Bitcoin (BTC) faced a showdown with a key trend line on February 28 when the monthly close finally arrived.

Bitcoin “does not feel bullish” at the close of February

Data from Cointelegraph Markets Pro and TradingView it showed BTC/USD circulating in an area around $23,500 at the open on Wall Street.

With US stocks flat and the US dollar avoiding any further strengthening, eyes were on Bitcoin to preserve its gains through last-minute volatility.

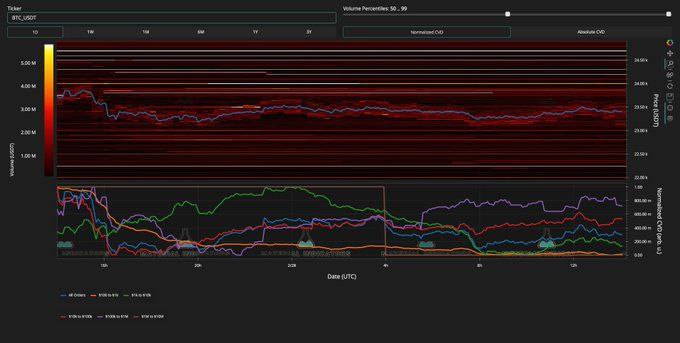

“I would like to see more Bitcoin supply liquidity enter the active trading range to increase the chances of closing the monthly candle above the 50-month moving average,” tracking resources Material Indicators wrote in one of several Twitter posts of the day.

“Volume has been weak, so at this stage it doesn’t feel bullish.”

An accompanying chart showed the bid and ask levels for BTC/USD on the Binance order book.

Material indicators signaled that the month of March had a key macroeconomic event in the form of the upcoming Federal Reserve decision on interest rate hikes. This expired on March 22 courtesy of the Federal Open Market Committee (FOMC).

“Close above 50-month moving average = Bullish close below $23,128 = Red and an invitation to retest key support levels,” part of another post continued.

“Close between 50-month MA – $23,128 = Green monthly close and range until next rate hike around the March 22 FOMC meeting.”

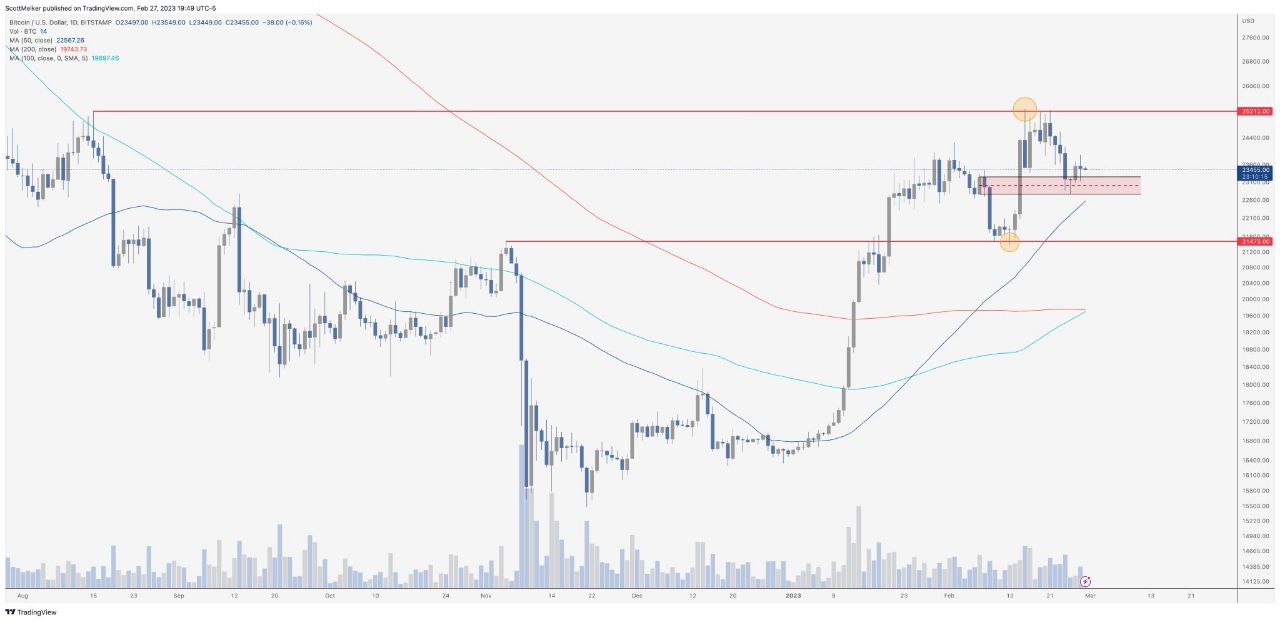

Meanwhile, Scott Melker, the dealer and podcast host known as “The Wolf of All Streets,” demanded more than the spot price, calling the area immediately above “no man’s land.”

“Bullish switch (red zone) remains support at the moment. Still in no man’s land between $21,473 and $25,212,” he said. commented on a chart showing target levels.

All quiet in the macro landscape

Meanwhile, the lack of direction in the US dollar removed a potential headache for risk asset bulls on the day.

Related: Bitcoin Exchanges Now Hold 16% Less BTC Than Older Hodlers

The US dollar index (DXY) soars to multi-day lows as it failed to recover after giving up the previous week’s gains.

In US stocks, the S&P 500 was trading 0.2% lower at the time of writing, while the Nasdaq Composite Index was flat on the day.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.