Tech Entrepreneur, Angel Investor, and Network State Author Balaji Srinivasan Says It Takes a Proverbial “Giant Robot” of Supporting Government Bodies and Crypto Advocates to Fight the US Federal Government’s “Giant Monster” The former Coinbase CTO also said that he will be posting an update “soon” on his current $1 million bitcoin bet, noting that “the reason I did it was to bring attention to this crisis.” .

Balaji foresees the fall of Western Fiat and promotes in-person meetings to build trust

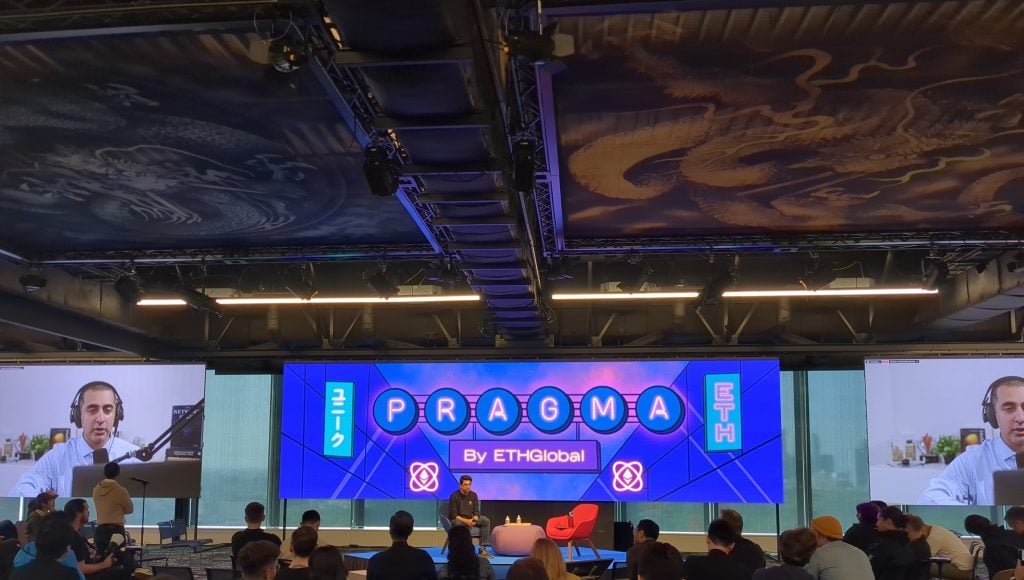

Talking remotely in the first face-to-face ETHGlobal Pragma Summit Tokyo on April 13, tech entrepreneur, author, and bitcoin advocate balaji srinivasan He stressed to attendees that difficult economic and social changes are ahead, but he is also optimistic about cryptographic tools and the broader community focused on “network states” already providing to weather the storm.

Asked by Bitcoin.com News what are the next practical steps on the road to establishing network states and what work is being done, Srinivasan emphasized that the fiat crisis will draw people to decentralization because of a “trust deficit in the world”. but he noted that some degree of trust is still required for society to function at the primary level, elaborating:

Decentralization is coming and then we need recentralization, but consensual recentralization (of) the other side in these small groups. I recognize that that is thinking ahead, but we need to think ahead because these changes can happen very quickly.

The author noted that he is working on a follow-up to his book The Network State and creating videos to accompany it, because “a lot of those things that I thought were going to happen in ten years could happen in a few.” years.”

“I can fund, you know, more DAO and network states and so on, but a lot of that stuff is happening in parallel. I have been pleased to see that happen,” Srinivasan said. “And the most important thing is to build high-trust communities, as difficult as it is, with physical meetings. Where people meet and meet in person. And that is the seed to rebuild things after what follows.

Speaking of the draconian physical lockdowns of the past few years, which mainstream media say are medical in nature, the angel investor stressed that “the state of the network is partly a recipe for a ‘new normal.'” Later in the question and answer session, he explained:

Once we have the digital lockdown, which is coming, and that’s capital controls, wage controls, price controls, CBDCs that are put in place (to) try to block the exits. Actually, that’s easier to implement than physical blocking. Digital lockdown: the alternative to that… is freedom, it’s cryptocurrency, it’s bitcoin, and I think that’s what you’re building as well.

He stressed to the room, “What I think they should be doing is thinking about building high-trust partnerships with physical meetings where they can physically verify people,” and then presented a vision of the near future:

In this kind of post-fiat crisis world where AI has risen, where China has risen, where fiat has crashed, where it’s a low-trust society, you need to cryptographically verify all sorts of things: the identity of someone in the other side, the fact that they actually have the money they claim to have. Everything you are making in crypto becomes much more valuable, if you can survive it.

Srinivasan said the change will go from people thinking that Web3 is “this stupid thing” in an adversarial environment to where it becomes an “absolutely necessary thing.”

Deals with ‘smart people of the state’: building the giant crypto robot and placing Bitcoin bets

Addressing US politics repeatedly in his presentation and in the question-and-answer session that followed, Srinivasan said that “the further away you are physically, financially and socially from Blue America, the better off you are.” He noted that many people are migrating to areas perceived to be crypto-friendly and pro-freedom, such as Latin America and red states in the US. Speaking with a summit participant, he noted:

“The closer you get to Blue America (Democratic Party controlled regions), the higher the level of state failure… I don’t think all states fail… I think red states could turn out to be like Eastern Europe or the Baltics ”. He continued:

What I think is the next step is to not just think about the state versus the grid… Another way is for the grid to work with smart people from the state, like Nayib Bukele, like Dubai… red states and purple states (in the United States).

“Find jurisdictions like El Salvador. Find jurisdictions like Palau. Find places where the state is actually supporting the network. Make deals with them… And then you have the support of the state and you have, you know, a government on your side.” The author mentioned the Hollywood movie Pacific Rim, where he pointed out that humans could not fight a huge monster that had risen from the sea:

So right now this giant monster has risen out of the ocean and it’s the US federal government, and it’s attacking every crypto bank, it’s attacking every tech bank… it’s attacking every piece of the future and it’s just doing everything possible for us.

He continued: “You cannot fight against the government as an individual or even as a company. To beat this gigantic monster you need a giant robot, a good robot of your own. You need your own government…you need the good states to fight the bad states…now it is sovereign against sovereign.”

While many proponents of bitcoin and crypto freedom maintain that there is no such thing as “good states,” traditionally understood, as even taxes are a form of theft, Srinivasan nonetheless says that the average individual needs the “HP.” and the power of the government. -level action.

Closing out his appearance at Pragma Tokyo, and explaining his current $1M bitcoin bet, the tech entrepreneur explained to the summit: “I will also have an update on the bet soon… I think it will be satisfying, of course, for everyone. The reason I did that was to draw attention to this crisis.”

What do you think about Balaji Srinivasan’s views on the states of the network and the current economic crisis and its ramifications for cryptocurrencies? Let us know in the comments section.

image credits: Shutterstock, Pixabay, WikiCommons, Balaji Srinivasan, Graham Smith

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.