Dogecoin has differentiated itself from the rest of the market with a 9% increase. Here's why this could be bad for bitcoin, based on history.

Dogecoin has recorded a 9% jump over the last 24 hours

While most of the cryptocurrency market has seen sideways price action over the past day, Dogecoin has proven to be different as its value has witnessed a notable rise.

The chart below shows the price trend of DOGE over the last month.

x/sG7t0imL/” alt=”Dogecoin price chart” />

From the chart, you can see that Dogecoin price has reached the $0.134 mark with this rally and has surpassed last month's high. Memecoin is now close to the July high, so if this streak continues, memecoin might as well give it a try.

In terms of weekly returns, the latest jump has meant that DOGE is now up over 24%, making it the best performer among the top 50 coins by market cap.

Dogecoin is not the only memecoin that has recovered; The asset's cousin, Shiba Inu (SHIB), also enjoyed bullish momentum over the past day, although its 5% jump is less impressive than DOGE's.

This latest focus on meme coins may not be the best sign for the cryptocurrency sector as a whole.

The market peaked the last time Memecoins caught attention

According to data from the analytics firmx.com/santimentfeed/status/1846979989595738559/photo/1″ target=”_blank”> HolyThe social dominance of memecoins had skyrocketed during bitcoin's recent high above the $68,000 level. “Social Dominance” here refers to an indicator that tracks the percentage of discussions related to the top 100 coins on social media that a given coin or asset group is currently occupying.

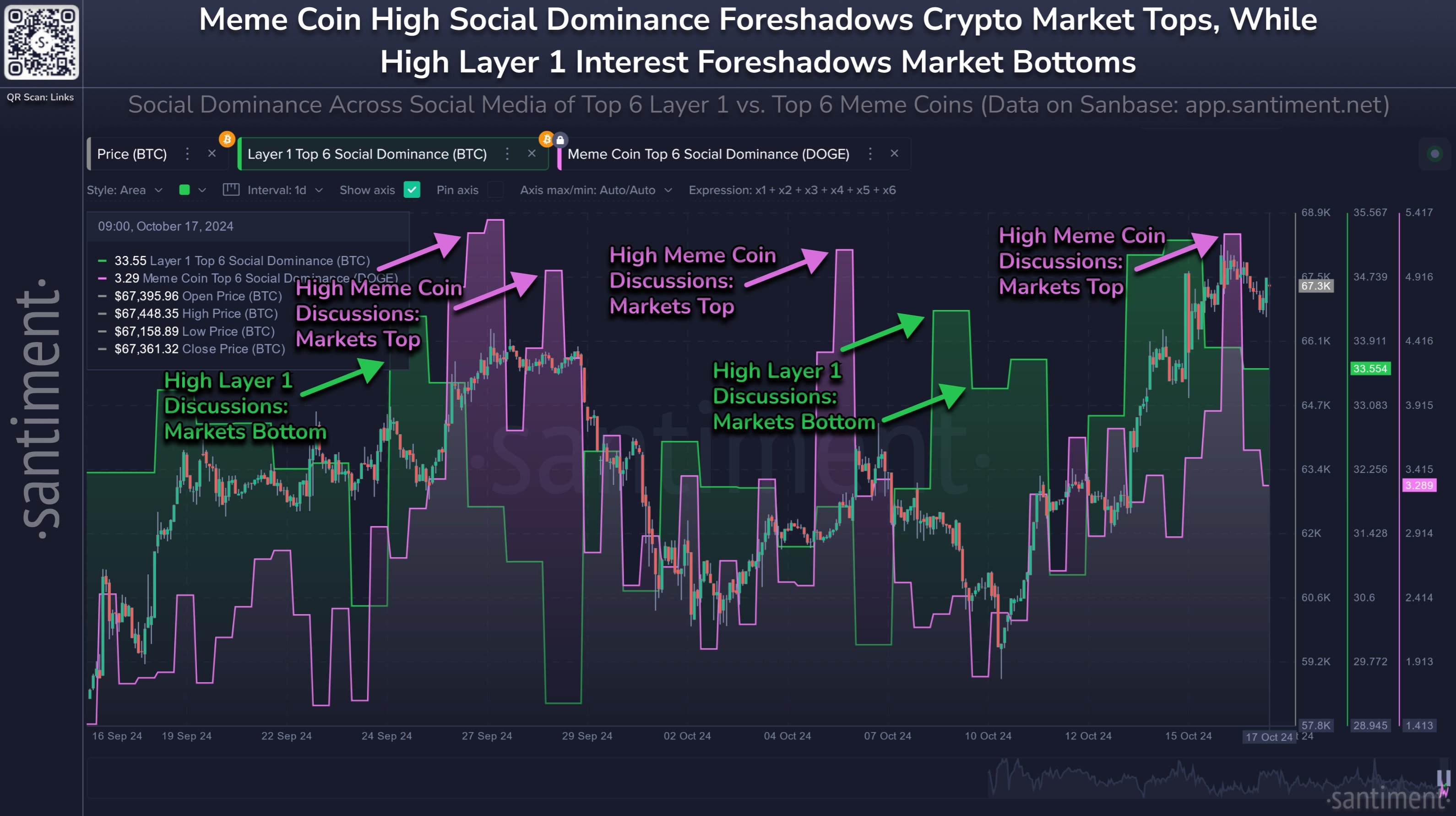

Here is a chart showing how the social dominance of the top 6 layer 1 assets has compared to that of the top 6 meme coins recently:

As shown in the chart above, the social dominance of memecoins had skyrocketed earlier as bitcoin and others rallied, suggesting that investors had begun to pay attention to these speculative assets.

However, this interest in meme coins ended up coinciding with the top of the market. “Normally, markets correct when the focus moves away from layer 1 and towards more speculative assets due to greed,” explains the analysis firm.

With Dogecoin and Shiba Inu pulling away from the pack over the past day, it appears investor greed remains high, potentially leading to more bearish action for bitcoin and other major assets.

You can see from the chart that the market has tended to bottom out when attention has returned to layer 1 networks, so this may have to happen again if the sector-wide trend has to continue.