Bitcoin (BTC) revolved around $23,000 through January 21 as buyers from Asia fueled a new force in the market.

The liquidity of the offer raises suspicions

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD fighting the bears hit $22,790 on Bitstamp overnight, its highest level since August.

With new multi-month highs in quick succession despite fears of a major correction, Bitcoin continued to surprise as traders cleared the way for more gains.

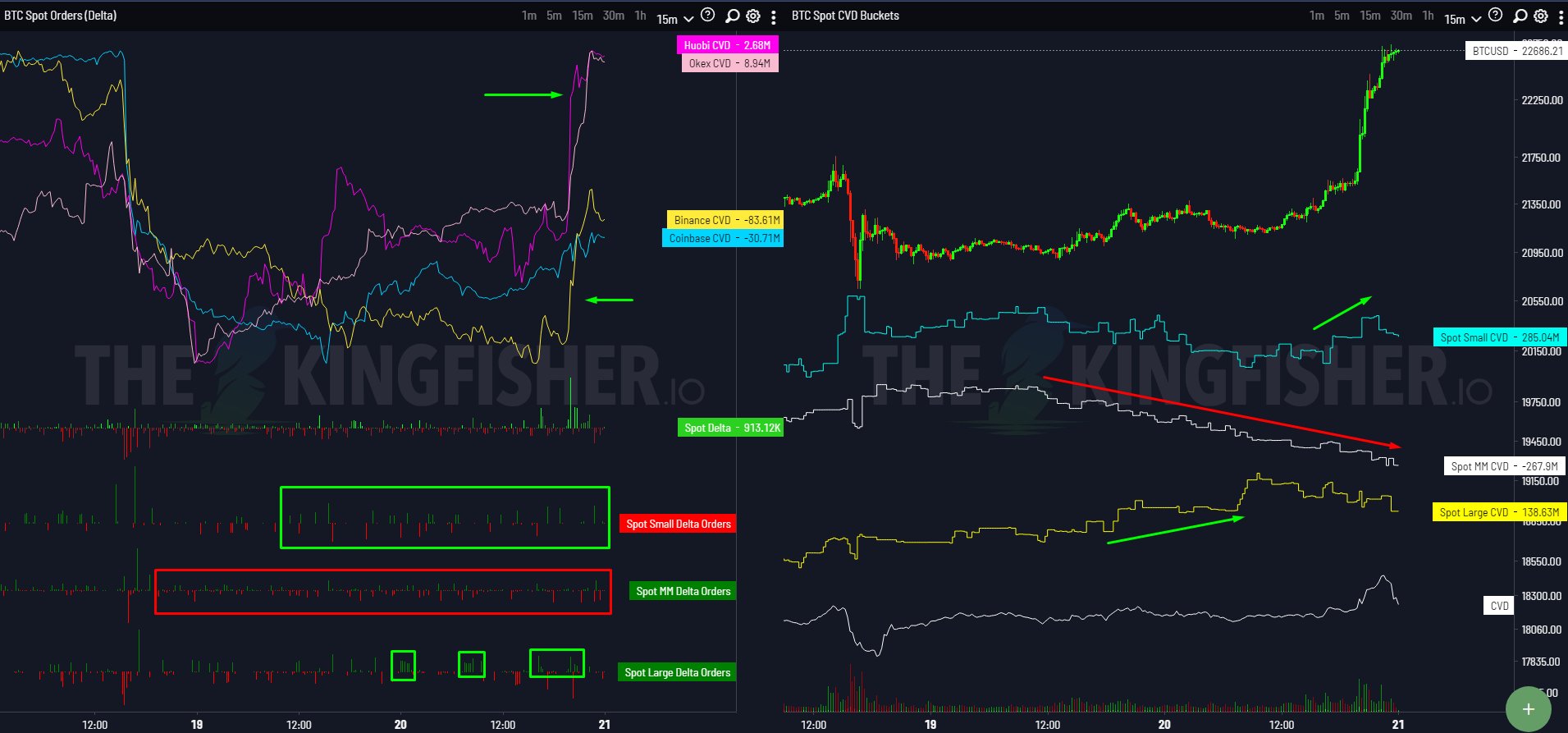

As intraday trader Skew pointed out, Asia was leading the way into the weekend, with selling pressure from market makers absorbed in the exchanges.

“Another supply-driven rally from Asia. TWAP buyers absorb the selling pressure of MMs. Big bids lifted, demand wall pulled ahead of another short squeeze,” Skew commented in a composite graph.

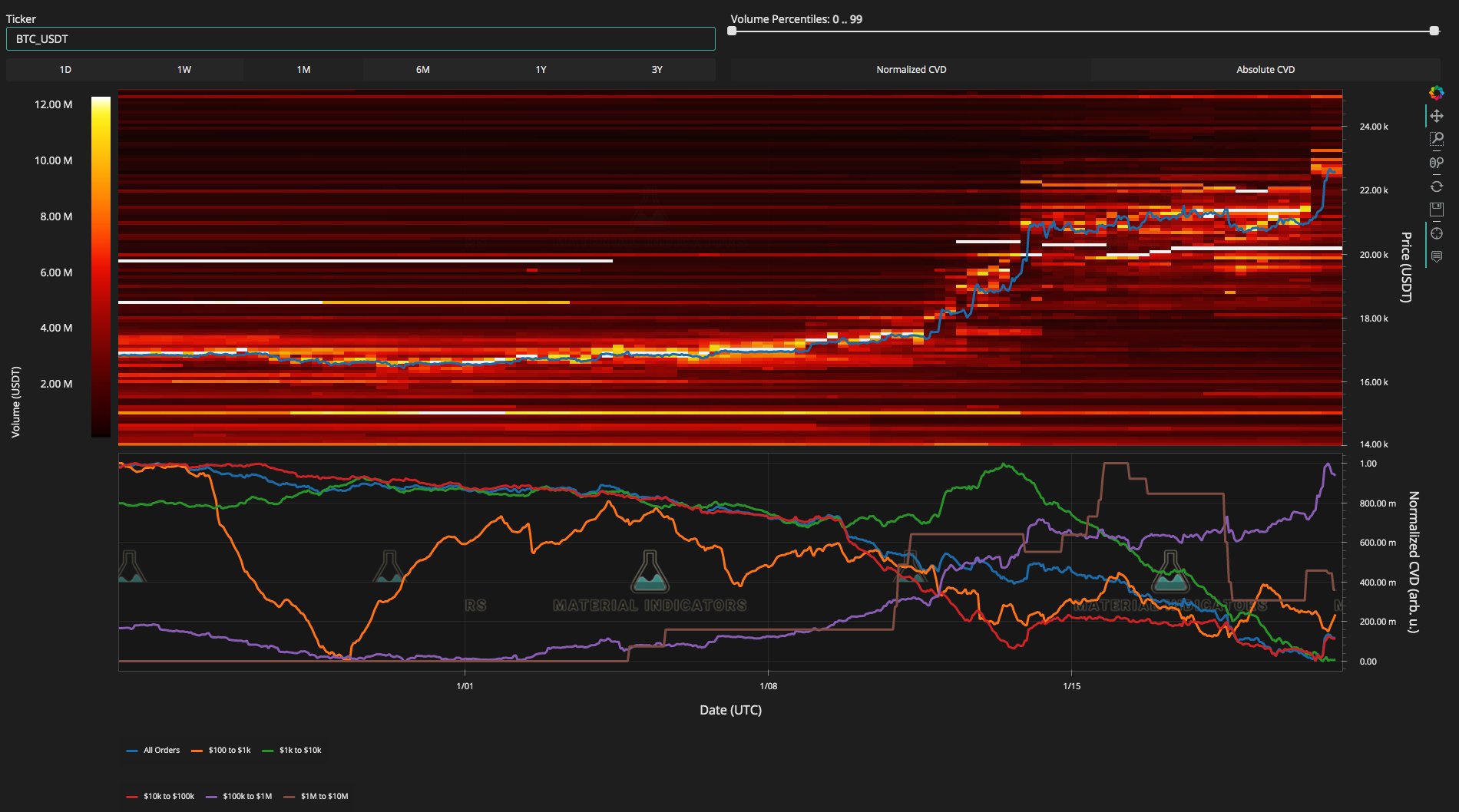

On-chain analysis resource material indicators meanwhile marked Call for liquidity on Binance to be removed the day before, allowing Bitcoin’s initial run to break above the $22,000 mark.

“Volatility continues. Don’t pay it all back, make sure you get some benefit along the way.” wrote in part from a later update.

“The bigger the bomb, the harder BTC will fall,” analyst Toni Ghinea tweetedwhile Crypto Tony argument that the entire movement may be nothing more than a “dead cat bounce”.

“Regardless of whether it’s a dead cat relief wave or a Bitcoin reversal, it’s great to see some optimism in Crypto,” he summed up.

Considering why more gains occurred after the end of TradFi trading for the week, a popular commentator further suggested that traders were being manipulative.

“No one who actually wants to buy and own cryptocurrency waits until the Friday close of each week to execute,” an update readand added that the “objective of these buyers is clear.”

Earlier in the week, Material Indicators had also warned of “choreographed” offers in BTC.

Key moving average on the horizon

Thus, attention turned to the upcoming BTC/USD weekly close, which if current prices held would be the best since mid-August.

At the same time, Bitcoin appeared to be about to print a so-called “death cross” on the weekly chart, with the descending 50WMA about to cross the still-rising 200WMA.

Related: Bitcoin Faces $15K Plunge As US Causes ‘Financial Meltdown’ – Arthur Hayes

A major target was the 200-week moving average (WMA), currently at $24,650 and out of reach for much of 2022.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.