In Cointelegraph Markets Pro’s latest VORTECS™ Report, the institutional-grade crypto trading platform showed how its members could have made a cumulative profit of 390% by following seven trades based on four different leading data indicators. The report shows trade alerts generated between March 11 and 18, 2023.

The potential gains available to Cointelegraph Markets Pro subscribers significantly exceed a simple buy-and-hold strategy over the same period, which would have given Bitcoin (BTC) holders a 33% gain.

Cointelegraph Markets Pro uses indicators such as the VORTECS™ Score, NewsQuakes™, Most Active On-Chain, and Top 5 Exchange Outflows to provide real-time alerts to subscribers.

The last three reports have included alerts with cumulative returns exceeding 100%, proving that this advanced crypto intelligence platform generates winning trading opportunities every week.

VORTECS™ Alerts

SingularityNET (AGIX): 100% gain

On March 12, AGIX was trading at $0.30 when a score of 77 signaled bullish historical patterns for the token. Three days later, the price jumped to $0.60, an impressive 100% increase! Scores above 80 also appeared on March 14, when it was trading at $0.40. Traders who bought at this price could have seen a 50% increase.

AGIX is the utility token of SingularityNET, a decentralized artificial intelligence (AI) network in which participants create, share, and monetize AI services at scale. AGIX is used to stake, govern and transact on the decentralized applications of the network.

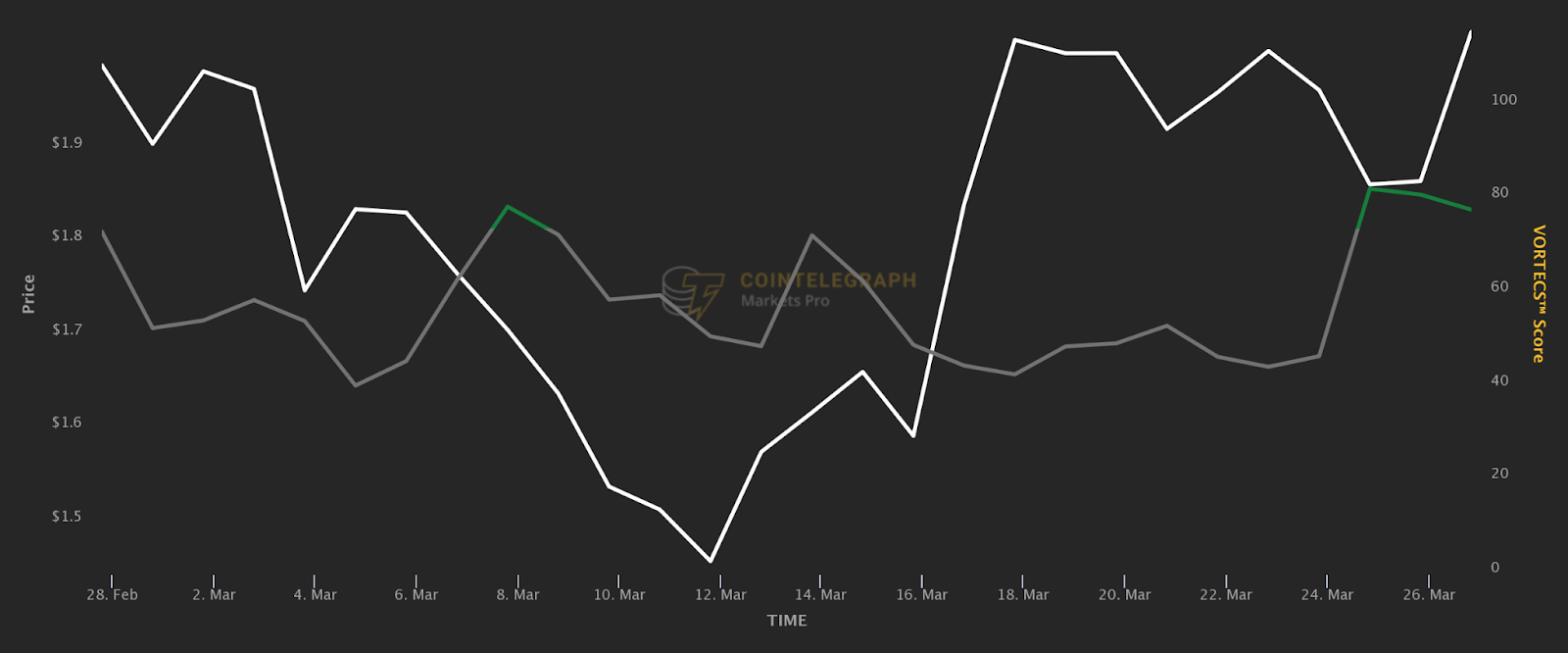

Radicle (RAD): 23% gain

On March 8, RAD was trading at $1.64 when a score of 79 signaled bullish historical patterns for the token. Nine days later, the price jumped to $2.02, a 23% gain. Remember, the annual return on investing in index funds is about 10%.

RAD is the native token of Radicle, a decentralized network for collaborative software development.

NewsQuakes™

Dance (PROM) — 64% profit

A NewsQuake™ alert immediately informed Cointelegraph Markets Pro subscribers of the PROM listing on Binance when the asset price was $4.49. Just three hours later, the price rose to $7.34, an increase of 64%!

PROM is the native token of the Prometheus network, a blockchain-based structure where users seek to communicate around the world. The platform aims to allow trading of any data in a decentralized manner, and users are required to spend or stake a certain number of PROM tokens to use the services and products.

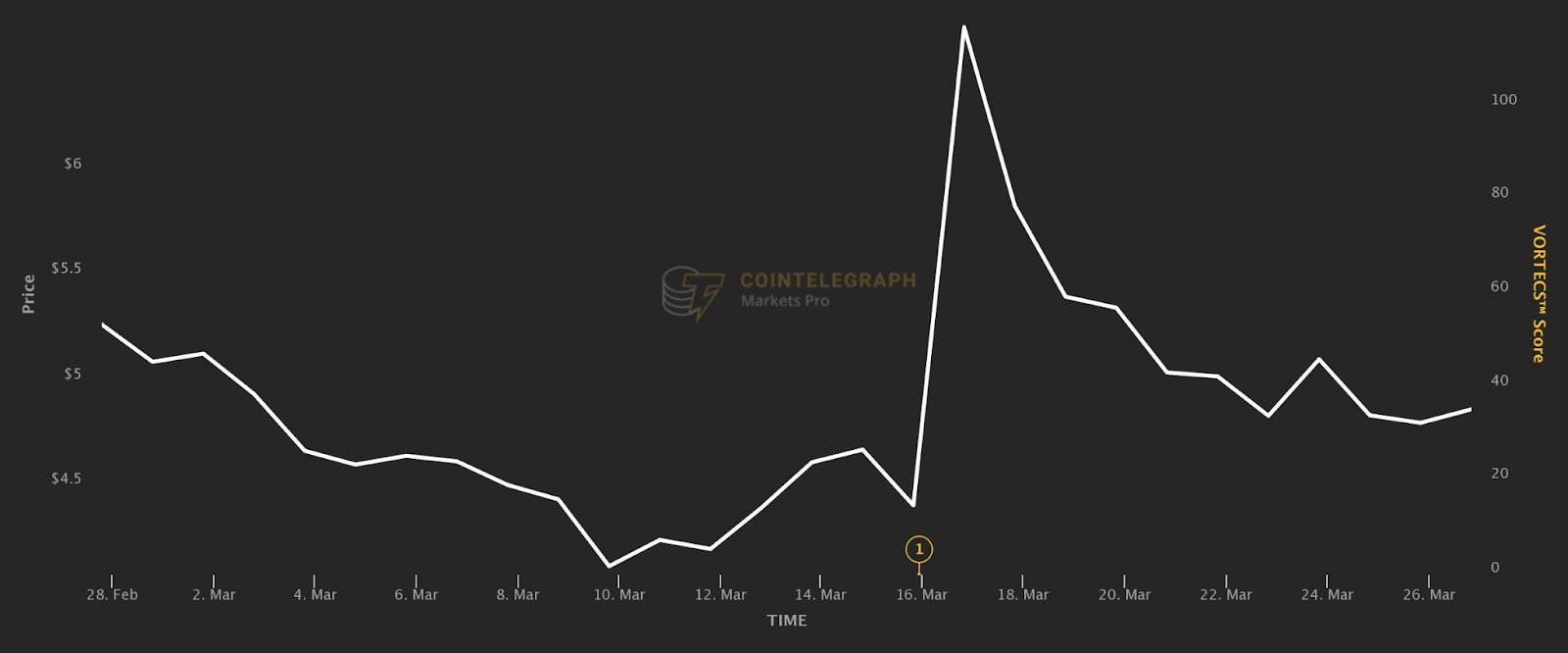

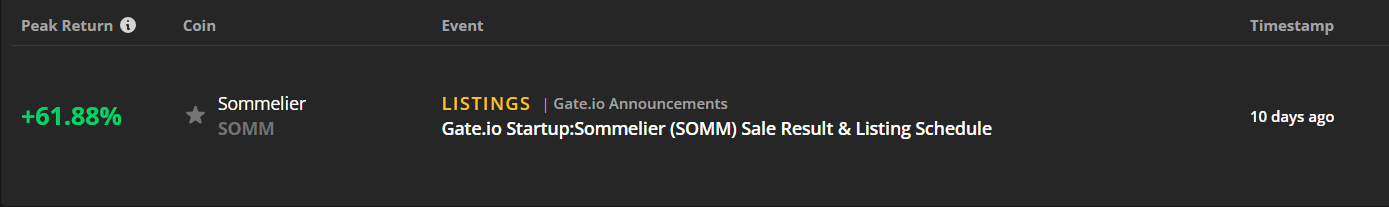

Sommelier (SOMM) — 62 wins

SOMM also performed well this week, following a NewsQuake™ over its Gate.io listing. Just three days after NewsQuake™ informed Markets Pro subscribers of the listing, the token price skyrocketed 62%.

SOMM is Sommelier’s native utility token, a non-custodial, cross-chain platform for running actively managed decentralized finance (DeFi) investment strategies. The token is used for security, transaction fees, participation, and governance.

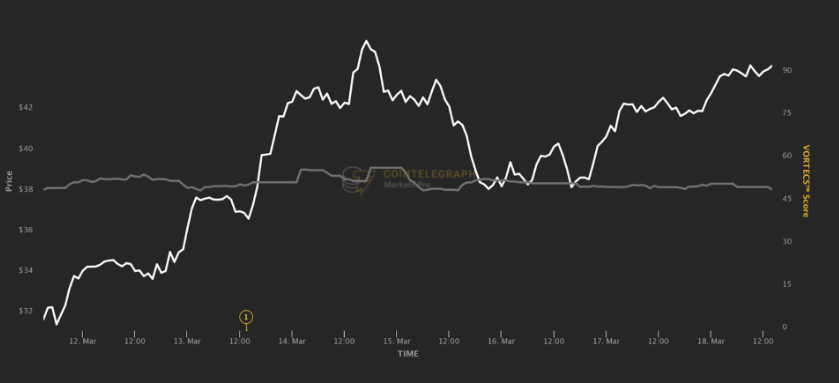

Rocket Pool (RPL) – 24% Gain

On March 13, a NewsQuake™ alerted Cointelegraph Markets Pro subscribers that the asset would be listed on BitPanda. At that time, the price of RPL was $36.74. The next day, the price skyrocketed to $45.48, an increase of 24%.

RPL is the utility and governance token for Rocket Pool, a liquid staking protocol on Ethereum. The coin is the first Ethereum staking pool that is completely decentralized.

Top 5 exchange outflows

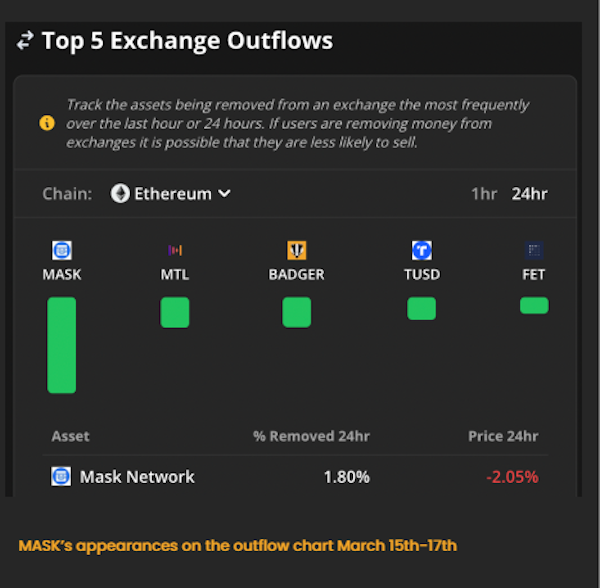

The Top 5 Exchange Outflows indicator, launched in Cointelegraph Markets Pro 2.0, tracks the assets that are removed from an exchange most frequently over the past hour or 24 hours. If users withdraw money from exchanges, they may be less likely to sell.

Red MASK (MASK) — 59% profit

MASK was on the chart of the top 5 exchange outflows on March 15, 16 and 17. On March 15, it was trading at $4.06 and its price peaked three days later at $6.38, an increase of 59%.

MASK is the native utility token of the Mask Network, which allows users of popular social media platforms to send cryptocurrency, interact with decentralized applications, and share encrypted content. MASK holders can vote on ecosystem initiatives through a decentralized autonomous organization called MaskDAO.

Most active in chain

Wrapped NXM (WNXM): 59% profit

Like all other dashboard features, the Most Active On-Chain chart had a great week for alerts. For example, on March 11, WNXM was on the chart when it was trading at $18.15. Soon after, its price began to rise rapidly, reaching a high on March 18 of $25.37, an increase of 59%.

Cointelegraph Markets Pro offers once again

Cointelegraph Markets Pro has a proven track record of generating this type of profit on a weekly basis. Sure, the magnitude of the gains can differ from week to week, but they are usually there regardless of market conditions.

Additionally, the institutional-grade platform has branched out from its two original indicators: the VORTECS Score and Newsquakes™ alerts. Cointelegraph Markets Pro version 2.0 now includes indicators such as Most Active On-Chain and Top Exchange Outflow, both of which provided winning trades last week.

Having multiple indicators is a form of risk diversification for members of the Markets Pro community. With up to seven individual indicators to choose from, members no longer rely solely on VORTECS™ scores or Newsquake™ alerts, regardless of their reliability. historical.

See how Cointelegraph Markets Pro delivers market-moving data before this information is public knowledge.

Cointelegraph is a publisher of financial information, not an investment adviser. We do not provide personalized or individualized investment advice. Cryptocurrencies are volatile investments and carry significant risk, including the risk of permanent and total loss. Past performance is not indicative of future results. Figures and graphs are correct at the time of writing or as otherwise specified. Live tested strategies are not recommendations. Consult your financial adviser before making financial decisions.

All ROIs quoted are accurate as of March 30, 2023…