Announcements from government agencies make tougher regulations seem imminent for the cryptocurrency industry. How derivatives market action impacts the bitcoin price.

The following is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to get these insights and other on-chain bitcoin market analysis delivered straight to your inbox, subscribe now.

Crypto in the crosshairs

On February 9, the bitcoin exchange rate gave back some of its year-to-date gains as headlines of an increasing regulatory crackdown on the broader crypto industry hit the news. The SEC announced charges against Kraken for selling unregistered securities due to the company’s cryptocurrency staking product offerings. Similarly, the New York Department of Financial Services announced an investigation into Paxos, the issuer of the Pax dollar and the BUSD Binance stablecoin.

While the regulator’s concerns are not directly related to Bitcoin itself, there is increasing talk of a new era. Operation Choke Point strangling the crypto industry. In simple terms, Operation Choke Point was a controversial initiative launched by the federal government that used the Federal Deposit Insurance Corporation (FDIC) to reduce access to the US banking system for certain “high risk” industries, but (mostly) legal. While there is no doubt that there has been a lot of fraud and criminal activity intertwined in various parts of the crypto industry, some worry that the heavy hand of the state could hurt honest players if regulators create onerous hurdles that have limitations. powerful. For example, some people who are still interested in staking their crypto may now choose to find an offshore and sketchy exchange to do so, putting their assets at even greater risk than before. We’ve written about some of the issues with performance bidding in “The collapse of cryptocurrency yield offers is a sign of “extreme duress”.’”

Bitcoin Market Dynamics

Regarding bitcoin price action, it could be assumed that the news flow was the cause of the recent local downturn, but there were several signs of local exhaustion after an explosive rally throughout the daily time frame.

The current dynamics in the bitcoin market are as follows:

- Bitcoin supply is inelastic as ever due to extremely strong HODLer dynamics.

- Risk/risk flows dominate, with the strength of the dollar and equity markets deciding much of the near-term bitcoin price direction.

- The extreme illiquidity in the order book for BTC will result in volatile moves in both directions, with liquidity at FTX post-collapse levels despite the recovery from the November 2022 lows.

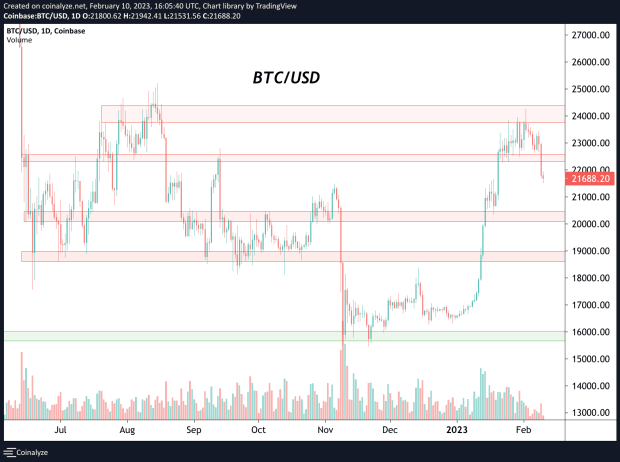

- Bitcoin is still range bound between the $16,000 and $24,000 levels until the market decides otherwise. Expect the bull vs. bear pinball match to continue for some time.

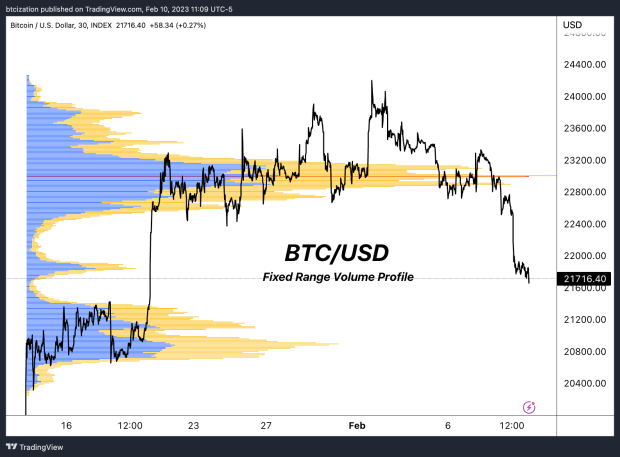

From a volume perspective, the market is currently in a significant liquidity gap due to the short squeeze that pushed prices to their recent 2023 highs. Volume support lies around the $21,200 level, with more buyers waiting in the barracks between $19,000 and 20,000.

Bitcoin derivatives

The futures and derivatives market has been relatively quiet since the short fuel rally that led to significant outperformance at the start of the year. During rapid periods of price appreciation, watch call demand as it shows a negative bias. Long-call and short-put strategies are two different ways this dynamic can play out and can serve as a tailwind for the market until a mean reversion occurs.

The futures market is no longer indicating that Bitcoin is in the depths of its contagion, but it is still a long way from the superheated levels seen during the bull market that helped cause the collapse of leverage that brought the market down like a house of cards.

Spot inflows are a must for any significant squeeze position to manifest and push Bitcoin out of its seven-month range.

Do you like this content? subscribe now to receive PRO articles directly to your inbox.

Relevant past articles:

- No policy pivot in sight: “higher for longer” rates on the horizon

- Bitcoin Rips to $21,000, Shorts Demolished in Biggest Squeeze Since 2021

- The collapse of cryptocurrency yield offers is a sign of “extreme duress”

- Crypto Contagion Intensifies: Who Else Is Swimming Naked?

- A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Higher Global Liquidity

- Inflationary bear market spells trouble for investors

NEWSLETTER

NEWSLETTER