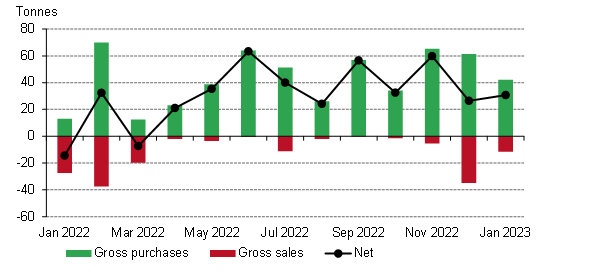

Central banks show continued demand for gold in 2023, according to a recent report by the World Gold Council (WGC), which noted that the world’s central banks hoarded 31 tonnes of the precious metal in January. Turkey was the biggest buyer of gold, adding 23 tons to its central bank’s reserves, while the People’s Bank of China also bought 15 tons of gold.

Central bank gold purchases hold steady despite potential challenges in 2023

At time of writing, a troy ounce of .999 fine gold is at $1,857.50 per unit, up 1.12% from the previous day. gold prices they have been down since January 31, 2023, when the price per ounce reached $1,950 per unit against the US dollar. On March 2, the World Gold Council (WGC) published a report titled “No Dry January for Central Bank Gold Buying,” which looks at how the January 2023 records show that the world’s central banks have maintained demand on record at the end of 2022.

According to Krishan Gopaul, author of the report, many purchases came from Turkey, China and Kazakhstan. “In January, central banks collectively added 31 net tonnes

Central bank purchases and sales accounted for 44 tons in January 2023, and one central bank offset its reserve by selling 12 tons. The largest buyer of gold was the Central Bank of Türkiye (Turkey), which bought approximately 23 tons during the month. According to the country’s records, Turkey now holds 565 tons of gold.

China came in second, with the People’s Bank of China purchasing 15 tons during the same time period, Gopaul detailed. “The National Bank of Kazakhstan increased its gold reserves by a modest 4 tons in January, bringing its gold reserves to 356 tons,” explains the WGC author. The report notes that the data is based on International Monetary Fund (IMF) records, and some of the data may be revised during the next WGC monthly report.

In addition to Turkey, China and Kazakhstan, the author of the WGC details that the European Central Bank (ECB) acquired two tons because Croatia United the eurozone, and the country was forced to transfer its reserve assets to the ECB. The seller of the 12-ton gold sale in January 2023 was the Central Bank of Uzbekistan, and the country now owns approximately 384 tons.

The WGC report concludes that the organization has little doubt that central banks around the world will continue to buy gold through the remainder of 2023. However, the WGC author stresses that this year’s gold purchases may not match records. set in 2022. “It is also reasonable to believe that central bank demand in 2023 may struggle to catch up to the level it reached last year,” the report notes.

What do you think the future holds for central bank gold demand? Will it continue to increase or decrease in the coming months and years? Share your thoughts in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons, World Gold Council, Tradingview

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.