The Reserve Bank of Zimbabwe recently revealed that some 25,188 of its value-preserving gold coins were sold between July 2022 and January 13. According to central bank governor John Mangudya, gold coins “have proven to be an effective open market instrument. to absorb excess liquidity in the economy.

Gold Coins as an Alternative Value Preservation Tool

According to Zimbabwe’s central bank, around 25,188 “Mosi-oa-Tunya” gold coins valued at more than $28 million (ZWD$20 billion) were sold between July 2022, when the coins were initially introduced, and 13 from January. Of this total, so-called corporate acquisitions accounted for 84% “while purchases by individuals accounted for 16%.”

Initially launched to act as “an alternative value-preserving retail investment product” for the wealthy, the bank said lower-denomination gold coins introduced in November 2022 “accounted for 38% of all sales.”

Commenting on the impact of gold coins since their introduction, Reserve Bank of Zimbabwe (RBZ) Governor John Mangudya saying:

Coins have proven to be an effective open market instrument for absorbing excess liquidity in the economy and a retail investment product for preserving the value of investable funds.

The RBZ governor added that the currencies, which have a consolidation period of 180 days, together with the bank’s high interest rate policy, played a role in stabilizing inflation and the exchange rate of the local currency against to the dollar.

Zimbabwe’s declining inflation

According to the local statistical office, Zimstats, monthly inflation in the southern African country fell from a peak of 30.74% in June 2022 to 1.1% in January 2023. Despite this slowdown, the rate of Zimbabwe’s most recent annual inflation of 230% holds. one of the highest in the world.

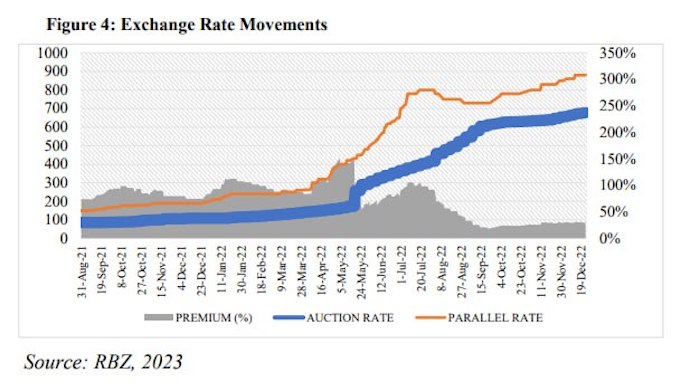

Regarding the exchange rate of the Zimbabwean dollar against the US dollar, the latest data from the RBZ suggests that the parallel market premium fell from a high of almost 100% on July 1, 2022 to well below 50% on December 19, 2022. As shown in According to the data, the auction market exchange rate of the local currency, which stood at just over ZWL100:USD1 on January 11, 2022, closed the year at approximately ZWL700 :USD1. According to RBZ data, the parallel market exchange rate for the local currency on December 19 stood at approximately 900:1.

Meanwhile, in his 2023 monetary policy statement, RBZ Governor Mangudya said the bank “will continue to use gold coins based on demand as it seeks to promote a culture of thrift.”

What are your thoughts on this story? Let us know what you think in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons