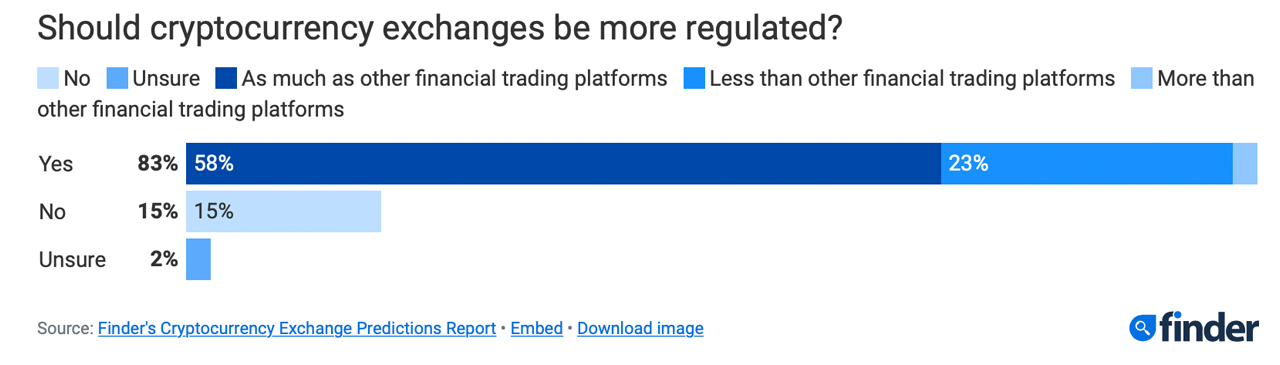

Following finder.com’s reports on bitcoin and ethereum predictions, the product comparison site surveyed 56 fintech and cryptocurrency industry specialists to gauge their views on future regulation of cryptocurrency exchanges. Experts predict that virtual currency trading platforms will be regulated, but not until 2025 or 2030. When regulation occurs, 76% of Finder panelists expect trading platforms to be treated similarly to financial institutions traditional.

87% of Finder’s fintech and crypto experts believe exchanges should disclose proof-of-reserves audits

a recent post report from finder.com, which surveyed 56 cryptocurrency and fintech industry experts, shows that 87% believe exchanges will be required to disclose proof-of-reserve audits and accountability records. Specialists reveal that standard regulations for cryptocurrency exchanges will not occur until 2025 or 2030.

While 76% of panelists believe that crypto trading platforms will be regulated in a similar way to traditional financial platforms, 17% expect this to happen by 2024. 22% predict regulation by 2025 and 35% expect to take place in 2030.

“Any exchanges that remain must be in compliance with the schedule, proof of reserves and liabilities must be a prerequisite and non-tradable for people selecting where to trade,” said Swyftx chief strategist Tommy Honan.

Honan believes, along with 87% of the panelists, that exchanges should provide a record of liabilities and proof of reserves. “Exchanges must also continue to improve the skills of their users in self-custody and lean on new and innovative products that support it,” Honan added.

Split Opinions on Crypto Regulation: 15% Economic Tradition, Half Believe Industry Will Weather the Storm

About 15% of the Finder panel, including Cryptoconsultz CEO Nicole DeCicco, does not believe that crypto exchanges should be regulated in a similar way to traditional financial institutions. However, DeCicco predicts that standard regulations will apply across the entire cryptocurrency industry by 2024.

“However, it is imperative that investors be warned of the risks involved,” DeCicco said in a statement. “At Cryptoconsultz we teach our clients to think of cold storage and self-custody solutions like their bank account and centralized exchanges similar to the money one might take out of an ATM and walk in their pocket,” added the executive.

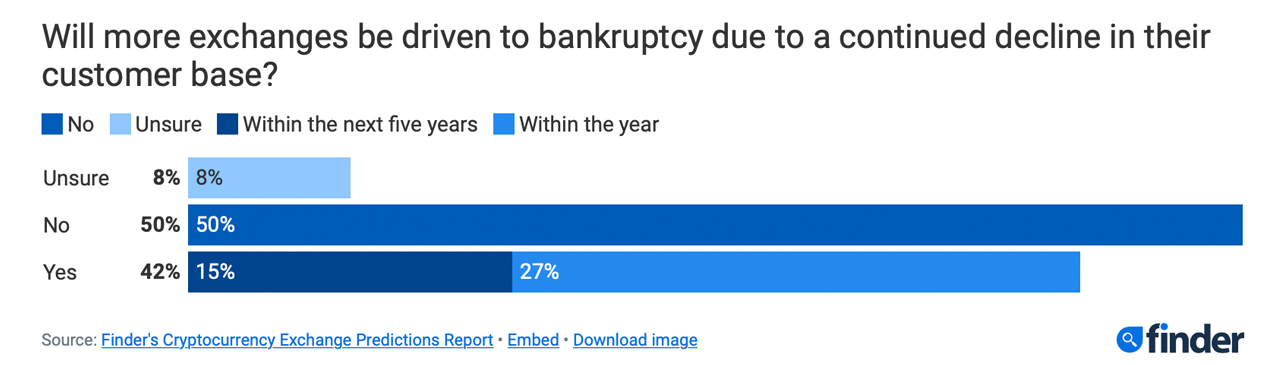

Approximately 42% of Finder experts believe that the number of cryptocurrency exchange customers will continue to decline following several bankruptcies in the industry, including the collapse of FTX. 84% of the panelists emphasized that the cryptocurrency industry will survive the FTX implosion that occurred in November 2022.

42.31% predict that more cryptocurrency trading platforms will fail due to customer loss, with more than 15% thinking this will happen in five years and 26.92% in one year. However, exactly half of the Finder panelists believe that such an event will not occur.

You can check out Finder’s crypto exchange regulation prediction report in its entirety here.

What do you think of the Finder experts’ predictions about the future of cryptocurrency exchanges? Do you agree or disagree with their views on regulation and the potential impact on the industry? Share your thoughts in the comments below.

image credits: Shutterstock, Pixabay, Wiki Commons

NEWSLETTER

NEWSLETTER