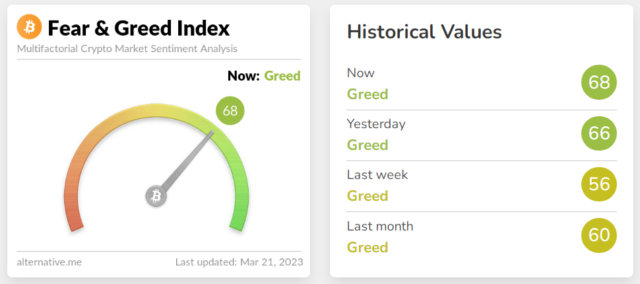

The Crypto Fear and Greed Index, a measure of market sentiment towards cryptocurrencies, hit its highest level this year, hitting a score not seen since November 2021 when Bitcoin hit its all-time high.

Ranging from 0 to 100 and based on factors such as volatility and trading volume, the index reflects growing optimism and confidence among investors as BTC tops $28,000.

The rise in the index suggests that traders are feeling more optimistic about the future of cryptocurrency markets, despite recent regulatory concerns and market volatility.

Crypto Fear & Greed Index: Bullish sentiment in the wake of the banking crisis

Bitcoin has experienced a significant increase in value, with its price rising nearly 30% to reach $28,500 in just one week. At the time of writing, BTC was trading at $28,122, up 16.3% over the past seven days, data from crypto market tracker Coingecko shows.

Source: Coingecko

This increase in performance has also had an impact on the Bitcoin Fear and Greed Index, which analyzes a variety of factors, including price volatility, social media activity, and surveys to gauge investor sentiment. towards BTC.

Now, the index stands at 68, indicating a state of “greed”. This level was last seen in mid-November 2021, shortly after Bitcoin reached its highest value ever recorded, surpassing $69,000.

When the Crypto Fear and Greed Index is high, experts may warn that the market is overbought and needs to correct. They may also warn that investor sentiment has become overly optimistic, which could lead to a market bubble and subsequent price decline.

Source: Alternative.me

Also, experts can advise investors to be careful and not get sucked into hyping up a market rally, as prices could be subject to significant fluctuations.

Experts caution, however, that while a high Crypto Fear and Greed Index may indicate positive sentiment, it should not be the only factor when making investment decisions. It is important that investors do extensive research and consider a variety of factors before making any investment decision.

Bitcoin as a top-performing asset

Recent data from Goldman Sachs shows that Bitcoin has surpassed traditional investment assets and sectors in terms of absolute return and risk-adjusted return.

Specifically, the leading cryptocurrency has gained 51% in absolute year-to-date (YTD) returns, outperforming both gold and the S&P 500, which have each only gained 4% over the same period.

BTC total market cap now at $531 billion on the daily chart at TradingView.com

This increase in the price of Bitcoin is attributed to the increasing probability that the US Federal Reserve will change its monetary policy. In fact, since March 10, when regulators shut down Silicon Valley Bank, Bitcoin has risen 35%.

While market analysts have warned of a possible correction, the cryptocurrency has rallied more strongly than Wall Street stocks, making it an attractive option for investors.

-Featured image from Frank Sonnenberg Online