On March 2, 2023, FTX debtors released their second stakeholder filing, containing a preliminary analysis of the now-defunct cryptocurrency exchange’s shortcomings. The latest filing reveals a significant shortfall, as roughly $2.2bn of the company’s total assets were found in FTX-related addresses, but only $694m are considered “A-Category assets”, or liquid cryptocurrencies like bitcoin, tether or ethereum. In addition, John J. Ray III, FTX’s current chief executive, said the debtor’s effort had been significant, adding that the exchange’s assets were “highly mixed.”

A preliminary summary of what contributed to FTX’s $8.9 billion shortfall

Debtors and FTX CEO John J. Ray III released a comprehensive filing documenting FTX’s shortcomings. The preliminary report mentions the cyberattack that occurred the day after FTX filed for Chapter 11 bankruptcy protection on November 11, 2022. In a now-deleted Telegram chat channel, FTX US General Counsel Ryne Miller, described that the exchange was hacked and that the platform was insecure. The preliminary gap analysis refers to this specific cyberattack throughout.

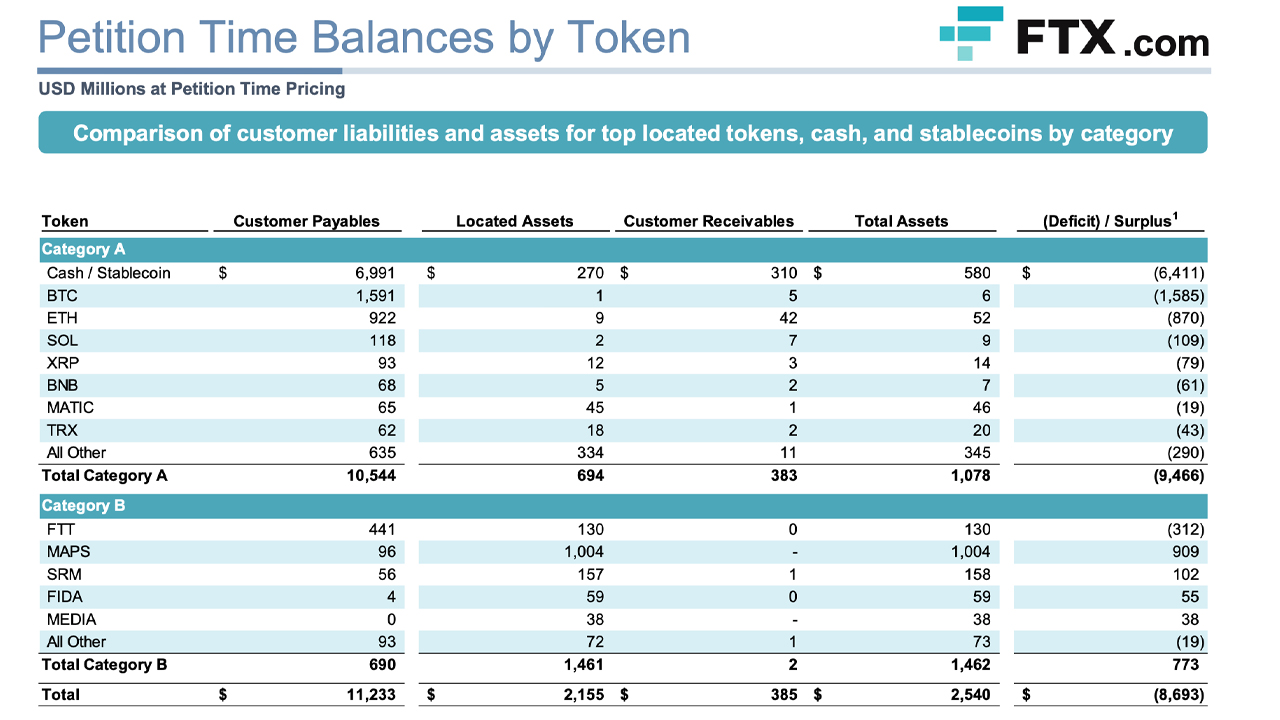

The report also mentions that both FTX and FTX US generally held digital assets in sweep wallets that were not segregated for individual clients. The debtors noted that due to the cyberattack, the company’s computing environment was protected and “remains subject to certain restrictions,” limiting access to critical data. The report classifies FTX’s holdings into two groups: “Category A Assets,” which have larger market capitalizations and trading volumes, and “Category B Assets,” which do not meet the liquidity requirements of FTX Assets. Category A.

However, despite identifying all the assets, there is still a deficit of $8.9 billion. “There is a substantial shortfall on the FTX.com exchange at the time of the petition, defined as the difference between the digital asset claims on FTX.com’s ledger and the digital assets available to satisfy those claims,” the statement states. report. “The shortfall is particularly significant for category A assets. Only a small amount of cash, stablecoins, (bitcoin), (ethereum) and other category A assets remain in the wallets preliminarily associated with the FTX.com exchange.”

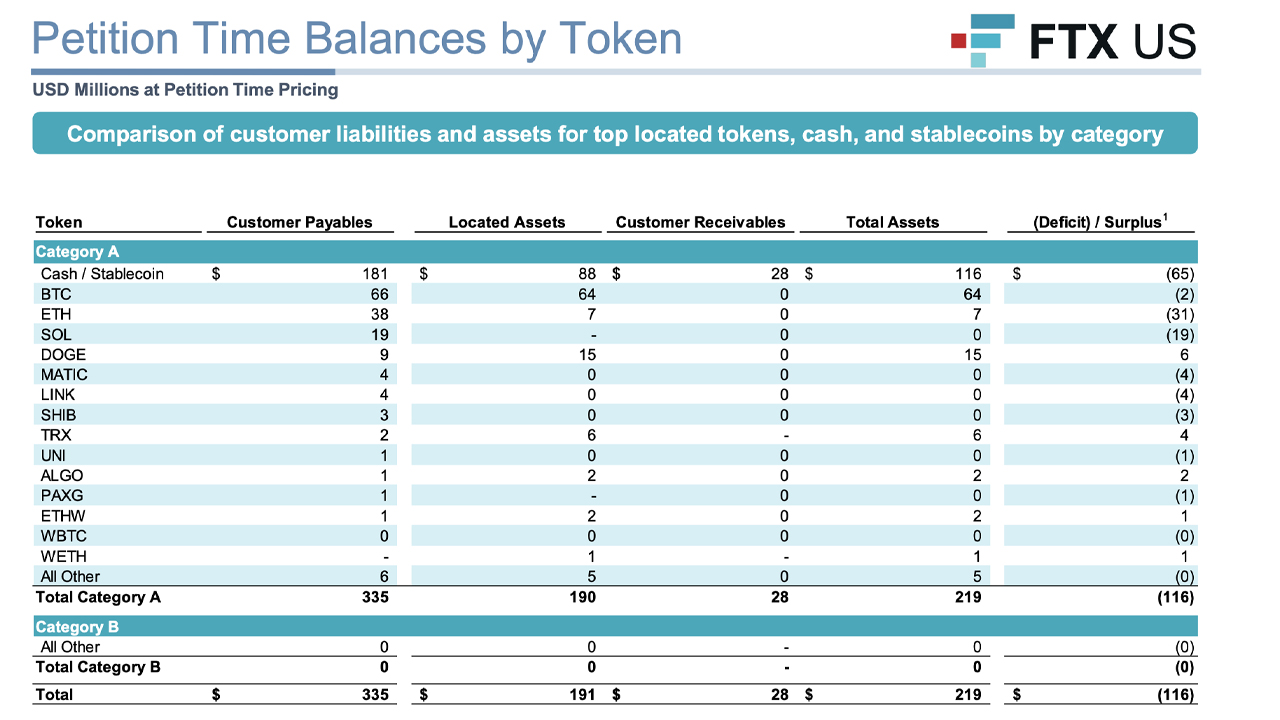

The report also notes that while the shortfall in FTX US was substantial, it was smaller than that in international exchange. in a Press releaseCEO Ray shared his thoughts on the presentation, mentioning that funds were mixed and record keeping was inadequate.

“This is the second in what FTX Debtors anticipates will be a series of filings as we continue to uncover the facts of this situation,” Ray said in a statement. “It has been a great effort to get here. The assets of the exchanges were highly mixed and their books and records are incomplete and, in many cases, totally absent. He stressed that the information provided by the debtors was preliminary and subject to change.

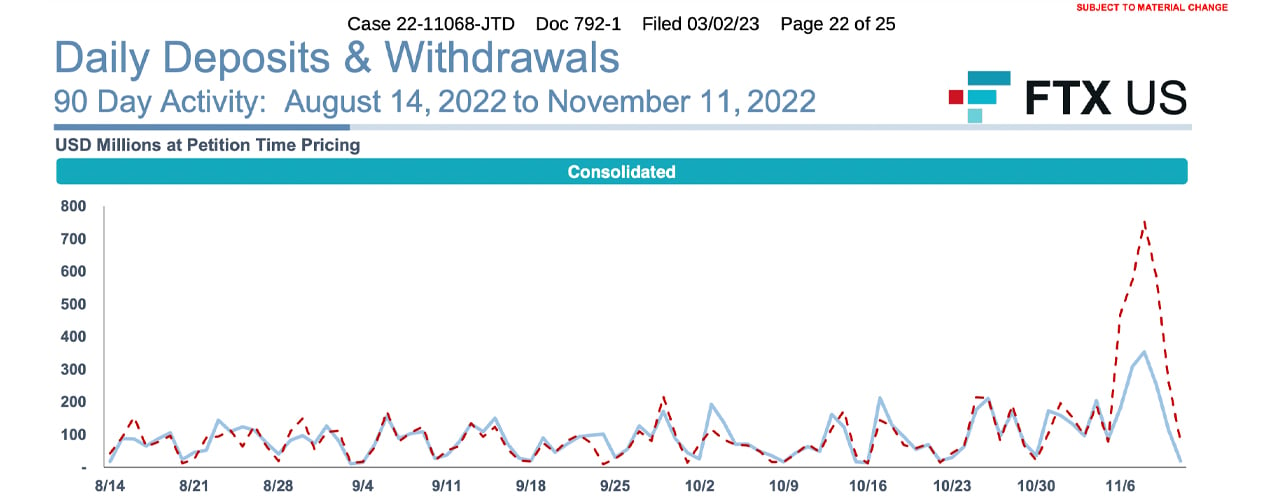

An interesting aspect of the latest debtors filing is that ftx token (FTT), the company’s exchange currency, is classified as a Category B Asset. BTC and ETH are category A assets, SOL, MATIC, UNI, SHIB, PAXG, WBTC and WETH are also considered class A assets. The report also highlights daily deposits and withdrawals made 90 days prior to the bankruptcy filing date.

Additionally, the exchange’s shortfall does not include Alameda Research’s assets, which consist of $956 million in solana (SOL) and aptos (APT), $820 million in third-party exchanges, $185 million in cold-stored stablecoin assets and $169 million in bitcoin (BTC) kept in cold storage.

What do you think will be the consequences of FTX’s significant shortfall for stakeholders? Let us know what you think about this topic in the comments section below.

image credits: Shutterstock, Pixabay, WikiCommons, Sergei Elagin

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.