The following is an excerpt from a recent issue of bitcoin Magazine Pro. bitcoin Magazine Premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

bitcoin builds massive support range

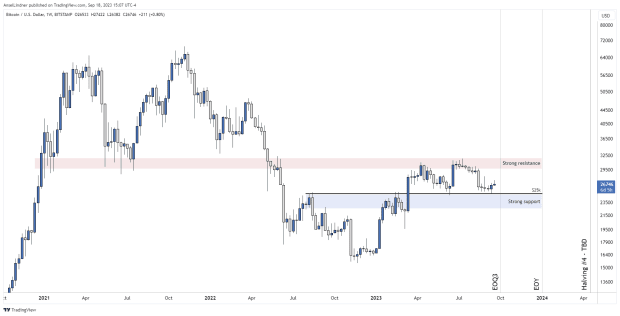

bitcoin is caught between strong support and resistance. Breaking out of this range, up or down, will be difficult, barring a surprise ETF approval. While we have been in this range for six months, the fundamentals have continued to improve. For example, him btc/”>number of bitcoin addresses with >1 btc it continues to grow, almost 30% of bitcoin supply hasn’t moved in over 5 years, asset allocators with a total of >17 billion dollars in assets under management have applied for bitcoin spot ETFs, bitcoin continues exit exchanges, and the halving is approaching. The price will eventually break the resistance and this range will become massive support.

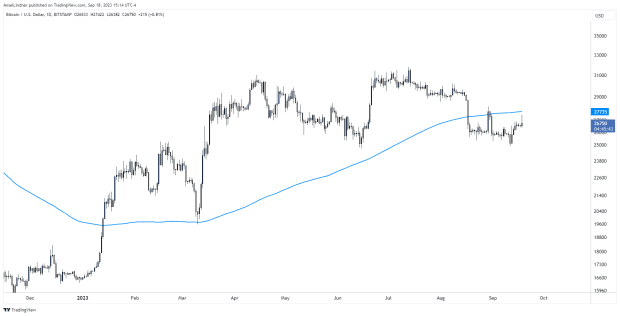

On the daily chart below, we see $25,000 holding firm as resistance turns into support. This week the price is trying to break out below the 200 day moving average.

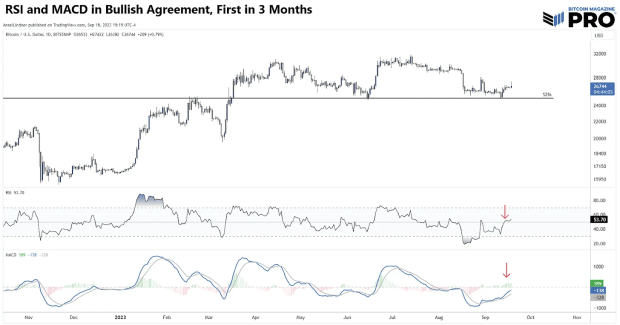

bitcoin‘s daily Relative Strength Index (RSI), an extremely popular momentum indicator, is safely above the 50-level midline, which is a necessary signal to start a new uptrend. Furthermore, the moving average convergence divergence (MACD) has managed to stay above the signal line in a bullish stance. Importantly, these two widely used indicators coincide bullishly for the first time since June.

Note on technical analysis: In our opinion, technical analysis is a series of Schelling points. These are prices or indicators that “people tend to choose by default due to lack of communication.” That is, they are things on the chart that traders and investors are watching.

The dollar rally: good or bad news for bitcoin?

The dollar wrecking ball threatens to return. The Dollar Index (DXY) broke its downtrend in mid-August, was backtested, and is currently recovering to the 38.2 fib retracement level. This is a strong move contrary to the almost universal bearish thesis for the dollar, but it has now reached a logical place for consolidation.

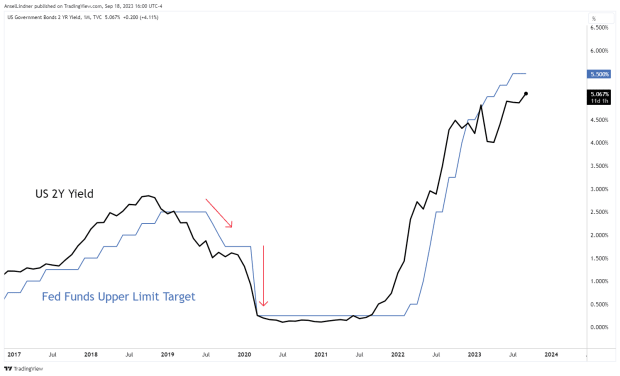

Not surprisingly, the dollar is rising as recessions in Europe and China are squeezing the market’s ability to repay existing dollar debt or access new dollar debt. In this environment, we should also expect interest rates to fall as money moves into safer, more liquid assets.

US Treasury yields cannot withstand the strong movement of the dollar for long. Milton Friedman’s interest rate fallacy tells us that rates fall when money is scarce, not loose. The rise of the dollar is a strong indication that there is a shortage of money; Therefore, we should expect rates to fall.

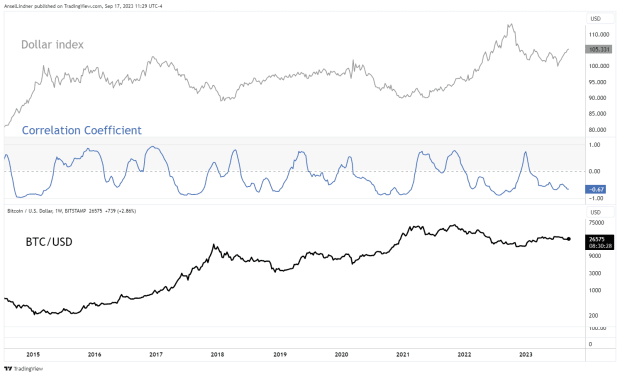

Normally, a strong dollar is considered negative for bitcoin, but in the history of bitcoin the correlation coefficient with the dollar index (DXY) has been positive many times. In 2016 it even reached 0.93. In fact, one could argue that before COVID, bitcoin and DXY were often positively or not correlated.

The correlation coefficient tends to be more negative than positive in recent years; However, in bull market breakouts it usually swings towards positive. For example, 2016 was dominated by a relatively positive correlation as the bull market began. Then again in the first half of 2019, when bitcoin entered an early bull market before COVID, it became positively correlated with DXY.

Negative correlation only begins to dominate after March 2020, coinciding with a high consumer price index (CPI). This is particularly interesting because bitcoin‘s fixed supply is a hedge against inflation. Those who do not mint coins have taken advantage of this mismatch, during the high CPI, bitcoin performed poorly. The explanation is easy but uncomfortable for most bitcoiners: the acceleration of the CPI was not due to inflation (money printing), but mainly due to supply chain disruptions and demand artificially stimulated by fiscal spending.

FOMC meeting preview

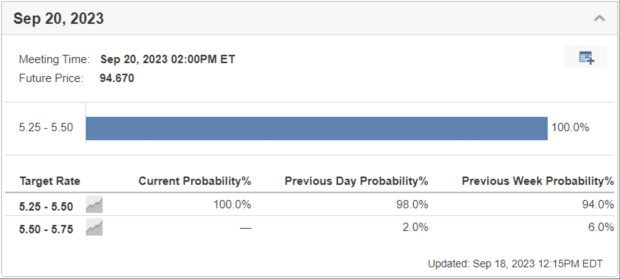

The Federal Open Market Committee (FOMC) will meet this week and they are sure to pause. They don’t like to surprise the market, and the market universally agrees not to raise rates. He Federal Reserve Rate Tracker Tool Investing.com is a good place to bookmark. It uses fed funds futures to signal what the market thinks.

Fountain: Invest.com

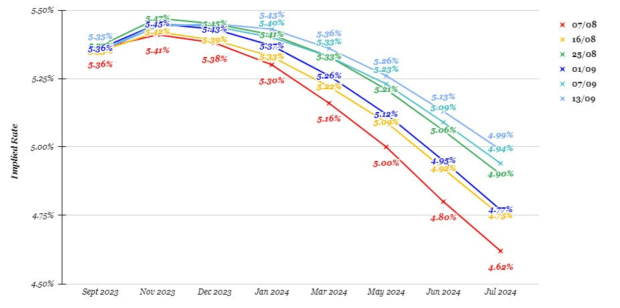

The fed funds futures curve has started to move up for next year, meaning the market is pricing in fewer cuts, but not moving up significantly on the short end. This tells us that the market believes that the Fed is most likely done and that rate cuts will begin sometime next year.

The curve is slowly moving upward, pricing in increasingly later cuts to the Fed Funds target range.

Fountain: Forexlive.com

According to the Fed’s rate tracking tool, a cut to 500-525 basis points (bps) becomes the most likely scenario by June 2024, and by the November 2024 FOMC meeting (US election time) , the federal funding target will be 450-475. bps, then 3 cuts.

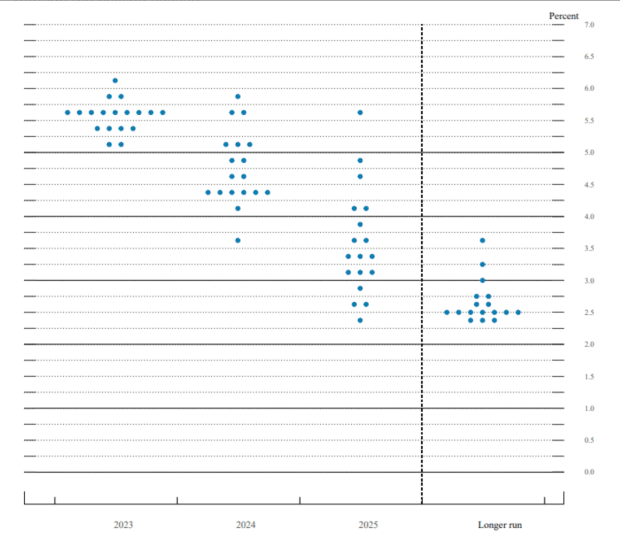

Surprisingly, markets agree with the Fed’s own dot plots. Neither forecasts a recession, but it does imply a slowdown is coming. This is a serious signal and should be considered the base case from now on. This is bullish for risk assets, including bitcoin, during the halving season.

Fountain: Federal Reserve

However, we know that the Federal Reserve never sees a recession coming and tends to react quickly when it arrives. Take Chairman Powell’s 2019 turnaround. Naturally, rates were falling, which meant money was becoming increasingly scarce. He responded with three sympathetic cuts, but when COVID hit he reduced it to zero. That same pattern seems to be implicit in the futures market.

When the financial system shuts down, the Federal Reserve will be forced to cut rates. These events tend to congregate towards the end of the third and first trimester. For example, this year’s banking crisis occurred towards the end of the first quarter. We have some evidence that the US recession will be averted until Q3 2024, leaving bitcoin time to get through the halving and a likely timely ETF approval.

*Note: Past performance does not guarantee future results. This article is not intended to be financial advice.

NEWSLETTER

NEWSLETTER