Join our Telegram channel to stay up to date on breaking news coverage

Grayscale bitcoin Trust (GBTC) discount is evaporating and new bitcoin ETF token ($BTCETF) has attracted $2 million from traders in the latest two signs that bets on the imminent approval of a bitcoin ETF cash are accumulating.

Meanwhile, Galaxy Digital Holdings founder Michael Novogratz believes that a timely approval of the bitcoin ETF will see the price of bitcoin return to its all-time high near $69,000 printed in November 2021.

“We’ll see a pretty successful psychology shift when the government says you can buy bitcoin,” says Novogratz, who expects billions of dollars of new money currently sitting on the sidelines to flood the market.

Analysts at Bloomberg Intelligence estimate that there is a 90% chance that a bitcoin ETF will be approved. It is this expectation that has seen the price of bitcoin double this year to outperform all other asset classes.

The new bitcoin ETF token is gaining traction as the only cryptocurrency specifically designed to reward its holders when a spot bitcoin ETF is approved.

Its value is tied to important real-world events related to bitcoin and bitcoin ETF products, such as their approval, launch, assets under management, and trading volumes.

These major achievements act as burn trigger points that increase the value of the $BTCETF token, which is proving to make the new cryptocurrency one of the smartest ways to approach the topic of bitcoin ETF investing.

For those who can access the Grayscale bitcoin Trust over-the-counter market through their broker of choice, this provides an alternative approach to playing this market.

At the beginning of this year the discount was -46%, but today it is only -8%. The discount measures how much less than the net asset value (the value of the bitcoin you own) that the stock trades for. If the trend continues or accelerates, then GBTC could start trading at a premium again, as it has done in bull markets.

However, the downside to the GBTC bet is that when the trust converts to an ETF from its current closed-end structure, funds will likely flow out as profit-taking begins.

Furthermore, to the extent that it is trading at a premium, this has been an additional price that institutional investors have been willing to pay to ensure a regulated route into the crypto asset class. The approval of a bitcoin spot ETF will eliminate the premium justification, if GBTC were ever to trade at a premium again.

Market participants expect the bitcoin spot ETF to be approved as soon as January 10, 2024, so there is not much time for GBTC to move to premium prices.

With $BTCETF none of these problems exist. On the contrary, because the coin has been designed to take advantage of approval and other product development events, it will continue to grow as a value proposition for traders and investors.

The $BTCETF ICO started a couple of weeks ago, but there are less than 48 hours before the next staged price increase from $0.0060 to $0.0062.

However, the current Stage 6 price ends when $2,498,109 is reached, which could arrive before the remaining allotted time, increasing FOMO in the market. There are 10 price stages in total on the way to the $5 million cap. As the pace of ICO execution accelerates, there is no time to waste, but potential buyers should do their own due diligence.

Such is the enthusiasm in mainstream finance that every week a new issuer enters the bitcoin ETF fray. Swiss asset manager Pando Asset has filed an S-1 form at the Securities and Exchange Commission for Pando Asset Spot bitcoin Trust.

Standard Chartered Bank analyst Geoff Kendrick has set a $100,000 price target for bitcoin by the end of 2024, out of optimism that the next bullish halving cycle is starting to take hold alongside the ETF craze.

Switzerland @PandoAsset enter the place of the USA bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin #ETF race among a wave of applicants, including @BlackRock and @Fidelityhinting at a possible change in the crypto?src=hash&ref_src=twsrc%5Etfw”>#crypto landscape. #BitcoinETF It also achieves a groundbreaking milestone by raising over $2 million! pic.twitter.com/NyGzDQIMkf

– BTCETF_Token (@BTCETF_Token) November 30, 2023

<h2 id="h-bitcoin-etf-token-is-the-only-crypto-that-directly-rewards-owners-as-bitcoin-etfs-are-approved” class=”wp-block-heading”>bitcoin ETF Token, the cryptocurrency designed to reward investors for bitcoin ETF approvals

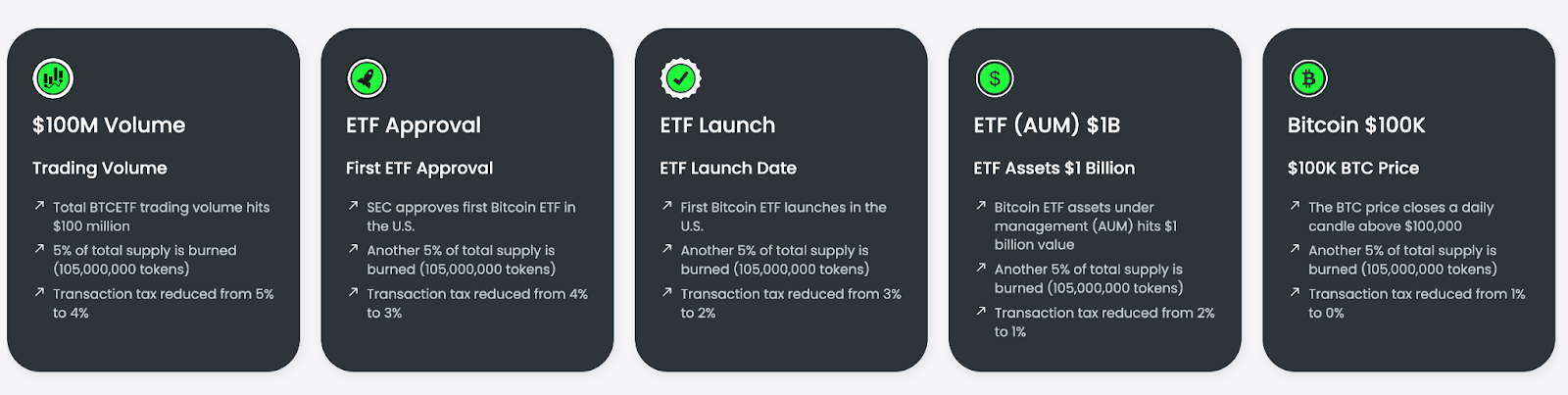

Built on the ethereum blockchain, the $BTCETF token initially includes a burn tax when the coin is launched on decentralized exchanges (DEX). The tax decreases by 1% as each milestone is reached.

There is also a separate burning mechanism of up to 25% of the total supply to fuel deflationary shortages of the currency. 5% of the total supply is burned for each $BTCETF milestone passed.

These two mechanisms mean that $BTCETF holders have the most closely aligned rewards of any cryptocurrency for the bitcoin ETF spot growth theme.

The bitcoin ETF ($BTCETF) token burn and transaction tax reductions are tied to real-world bitcoin ETF developments. Source: bitcoin ETF Token

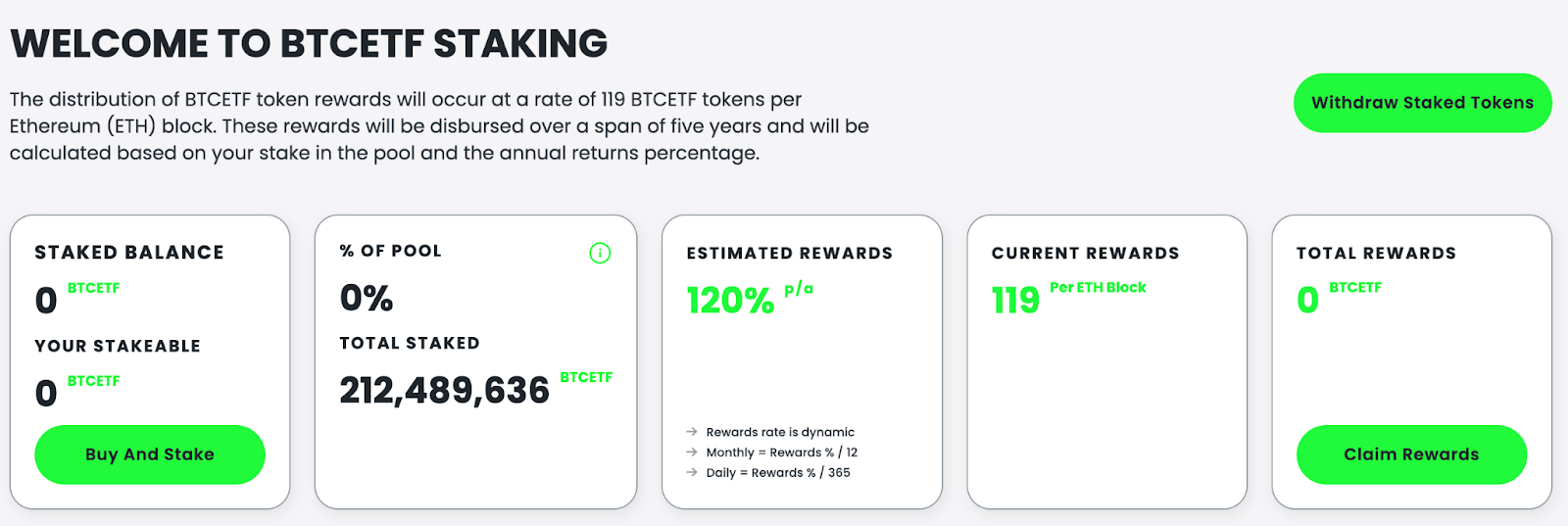

Buy and Stake $BTCETF Today to Earn 120% APY

$BTCETF tokens can be pre-sold today and staked to earn an annual percentage yield (APY) of 120% at the time of writing.

To date, $212 million BTCETF tokens have been deposited into the staking smart contract, which is a testament to the popularity of this passive income route. Staking rewards are distributed in $BTCETF over a five-year period. Each eth block produced generates a reward of 119 $BTCETF.

<h2 id="h-youtube-crypto-expert-on-btcetf-this-honestly-looks-appealing” class=”wp-block-heading”>YouTube crypto Expert Says $BTCETF ‘Looks Honestly Attractive’

There is a bandwagon going for bitcoin ETF Token, as evidenced by the number of major influencers behind the coin.

Showcasing just some of the media coverage is influential crypto YouTuber Matthew Perry, who has told his more than 200,000 subscribers that he likes the concept behind the $BTCETF token. “Honestly, this looks attractive.” he says.

Other YouTube crypto experts who like what they see include Michael Wrubel with 310,000 subscribers. He is super bullish on $BTCETFas he explains in his video from a day ago, which has already accumulated 21,000 views.

Austin Hilton is also impressed by the coin’s concept, telling his 235,000 subscribers that he believes it has a unique use case because it is “Like nothing you’ve ever seen.”

Yet Another crypto Analyst on YouTube Tells His Viewers to Prepare for ride an explosive wave investing in $BTCETF.

<h2 id="h-use-btcetf-to-gain-direct-exposure-to-a-pivotal-moment-in-the-bitcoin-market” class=”wp-block-heading”>Buy $BTCETF to gain direct exposure to historical momentum in the bitcoin market

It cannot be understated how seismic the timely approval of the bitcoin ETF will be for the crypto industry and its markets. For the first time, ordinary retail investors, as well as professional traders and institutions, will be able to gain cheap, regulated access to bitcoin.

Additionally, asset managers and financial advisors will soon be able to allocate client funds to bitcoin without having to enter futures markets or worry about custody and regulations.

If the arrival of a bitcoin spot ETF has as big an impact as the launch of the first gold exchange-traded fund in 2003, then hundreds of billions of dollars could flow into the market in the coming years. In the inception year of spot bitcoin ETFs, Galaxy Digital expects inflows of $14 billion.

Thanks to $BTCETF, market participants do not need to wait for the launch day of the first bitcoin spot ETF in the US to gain exposure to this inflection point in the cryptocurrency market. Instead, investors can purchase bitcoin ETF tokens today to align their portfolio with the historic bitcoin bull run ahead.

To purchase $BTCETF, connect a crypto wallet funded with eth or USDT or use a bank card to make your contribution.

- Audited by Coinsult

- Secure and decentralized cloud mining

- Earn free bitcoin daily

- Native Token on Pre-Sale Now – BTCMTX

- Staking Rewards: Over 100% APY

Join our Telegram channel to stay up to date on breaking news coverage