bitcoin, the king of cryptocurrencies, could have terrible news in store for investors. According to popular YouTuber Steve of crypto Crew University, it may have already peaked and as such, it could all be “downhill from here.”

Detailed technical analysis using key indices

In the video titled “WARNING: bitcoin'S WORST SCENARIO COULD BE HAPPENING NOWSteve's analysis starts with the btc-USD chart, where he focuses on the monthly period to analyze the behavior of the bitcoin market using two fundamental indicators: Traders Dynamic Index (TDI) and Rank Correlation Index (RCI) . Historically, these indices have provided reliable signals for predicting major market swings, including market lows in 2018 and 2022 and subsequent bull runs in 2019 and 2023.

Steve identifies a critical pattern in today's market: the formation of a “Red Cross” in both TDI and RCI. This pattern was previously observed during the peak of the bitcoin market cycle in 2021, indicating potential problems. The video methodically illustrates the appearance of these signals with yellow and red circles on the charts, suggesting that the market could be approaching a recession.

Historical analysis and signal accuracy

The video delves into several historical cases where the alignment of these indices was correlated with important market events. A notable example was in January 2018, when these indices signaled a slowdown right at the peak of the market cycle, leading to a substantial market correction. Steve provides a step-by-step guide on how to set up these indices, allowing viewers to track these critical signals on their charts.

Despite their reliability, Steve acknowledges cases where indices provided misleading signals. For example, in July 2013, despite a sign of slowing, the market momentarily moved sideways before finally reaching new highs. These exceptions underscore the need for cautious interpretation and validate that, while predictive tools are insightful, they are not infallible.

bitcoin Theory 5.3 of Market Cycle Highs

Steve's bitcoin Theory 5.3 Market cycles propose a predictive model in which returns from the trough to the peak of the cycle decline by a factor of approximately 5.3 times each cycle. This model has led to an estimate that bitcoin's next cycle high could be around $77,000. The calculations are based on a historical analysis of bitcoin return on investment (ROI) patterns, where previous cycles showed returns not exactly 5.3, but rather ranging between 4.96x and 5.63x. When averaged, these returns support the theory with a mean of approximately 5.31x.

According to the theory, reaching a cycle high of $100,000 would require a considerably lower diminishing rate of return of around 3.84 times compared to the last cycle, which seems optimistic given current and historical market data. This rate of return would significantly deviate from the established patterns seen in bitcoin price movements, which generally align with Fibonacci extension levels that predict lower highs. Furthermore, the introduction of new market factors such as bitcoin exchange-traded funds (ETFs) could potentially alter market dynamics, influencing the peak of the cycle beyond what traditional models could predict.

The theory underscores a conservative outlook for bitcoin's immediate price potential, suggesting that unless fundamental market dynamics change dramatically, such as through increased institutional investment or significant changes to regulatory landscapes, the upper bounds of bitcoin's price bitcoin in this cycle might not reach the optimistic heights of $100,000 as some expect.

Current market signals and forecasts

Based on his extensive analysis, Steve suggests that the current alignment of the TDI and RCI in 2024 reflects conditions seen at previous market peaks, which could portend a major market decline. He meticulously compares this to previous cycles, stating that current market conditions could be forecasting one of the most challenging periods for bitcoin.

Our thoughts

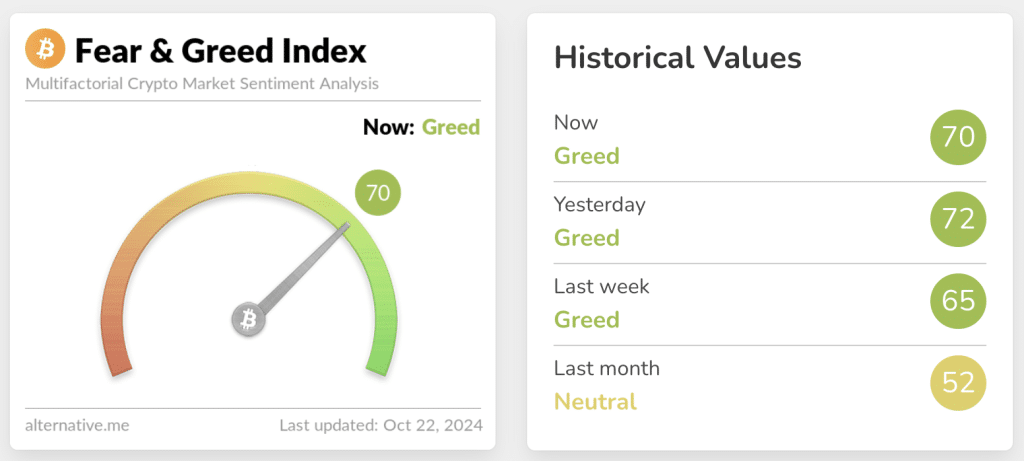

While we agree with most of Steve's analysis, we want to draw our readers' attention to the fact that crypto/fear-and-greed-index/”>the current “Fear and Greed” market index indicates “greed”, which is a contrary signal and serves to further indicate the likelihood of a slowdown, rather than the continued rise that everyone expects.

Finally, we note that there is an additional clue that could suggest that bitcoin will not continue to rise: the breakout weakness and rejection at the top of the channel, which may indicate a false breakout. False breakouts are usually associated with strong moves in the opposite direction, in this case, down.

All is not lost

However, Steve also presents a potentially optimistic scenario where, similar to past market behaviors, bitcoin could witness a final rallyforming a double or triple top before any dramatic drop. This scenario is analyzed as a “best case” possibility, highlighting the complex dynamics at play in cryptocurrency markets. He also urges viewers that the fact that bitcoin has peaked is not necessarily a sign that the best course of action is to sell everything and not re-enter the market this cycle. Smart traders can take into account all available information and manage to be profitable, despite market conditions.

We should also add that regardless of whether this scenario plays out or not, during the next bitcoin rally, altcoins will also rally, offering significant profit opportunities. Investors and traders are advised to choose the right time if they decide to buy any of these.

Best Wallet Review: A Smart Approach to Managing Your crypto Assets

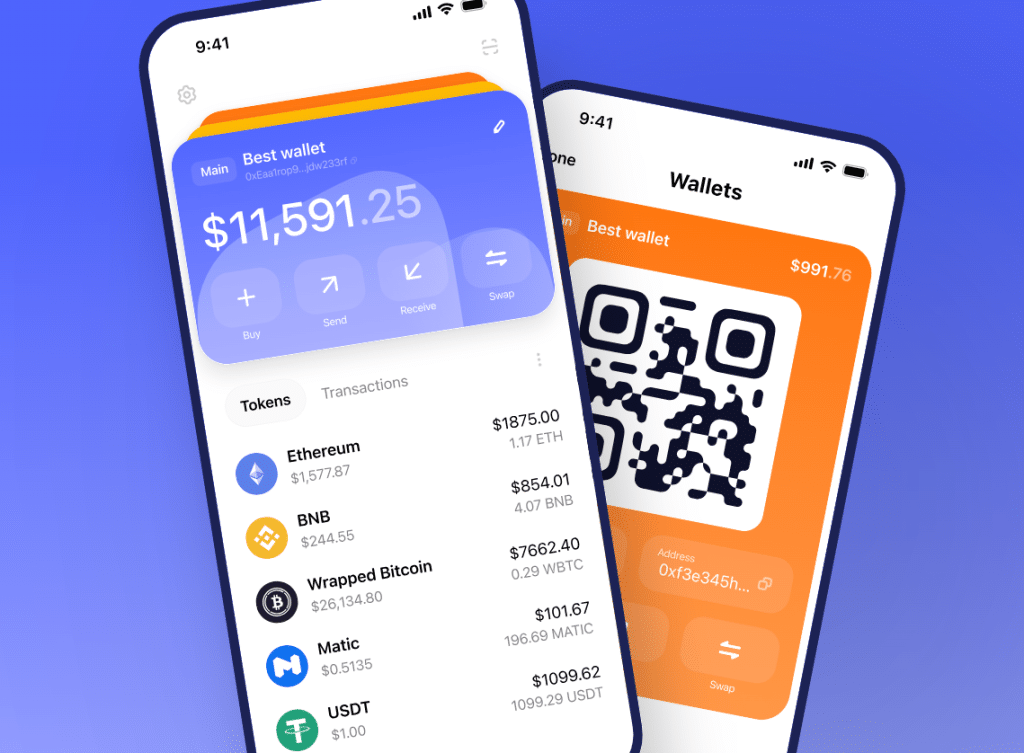

As the world of cryptocurrency continues to evolve, protecting your digital assets has become more important than ever, especially with recent increases in thefts and scams. Amidst the multitude of available wallets, Best wallet has become a pioneer, earning the trust of the cryptocurrency community.

This wallet is designed to be a cutting-edge solution for both storing and purchasing cryptocurrencies. It highlights several features and future developments that are sure to intrigue investors. However, security concerns are valid, so we'll take a closer look at what Best Wallet offers to help you decide if it's the right choice for you.

What exactly is the best wallet?

Best Wallet is redefining what a cryptocurrency wallet can do. Unlike many wallets that primarily focus on Dapps or DEX interactions and secure asset storage, Best Wallet offers a set of unique features that set it apart from its competitors.

Despite being relatively new to the market, it has attracted a growing user base thanks to its attractive and easy-to-use interface. The website showcases upcoming features, further fueling investor enthusiasm.

Aiming to be a comprehensive platform for cryptocurrency investing, Best Wallet strives to simplify a variety of investor activities. From real-time market updates to alerts on new tokens and airdrops, as well as portfolio management and easy cryptocurrency transactions, it is designed to be a one-stop shop for all your crypto needs.

The developers have implemented a variety of services, including Best Wallet, Best DEX, Best Bot, and an upcoming BEST airdrop, expanding the scope of offerings for investors. By incorporating ai elements into the platform, Best Wallet becomes an even more attractive option for potential users.

While the identities of the core team remain undisclosed, they are moving forward through a structured roadmap aimed at achieving their goals in the fast-paced crypto environment.

Best Wallet Key Features

Multiple wallet and multiple chain

Best Wallet eliminates the need for users to manage multiple accounts across multiple wallets. Its multi-wallet feature allows users to create separate wallets within the app, simplifying management of their cryptocurrency holdings.

This platform stands out for its in-house decentralized exchange, aptly named Best DEX. Users have the freedom to purchase and store a wide range of cryptocurrencies directly within Best Wallet, with no registration required. The DEX features low fees and a highly decentralized model, complemented by various analytical tools to help users understand their investment options.

Portfolio management

Best Wallet includes a portfolio management system that allows investors to monitor their profits or losses in real time. Users can easily view purchase prices and current values of assets, as well as tag, organize and search their holdings. This functionality ensures that users stay informed about their investments, whether they are experiencing gains or losses, and helps them make diversification decisions.

Market outlook

To remain competitive, investors need access to market information, and Best Wallet offers a section dedicated to cryptocurrency trends. Users can access vital statistics such as market capitalization and trading volume, along with updates on important developments in the crypto space.

This feature provides users with information on recently launched cryptocurrencies, ongoing pre-sales, and trending tokens. Basically, it helps users discover projects that may be overlooked but have significant potential for appreciation.

Airdrop Opportunities

Many investors miss out on airdrop opportunities due to a lack of knowledge about available events. Best Wallet addresses this issue by providing a dedicated section that keeps users informed about upcoming airdrops. This functionality allows investors to participate in projects and potentially increase their profits through airdrop tokens.

User experience with Best Wallet

Best Wallet's interface is designed for simplicity and efficiency, providing users with clear and informative content. According to the developers, the platform is aimed at a wide range of investors, making it accessible to everyone.

The DEX is integrated into the platform with an intuitive design that minimizes confusion. A simple color scheme enhances the interactive features and information presented on the site.

Overall, Best Wallet stands out as a reliable option for anyone looking for a secure way to store cryptocurrency while interacting with the Web3 ecosystem. While it is always wise to do your own research before choosing a wallet, Best Wallet appears to be a strong contender in the current crypto landscape.

Visit the best wallet

Related news

Most Wanted crypto Launch: Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured on Cointelegraph

- SolidProof and Coinsult audited

- Staking Rewards – pepeunchained.com

- Over $10 Million Raised in ICO – Ends Soon