Bitcoin (BTC) dipped to $28,000 at the Wall Street open on March 24, as fresh banking troubles failed to provide further momentum for cryptocurrencies.

Traders remain bullish on BTC’s long-term trend

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD lost momentum to hit daily lows of $28,001 on Binance.

The pair was trying to cement support after a classic comeback the day before erased the panic on the back of the latest US economic policy moves.

The Federal Reserve raised benchmark interest rates by 0.25% on March 23, this along with contradictory comments from Chairman Jerome Powell served to destabilize risk assets amid the lack of a clear trajectory.

Related: The Federal Reserve’s balance sheet adds $393 billion in two weeks. Will this send the price of Bitcoin to $40k?

Therefore, Bitcoin showed indecision on the day, with analysts equally divided on where BTC’s price action might head next.

“It is typical to see some panic on that drop, but unless we start to see a change in market structure, lower lows and lower highs, then we have nothing to worry about from a bullish perspective,” a Crypto Tony optimistic. said Twitter followers.

Popular trader and analyst Rekt Capital was similarly bullish on the overall strength in BTC/USD.

“All BTC needs to do to confirm a new macro uptrend is the monthly candle close above ~$25000,” he said. argument in part of his latest analysis.

“So far, so good.”

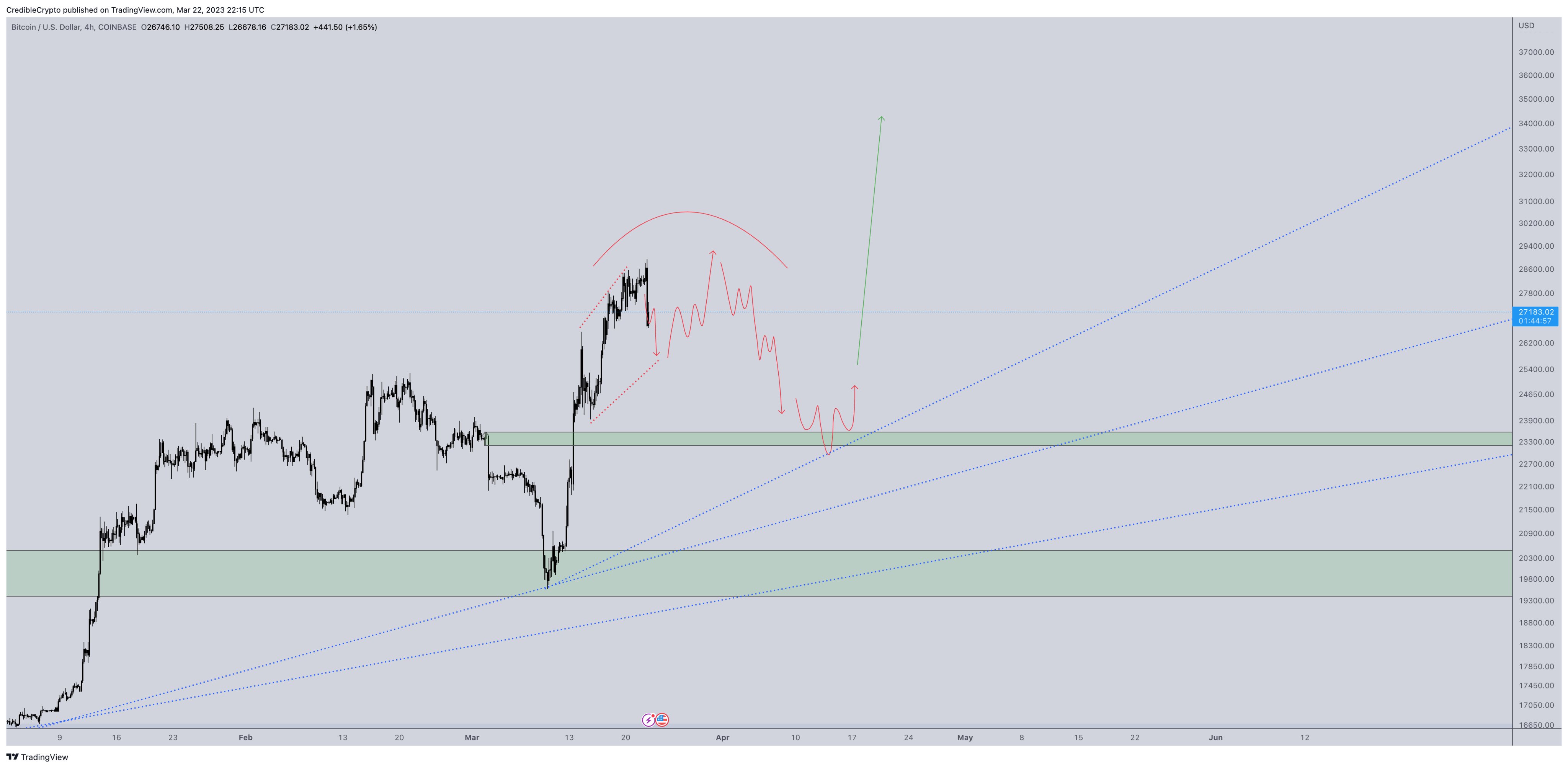

Meanwhile, fellow trader Credible Crypto suggested that even if BTC/USD were to fall to $23,000, this would not imply a clean break from current bullish behavior.

“A few weeks of work before continuing our rally would be good for us here. Anything below 22-23k is fair game and nothing to worry about in my opinion,” he said. wrote on March 23.

Deutsche Bank makes market nervous after Credit Suisse

Near-term sentiment was affected by a temporary trading halt on the world’s largest exchange Binance, which briefly suspended spot trading.

Related: Crypto winter may affect mental health of hodlers

On-chain monitoring resource Material Indicators noted that supply liquidity had appeared on the Bitcoin order book to prevent a sell-off.

After a long interruption @Binance comes back online, and someone put up a $13 million bid liquidity block to try to stem a sell-off. I wonder who it could be. pic.twitter.com/o195XMo4Zt

— Material indicators (@MI_Algos) March 24, 2023

Elsewhere, macroeconomic concerns stemming from the US banking crisis mounted on the day, as Deutsche Bank lost value just days after Swiss lender Credit Suisse witnessed a takeover and government bailout.

OH! Deutsche Bank’s credit default swaps, which provide insurance for its bondholders against a possible default, soar as bank doom returns in Europe. Markets price a probability of default of 31% for DB sub-bonds and 16% for DB senior paper. pic.twitter.com/APrSRh9yVb

—Holger Zschaepitz (@Schuldensuehner) March 24, 2023

“Dumping of bank actions, Dumping of yields. Precious metals up. Bitcoin a bit flat”, analyst Daan Crypto Trades answered.

“It seems that the TradFi world continues with the same trend as last week. Let’s see if BTC has more fuel left or not.”

At the time of writing, Deutsche Bank (DBK) shares were down nearly 10% on March 24.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER