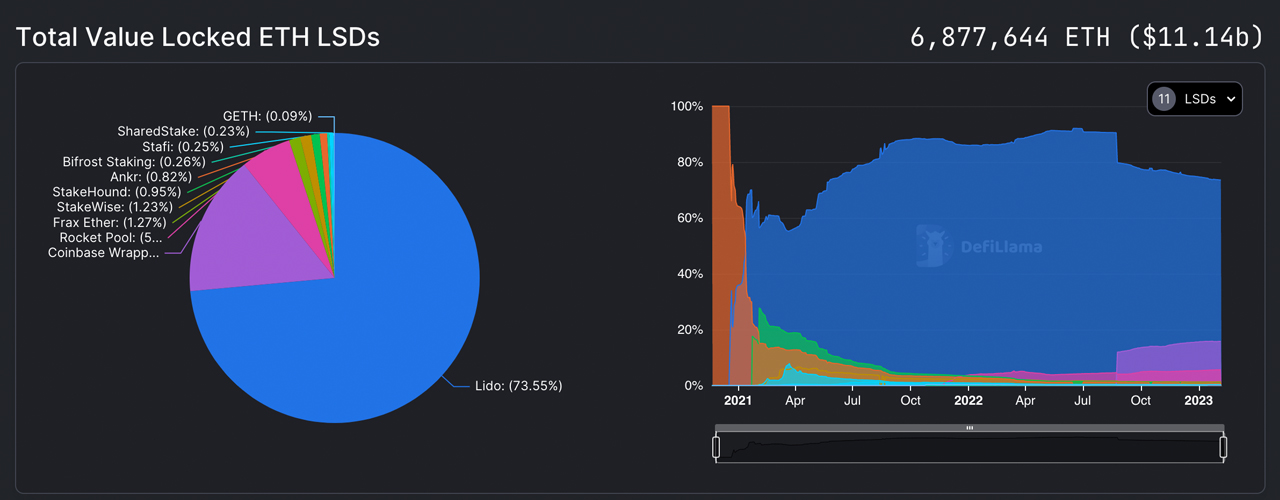

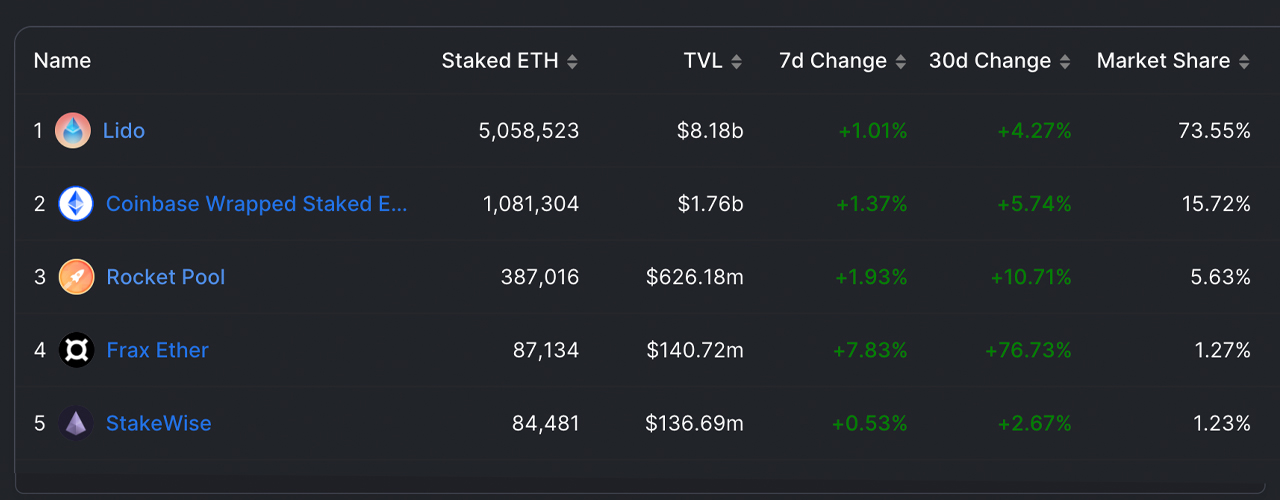

As of February 7, 2023, the value locked in 11 Ethereum-based liquid staking protocols has risen above $11 billion, with Lido, Coinbase, and Rocket Pool posting gains of 4-10% over the year. last month. Lido owns more than 73% of the total value locked (TVL) of the 6.87 million ether held by the 11 liquid staking platforms. More than 15% of the liquid stake TVL is being staked with Coinbase’s wrapped ether.

Lido leads the pack with 73% of total value locked in Ethereum’s liquid staking industry

Ethereum staking has become a much-requested trend since its introduction on the network’s Beacon chain. The Beacon chain contract has 16.47 million ether locked up, worth $26 billion, which cannot be withdrawn until the next hard fork in March. A significant portion of this locked ether is held within liquid staking protocols, as 11 decentralized finance (defi) protocols hold 41% of the total, or 6.87 million ether.

Liquid staking involves exchanging ether for tokenized versions of ether. This allows holders to earn rewards while still having a liquid form of the currency that they can sell at any time without relying on a custodian. The ether staked is held within various protocols, and the exchanges are handled by the platforms for the minting and redemption processes. Of the 41%, which is valued at over $11 billion, Lido owns 73% of the total value locked (TVL). Lido’s TVL saw an increase of 4.27% last month, and its locked value is around $8.18 billion today.

Coinbase’s wrapped ether has 1,081,304 ethereum (ETH) blocked on the platform and the TVL has gained 5.74% last month. Coinbase’s shrouded ether platform TVL accounts for 15.72% of the market share and the stash is worth $1.76 billion. The next two largest liquid staking platforms saw the largest gains over the last month of the top five projects. Rocket Pool’s TVL was up 10.71% in 30 days, and over the same period, Frax Ether’s TVL was up 76.73%. Rocket Pool has about 387,016 ETH locked and Frax Ether has a total of 87,134 ether.

Stakewise is the fifth largest liquid participant, with 84,481 ether locked on February 7, 2023, valued at $136 million. Frax Ether has a 1.27% market share, while Stakewise owns 1.23% of the 6.87 million ether. The other six decentralized finance liquid staking platforms own just 2.6% of the $11 billion in value, while the top five liquid stakeholders control 97.4%.

What do you think about the continued growth of Ethereum Liquid Staking protocols? Share your thoughts in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.