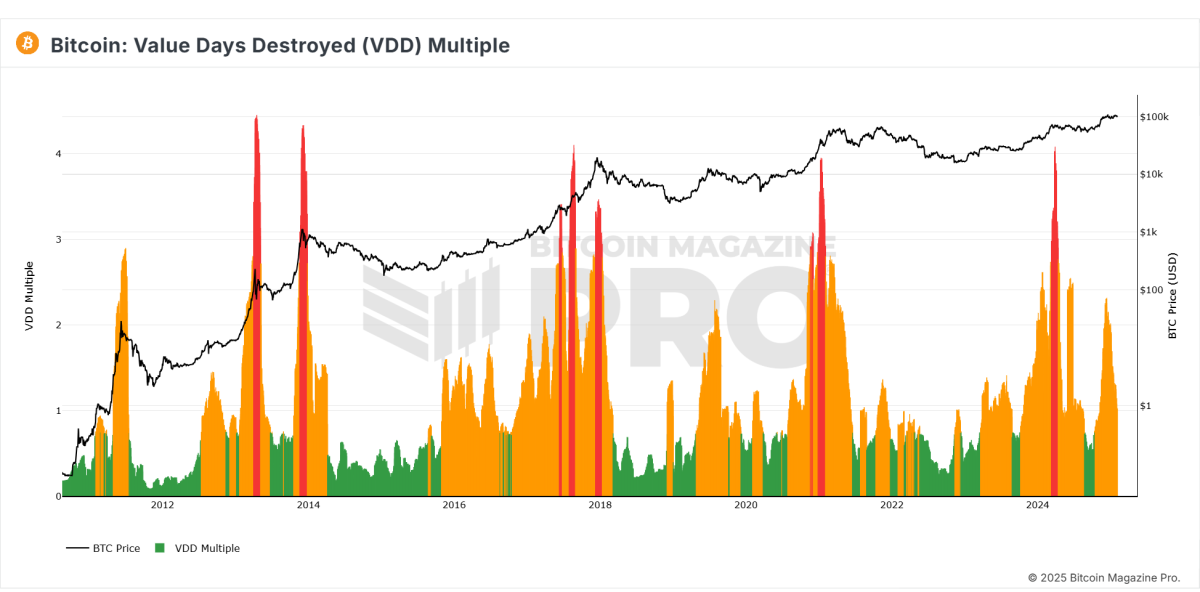

Didseed days (VDD)

VDD Indicates the sales of long -term holders. The metric has shown a decrease in the sale pressure, which suggests that bitcoin is stabilizing at high levels instead of addressing a prolonged lower trend.

Institutional and market feeling

- Institutional investors such as Microstrategy continue to accumulate bitcoin, indicating confidence in their long -term value.

- The feeling of the derivatives market has become negative, which historically indicates a short -term price potential, since merchants with leverage bitcoin bets can be settled.

Macroeconomic factors

- Quantitative tight: Central banks have been reducing liquidity, contributing to the temporal decrease in bitcoin's price.

- GLOBAL M2 MONEY SUPFEREN: A contraction in the money supply has affected risk assets, including bitcoin.

- Federal Reserve Policy: There are indications of the main financial institutions, including JP Morgan, that quantitative flexibility could return to mid -2025, which would probably increase the value of bitcoin.

Related: Is $ 200,000 a realistic price of bitcoin price for this cycle?

Future perspective

- bitcoin's price action shows signs of entering a consolidation phase before another possible rally.

- The data in the chain suggests that there is still significant space for growth before reaching the peaks of the cycle seen in the previous Alcista markets.

- If bitcoin experiences more setbacks to the range of $ 92,000, this could present a strong accumulation opportunity for long -term investors.

Conclusion

While bitcoin has experienced a temporary setback, the metrics in the chain and historical data suggest that the bull cycle is not over yet. Institutional interest remains strong, and macroeconomic conditions could change in favor of bitcoin. As always, investors must analyze the data carefully and consider long -term trends before making investment decisions.

If you are interested in a deeper analysis and data in real time, consider checking bitcoin Pro Magazine For valuable information about the bitcoin market.

Discharge of responsibility: This article is only for informative purposes and financial advice should not be considered. Always do your own research before making investment decisions.

NEWSLETTER

NEWSLETTER