Following the fallout of the past two weeks in the US banking industry, the Federal Reserve raised the federal funds rate by 25 basis points (bps) on Wednesday, citing the need for the inflation rate to return to 2%. long-term.

The Fed raises the rate despite the calamity in the US banking sector.

It has been a difficult two weeks for the US economy after the fall of the silvergate bank, Silicon Valley Bankand signature bank. After these bank failures occurred, the Federal Reserve announced the creation of the Bank Term Financing Program (BTFP) and Announced that the uninsured depositors of Signature Bank and Silicon Valley would be redressed. After the turmoil in the banking industry, some experts suspected the Fed would not raise the benchmark rate this month.

On Wednesday at 2 pm Eastern Standard Time, the Federal Open Market Committee (FOMC) revealed which would raise the rate by 25bps. “The committee seeks to maximize employment and inflation at a rate of 2 percent over the long term,” the FOMC said. “In support of these goals, the committee decided to raise the target range for the federal funds rate from 4-3/4 to 5 percent. The committee will closely monitor the incoming information and assess the implications for monetary policy.”

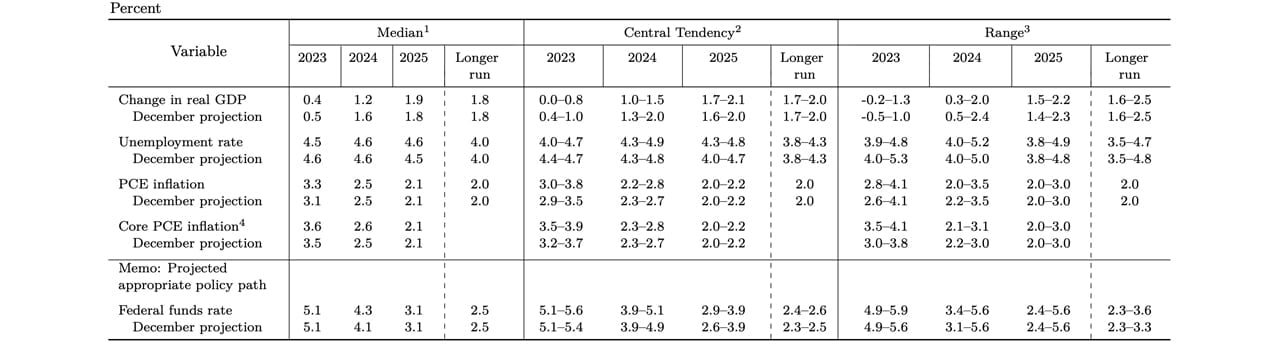

In addition, the Fed published the “Summary of Economic Projections”, suggesting that the inflation rate may reach 2.1% by 2025 and 2% in the long term. By 2025, the FOMC projections call for the federal funds rate to fall to 3.1%. Following the FOMC statement and forecast report, equity markets rallied on the news, with three of the four US benchmark indices in the green.

crypto assets fell after the Fed’s small hike, with bitcoin (BTC) approaching the $29K to $28,700 range as of 2:15 p.m. Eastern Standard Time on Wednesday. But at 2:45 p.m., BTC it had dropped rapidly to the range of $27,876 per unit. At the moment, BTCThe USD value is just above the $28K zone.

While cryptocurrencies had a mixed reaction to the Fed news, precious metals remained strong. Both gold and silver rose with the Fed hike, rising 1.6% to 2.5% higher against the dollar. Overall, the FOMC statement noted that recent indicators have shown “modest growth in spending and output.”

In addition, the Fed says that while “job gains have picked up in recent months and are running at a strong pace (and) the unemployment rate has remained low, inflation remains high.”

Following the FOMC press release, Fed Chairman Jerome Powell insisted that the US banking system “is strong and resilient, with strong capital and liquidity”. Powell added: “We think our monetary policy tool works, and we think…our rate increases were well telegraphed to the markets, and many banks managed to handle them.”

What do you think the Fed’s decision to raise interest rates means for the US economy? Share your thoughts on this topic in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.