bitcoin (btc) experienced a classic pullback after the Nov. 16 Wall Street open as deja vu btc price action continued.

Analysis: Door open to a deeper btc price correction

Data from Cointelegraph Markets Pro and TradingView It followed bitcoin as it fell to $36,470, down less than $1,000 on the day.

The picture closely followed developments earlier in the week, where bulls failed to reach new highs to support and endured prolonged sell-offs.

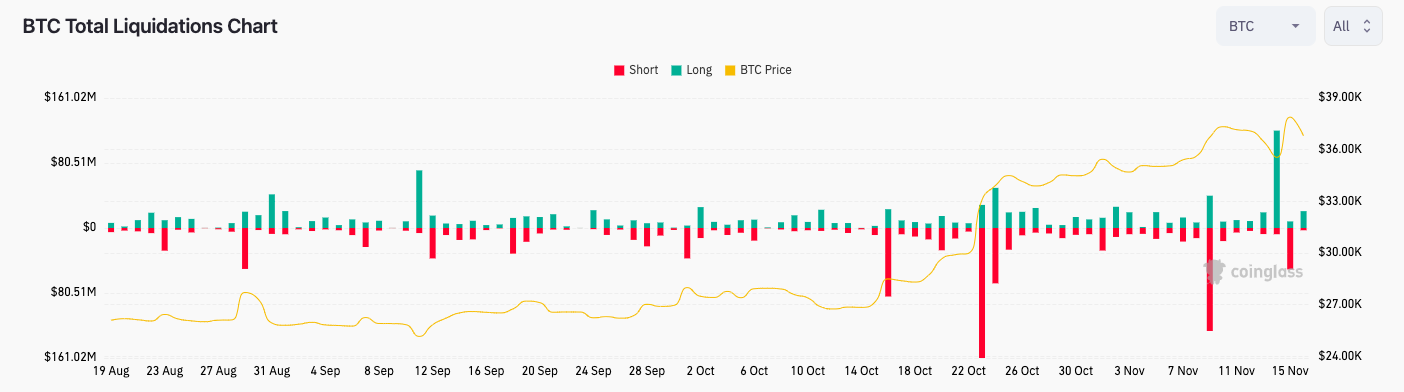

These were less present that day, with around $21 million in btc long positions wiped out at the time of writing, according to data from the monitoring resource. glass coin. On November 14, the figure reached $120 million.

Commenting on the status quo, market participants noted the repetitive nature of btc price action, leaving open the possibility of new highs and a deeper pullback.

“While I stand by my view that the market is due for a correction, we still cannot rule out the possibility of another attempt at the $38,000 to $40,000 range,” on-chain monitoring resource Material Indicators. wrote in part of his latest publication X.

He added that news about the United States’ first bitcoin spot exchange-traded fund (ETF) “would be a likely catalyst for such a move,” but that time was running out thanks to regulatory time constraints.

An accompanying snapshot of btc/USDT order book liquidity showed an increase in sell-side liquidity at $38,000, with complementary bid volume only present at $33,000.

“The path of least resistance for $btc is down if we go by the number of resting orders waiting to be executed,” said popular pseudonymous trader Horse. continued in the subject.

“My view is that this recent rally was easy because the sell-offs left the pocketbook empty and anyone who passively waited for the decline added a lot of time in the market.”

Dollar weakness bolsters crypto prospects

The macroeconomic outlook was cold that day, as US dollar weakness reappeared, negating a recovery after a precipitous decline on November 14.

Related: $48,000 is now “reasonable” btc price target – Filbfilb by DecenTrader

This came on the back of US inflation data, which came in more positive than expected in a welcome surprise for risk assets.

The US Dollar Index (DXY) is back near 104, near its lowest levels since early September.

“The DXY got slaughtered today, I’d say I’m surprised, but it’s actually not going down much further,” popular trader Bluntz. reacted to the previous movement.

“Don’t underestimate how GOOD this is for cryptocurrencies.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.