In a surprising turn that shocked the bitcoin community, experienced trader Peter Brandt recently shifted his focus from his well-established technical analysis to delve into the fundamentals of the cryptocurrency market.

In a thought-provoking post about X, Brandt questioned the widely held belief that the bitcoin halving event has a significant impact on the coin's price. Contrary to the expectations of many btc holders, Brandt argued that the reduction in supply resulting from the halving could be accompanied by a lot of publicity but, in reality, would have minimal repercussions on the value of the coin.

On supply reductions and the mosquito behind them

Brandt's unorthodox stance sparked a wave of skepticism and curiosity among his followers. However, he justified his point of view and emphasized that the reduction in supply, while generating substantial enthusiasm, ultimately acts as a mitigating factor to prevent a substantial increase in bitcoin prices.

bitcoin Halving Hype Is a Lot of Excitement for Nothing

Sure, halving advertising could temporarily affect the price

But the reduction in supply as a % of daily volume is the size of a mosquito's ass. pic.twitter.com/9JWRr12dkt—Peter Brandt (@PeterLBrandt) December 21, 2023

Following his commentary on ethereum (eth) short selling and his bitcoin (btc) research, Brandt has now shared some thoughts: “It is interesting to note that eth has lost 36% in value against btc in 2023,” he noted. Brandt on Wednesday.

The next day, he spoke about the opinion of some analysts who claim that bitcoin is very overbought. Despite this, Brandt said the 30-day Relative Strength Index (RSI) is currently in the ideal range where previous bull markets have seen a notable acceleration in their bullish momentum.

Amid the excitement, Brandt's contrarian point of view questions the dominant narrative and emphasizes the importance of maintaining a balanced point of view. His analysis suggests reconsidering the importance given to cryptocurrency market halves incidents.

bitcoin currently trading at $43,658 territory. Chart: TradingView.com

Even if some may disagree with Brandt's conclusion, pointing to bitcoin's past performance after the halving as evidence, it is important to recognize the different market dynamics at play.

Before the halving events in 2012 and 2016, the value of bitcoin experienced significant increases, peaking at $133 and over $4,000, respectively. The fact that the major coin's all-time high almost reached $70,000 raised hopes that the next halving in 2024 will raise the value of btc to levels never seen before.

In this context, bitcoin has proven resilient in 2022, increasing its value by an impressive 159.22% despite difficult market conditions.

bitcoin Future: NVT Signal Analysis and Dominance

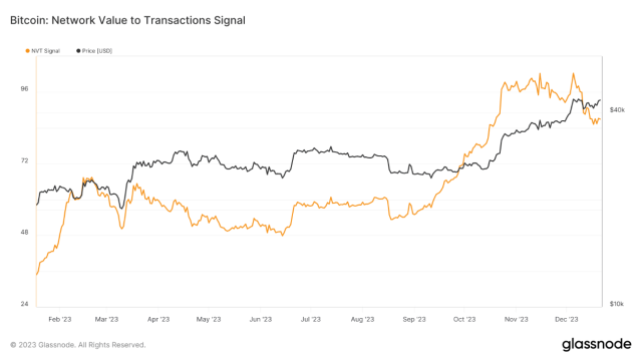

Bitcoinist conducted an analysis of the Glassnode network's transaction value (NVT) signal as part of its on-chain intelligence research to determine the possibility of future growth.

The NVT signal that exists now uses a 90-day moving average of bitcoin volume and transactions to identify likely market gains and losses. This helps illuminate the currency's fundamental durability in the face of changing market conditions.

$btc.D Still very undecided. There appears to be profit taking $btc before the ETF and some forward rotation for $ALTS after the approval of the btc ETF.

I think btc Dominance will trend down soon after the ETF approval. pic.twitter.com/0CLuT3wNXx

– Daan crypto Trades (@DaanCrypto) December 22, 2023

Meanwhile, renowned cryptocurrency expert Daan crypto turns his attention to bitcoin Dominance in anticipation of changes in the industry.

By their estimate, bitcoin currently enjoys a 53% market cap dominance, with significant thresholds for future modifications. The “btc ETF approval target,” he said, is 57%. Predicts a decrease in mastery after approval.

Featured image from Shutterstock

NEWSLETTER

NEWSLETTER