The bitcoin (btc) rally has been taking a breather over the past few days, but its strong rally in 2023 has not gone unnoticed. A survey of US financial services companies by cryptocurrency company Paxos showed that 99% of companies were as much or more focused on cryptocurrency projects this year compared to previous years.

Analysts are increasingly bullish on bitcoin and the crypto space in 2024. Bitwise Senior Research Analyst Ryan Rasmussen made ten predictions for the crypto industry in 2024 in a December 13 X (formerly Twitter) post. He believes bitcoin will skyrocket to $80,000 in 2024 and “more money will be settled using stablecoins than using Visa.”

Along with cryptocurrency-specific issues, expectations of rate cuts by the Federal Reserve in 2024 add to the bullish sentiment. Arthur Hayes, former CEO of cryptocurrency exchange BitMEX, reiterated his bullish view on cryptocurrencies in an X post on December 14. He said that fiat money was “a disgusting piece of garbage” and that there was no reason not to be crypto for a long time.

What are the vital support levels that could stop bitcoin and altcoins from falling? Let's analyze the charts of the top 10 cryptocurrencies to find out.

bitcoin price analysis

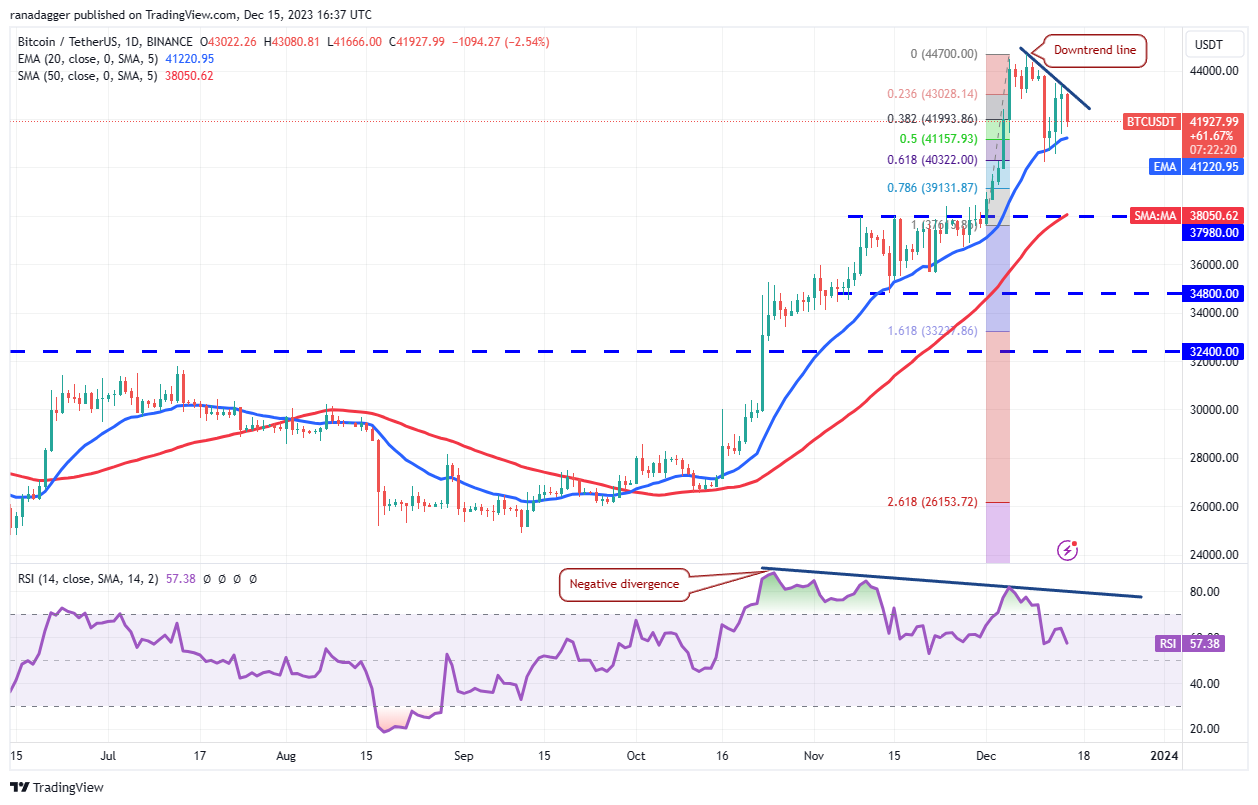

bitcoin has been stuck between the downtrend line and the 20-day exponential moving average ($41,221) for the past few days. This tightening of price action suggests that a range breakout is possible in the near term.

If the price turns lower and falls below the 20-day EMA, it will indicate that the bulls are aggressively booking profits. That could sink the btc/USDT pair to the 50-day simple moving average ($38,050). Buyers are expected to fiercely defend this level.

Alternatively, if the price bounces off the 20-day EMA and pierces the downtrend line, it will indicate that the bulls remain in control. The pair could rise to the 52-week high at $44,700 and if this level is broken, the next stop is likely $48,000.

Ether Price Analysis

Ether (eth) rebounded from $2,200 support on December 13, but the relief rally faces selling near $2,332. This suggests that the bears are selling on the rallies.

The negative RSI divergence also suggests that bullish momentum is slowing. Sellers will try to strengthen their position by lowering the price below $2,200. If they manage to do that, the eth/USDT pair could fall to the 50-day SMA ($2,049) and then to solid support at $1,900.

On the contrary, if the price bounces back to $2,200, it will suggest that the bulls have turned the level into support. That will increase the probability of a rally to $3,000.

BNB Price Analysis

The bulls are struggling to push BNB (BNB) above the overhead resistance at $260, but a minor positive is that they have not given any ground to the bears.

The gradually rising 20-day EMA ($240) and the RSI in positive territory indicate an advantage for buyers. If the price rises from the current level or bounces off the 20-day EMA, the bulls will again try to push the price to the neckline of the inverse head and shoulders pattern.

On the other hand, if the price falls below the moving averages, it will suggest that the bulls are losing control. The pair may then fall to the strong support at $223, indicating range-bound action between $223 and $260.

XRP Price Analysis

XRP (XRP) is witnessing a tough battle between bulls and bears on the moving averages.

The flat 20-day EMA ($0.63) and the RSI near the midpoint suggest a balance between supply and demand. If the price closes below the moving averages, the XRP/USDT pair could fall to $0.56. This is an important level for the bulls to defend because a break below it could drop the pair to $0.46.

If the price bounces off the moving averages, the pair will again try to rise above $0.67. If that happens, the pair could rise to $0.74. The bears are expected to mount a strong defense at this level.

Solana Price Analysis

Solana (SOL) bounced off the 20-day EMA ($66) on December 13 and broke above the overhead resistance at $78 on December 15.

If buyers sustain the breakout, the SOL/USDT pair is likely to jump to the psychological level of $100. The rising moving averages indicate an advantage for the bulls, but the negative divergence on the RSI warns that the bullish momentum may be weakening.

The crucial support to watch on the downside is the 20-day EMA. A breakout and close below the 20-day EMA could affect several traders in the short term. That may start a pullback towards the 50-day SMA ($55).

Cardano Price Analysis

Cardano (ADA) rose from the 50% Fibonacci retracement level of $0.51 on December 11 and surpassed $0.65 on December 13.

If buyers keep the price above $0.65, the ADA/USDT pair could reach $0.70 and subsequently $0.78. However, the risk of a correction is great as the RSI has been trading in overbought territory for the past few days.

The first sign of weakness will be a drop below $0.61. That may start a pullback towards the 20-day EMA ($0.51). This remains the key level to watch because a break below it will indicate a trend change in the short term.

Dogecoin Price Analysis

Dogecoin (DOGE) bounced off the 20-day EMA ($0.09) on December 13, but the bulls are finding it difficult to push the price above the $0.10 level.

The bears will try to push the price below the 20-day EMA. If they do, selling could intensify and the DOGE/USDT pair could fall to the 50-day SMA ($0.08). This level can act as support, but if it is broken, the pair may fall to $0.07.

Both moving averages are rising and the RSI is in positive territory, indicating that buyers maintain the advantage. If the price bounces off the 20-day EMA, it will suggest that the bulls continue to buy on dips. That will increase the probability of a rally to $0.11.

Related: US Dollar Hits 4-Month Low as bitcoin Trader Predicts 10% Drop Ahead

Avalanche Price Analysis

Avalanche (AVAX) rebounded from the 38.2% Fibonacci retracement level of $34.36 on December 13, indicating that buyers are not waiting for a deeper correction to buy.

The bulls are trying to push the price above the overhead resistance of $42.89. If they can achieve this, the AVAX/USDT pair could begin the next leg of the uptrend. The next upside target is $50 and then $70.

The risk to the upside is that the RSI is trading at deeply overbought levels. That suggests the pair is vulnerable to a correction or consolidation in the near term. If the price turns down from $42.89, the pair could slide towards the 20-day EMA ($30.40).

Polka dot price analysis

The bulls again attempted to push Polkadot (DOT) above the overhead resistance at $7.90 on December 14, but the bears held firm.

The bulls' repeated failure to overcome the overhead hurdle may have tempted short-term traders to book profits. Although the bulls bought the dip on December 14, they were unable to sustain the higher levels. Renewed selling on December 15 threatens to sink the DOT/USDT pair to the 20-day EMA ($6.43).

A strong bounce off the 20-day EMA will suggest that sentiment remains positive. The bulls will again try to push the pair to $7.90. The short-term trend will turn bearish if it breaks below the 20-day EMA.

Polygon price analysis

Polygon (MATIC) has been trading near $0.89 since December 12, but the bulls have failed to push the price above the resistance. This suggests that the bears are aggressively defending the level.

The 20-day EMA ($0.84) is the important support to pay attention to. If the price bounces off the 20-day EMA, it will indicate that lower levels are being bought. That will improve prospects for a rally above $0.89. If this resistance is broken, the MATIC/USDT pair could skyrocket to $1.

On the other hand, if the price falls below the 20-day EMA, it will suggest that the bulls have given up in the short term. That may initiate a decline to the 50-day SMA ($0.78) and subsequently to the solid support of $0.70.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.