The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

As the Hong Kong bitcoin ETF quickly approaches, new applications have come from an unexpected source: some of mainland China's largest traditional asset managers.

what's new in hong kong bitcoin“>ETFs has been in development for several months and has attracted no small amount of interest in the digital asset space around the world. Its in-kind generation model is not only a totally different protocol from the bitcoin spot ETF style popularized by the United States, but is also an important foothold for ETF acceptance in East Asia. Total Assets Under Management (AUM) of Hong Kong Futures ETF Already Approved technology/hong-kongs-largest-bitcoin-etf-assets-up-five-fold-since-october-2024-02-29/”>already It surpassed the $100 million mark in February, and the spot ETF has outperformed in every country where it received the green light. Since this economic region has significant capital investments and many international financial connections, Hong Kong would be the perfect candidate for a new testing ground in this market.

However, not even the most optimistic readings of the situation have predicted the emergence of a new actor in this space. As of late March 2024, there were a wide variety of Hong Kong-based equity firms that had expressed some form of interest in launching their own ETF, but only a comparatively handful had submitted a formal application. This situation changed radically on April 8, when a series of big players from mainland China threw their hats into the ring. Harvest Fund, with more than $230 billion in total assets under management, and Southern Fund, with more than $280 billion in assets under management, filed their own applications through Hong Kong-based affiliates. In addition, local media reported that China Asset Management, with $270 billion in assets under management, had its own subsidiary establish an unspecified partnership with existing bitcoin ETF providers in the city.

Considering that there are already signs of ebb The commotion of ETFs in the US market, news like this is undoubtedly a breath of fresh air. Even if American ETF issuers like BlackRock or Fidelity control several trillion assets under management, the sudden emergence of these multi-billion dollar companies is nothing to sneeze at. However, it raises the question to what extent the interactions between these mainland companies and Hong Kong's financial regulations will work together. Isn't it bitcoin? technology/bruised-by-stock-market-chinese-rush-into-banned-bitcoin-2024-01-25/”>forbidden

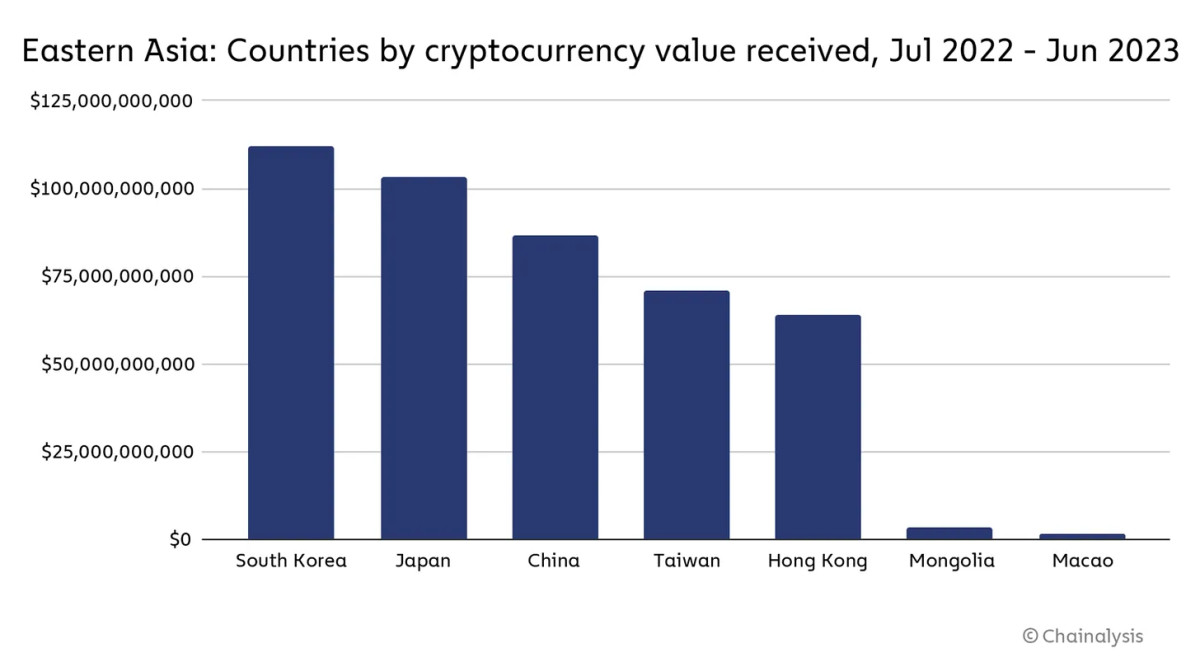

Mainland China has undoubtedly adopted a tougher attitude towards bitcoin in recent years. After the ban on bitcoin mining in 2021, one of the largest mining centers in the world dried up practically overnight. However, the apparent repression leaves crypto/”>many Windows open to the market. Essentially, the main objective of the Chinese authorities has been to raise the bar for entry and make it more annoying and difficult for the average citizen to continue accessing this market. Furthermore, as many legitimate businesses are unable to operate, Chinese Bitcoiners receive an implicit warning: “If you get scammed, don't expect our help or sympathy.” The silent operations evidently amount to many billions.

It's that same ambiguous attitude that makes these new ETF developments so encouraging. Three of the largest asset managers in all of China have joined the project in quick succession, and it is no small commitment; If these companies become ETF issuers, they will become enmeshed in a business with unprecedented trading volumes and broad international interest. It would not be the first time that Chinese capital companies invested largely in bitcoin-related companies, but mining hardware in distant Ethiopia is very different from financial instruments in a city that is legally part of China. By taking this leap, these companies have found a way to legally engage with the world of bitcoin, and the intertwining will even predominantly involve Chinese citizens.

<img src="https://bitcoinmagazine.com/.image/c_fit%2Ch_800%2Cw_1200/MjA0MzE5MTg5MTE1NDc5NDkz/bm-x-unchained-article-cta—learn-more.png”>

Such a move could go a long way in showing both investors and regulators that the world of bitcoin is nothing to fear, but rather a very interesting opportunity. The Hong Kong in-kind model mentioned above means that new buyers will have to exchange custodial Bitcoins for a corresponding share in the ETF rather than simply purchasing them with fiat money. In other words, there will be an undeniable and direct link between prestigious national companies and a trade that operates largely out of sight. Could this link convince party officials that bitcoin has a place in China after all? Will ETF issuers try to pull their weight and push for bitcoin to re-enter the legal system? How will the complicated relationship between the People's Republic of China and Hong Kong affect the entire agreement?

As far as the Hong Kong part of the deal is concerned, they seem quite committed to the dream of creating a regional crypto hub. We not only have premises bitcoin.com/hong-kongs-za-bank-to-offer-custody-accounts-for-stablecoin-issuers/”>banks showed increasing acceptance of the digital asset space as a whole, but this pales in comparison to the news from HashKey Global. The South China Morning Newspaper tech/blockchain/article/3258196/hong-kongs-hashkey-crypto-exchange-launches-global-platform-aim-overtaking-coinbase-5-years”>reported On April 8, HashKey Group, a Hong Kong-based exchange that only trades bitcoin and ethereum, opened its new “Global” initiative with a Bermuda-based exchange. HashKey announced this plan at the Web3 Festival, and operations in Bermuda will be just the first step in an ambitious venture: the long-term hope is to “overtake US-based crypto giant Coinbase in trading volume within of five years”. a very difficult task.

And yet, COO Livio Weng didn't seem particularly concerned and told the Mail that “we have seen your data and we do not think it will be difficult.” He added that most global competitors are either “user-friendly but non-compliant” or “compliant but difficult to use,” and the challenges of Chinese regulation have given his company a substantial advantage in this department. It has been difficult to offer a convenient and attractive service to customers while maintaining regulatory compliance, so looser restrictions around the world will make HashKey a big fish in a small pond. For example, the Bermuda Stock Exchange is already prepared to crypto-exchange-goes-live-after-winning-license-in-bermuda/”>offer almost 20 more digital assets than the original Hong Kong operation. Chinese citizens living abroad are also a definite demographic target.

This kind of enthusiasm is certainly a bold statement in the world of bitcoin! Even in a chaotic market like this, the reigning champions of the foreign exchange business will not be easily toppled. However, this type of trust was reportedly reflected by the other attendees at the Web3 Festival, as the entire community has pinned its hopes on an increase in the price of bitcoin. Mainland companies are showing a real willingness to enter the world of bitcoin through Hong Kong, and the city's own existing companies are confident that they will be worth many billions before long. Is it really that difficult to imagine that a success here could change China's entire paradigm?

It is for these reasons that observers around the world are so eagerly awaiting the upcoming bitcoin ETF in Hong Kong. A new spin on the same financial instrument could shake up the entire paradigm, giving life to ETFs internationally. However, if China reverses its hostility towards bitcoin, frankly, it could be an even bigger upset than the spot ETF itself. It is for these reasons that we must closely watch developments in this space, as it seems likely that the impact will reverberate in one way or another. All signs seem bullish for bitcoin, and the next big opportunity could be just around the corner.