Anticipation is very high as bitcoin-conference-2024-starts-on-july-25″ target=”_blank” rel=”nofollow”>bitcoin Conference 2024 is approaching, driven not only by technical advances but also by the surprising backing of an influential person: Donald Trump.

Related reading

The surprising acceptance of bitcoin” target=”_blank” rel=”nofollow”>bitcoin The former president’s announcement could change the cryptocurrency landscape and cast long shadows over the political debate and market projections. Here’s a look at how a potential Trump presidency may impact the direction of cryptocurrencies.

Trump's Pivot Towards bitcoin

Donald Trump, once a staunch opponent of bitcoin, has radically changed his language. He has even gone so far as to suggest that bitcoin could be a potential reserve currency alongside the US dollar, but his campaign has aggressively embraced the digital asset. This newfound fervor is a far cry from his previous stance, which called bitcoin a “scam.”

In recent debates, the former president has called bitcoin “digital gold.” His campaign promises to increase the acceptability of the digital asset. This could give more confidence to businesses and investors, which would add further appeal to bitcoin.

Regulatory changes and economic effects

Trump’s potential impact on bitcoin largely depends on his attitude toward regulation. Given JD Vance’s pro-crypto stance, Trump’s choice of running mate suggests a likely tsunami of crypto-friendly laws. Clearer rules and increased institutional investment in bitcoin could find their way into this regulatory climate.

Another important element for bitcoin's price dynamics could be Trump's economic plans. His platform emphasizes reducing inflation and improving economic stability, qualities that directly influence the value of bitcoin.

Trump’s economic policies have been responsible for a relatively stable investment environment during his previous presidency. If he succeeds in fostering a better economic climate, bitcoin will benefit from increased liquidity and investor confidence.

Market guesses and responses

The bitcoin market is driven by speculation, so Trump's close relationship with the crypto asset has magnified this influence. Recent events, such as the Trump assassination attempthave shown how dramatically market sentiment can react to political changes. After the episode, cryptocurrencies experienced a huge surge; meme coins and market sentiment reflected how much was at stake with Trump’s involvement.

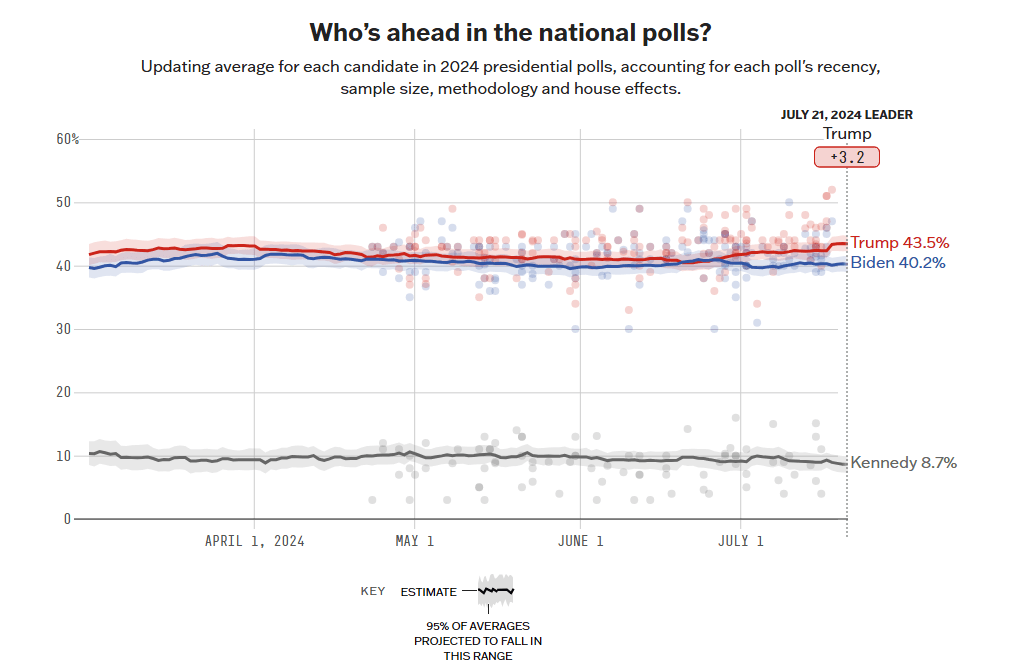

Meanwhile, following the assassination attempt, the former commander-in-chief… Ratings against Biden rose slightly (see chart below).

Trump’s erratic political trajectory further fuels speculation about his potential administration. The outcome of the election is still unknown, although Kamala Harris is emerging as a strong contender. Harris’s opinion on bitcoin could potentially affect market dynamics, thus adding another level of complexity to the currency’s future.

Analysts are divided on the possible effect of a Trump victory on the price of bitcoin as the election approaches. While some see a positive trend with bitcoin soaring above $100,000, others remain cautious awaiting firmer indications from Trump’s campaign and plans.

btc Price Forecast

Technical signals show that bitcoin will rise significantly next week. The cryptocurrency is trading 33% below our monthly projection, predicting a recovery if market circumstances improve. Bullish indications such as an upsloping moving average and a stronger relative strength index (RSI) imply that btc could rectify its undervaluation and reach the predicted price target.

Related reading

bitcoin's expected 536% increase in three months and 53% growth in six months show investor confidence. Analysts expect a bitcoin/predictions” target=”_blank” rel=”nofollow”>148% growth in The btc price one year ahead indicates its long-term potential. Positive trendline breaks and strong support levels support this projection. Institutional interest and favorable macroeconomic conditions could boost bitcoin price in the long run.

Featured image from Getty Images, chart from TradingView