Join our Telegram Channel to keep up to date with breaking news coverage.

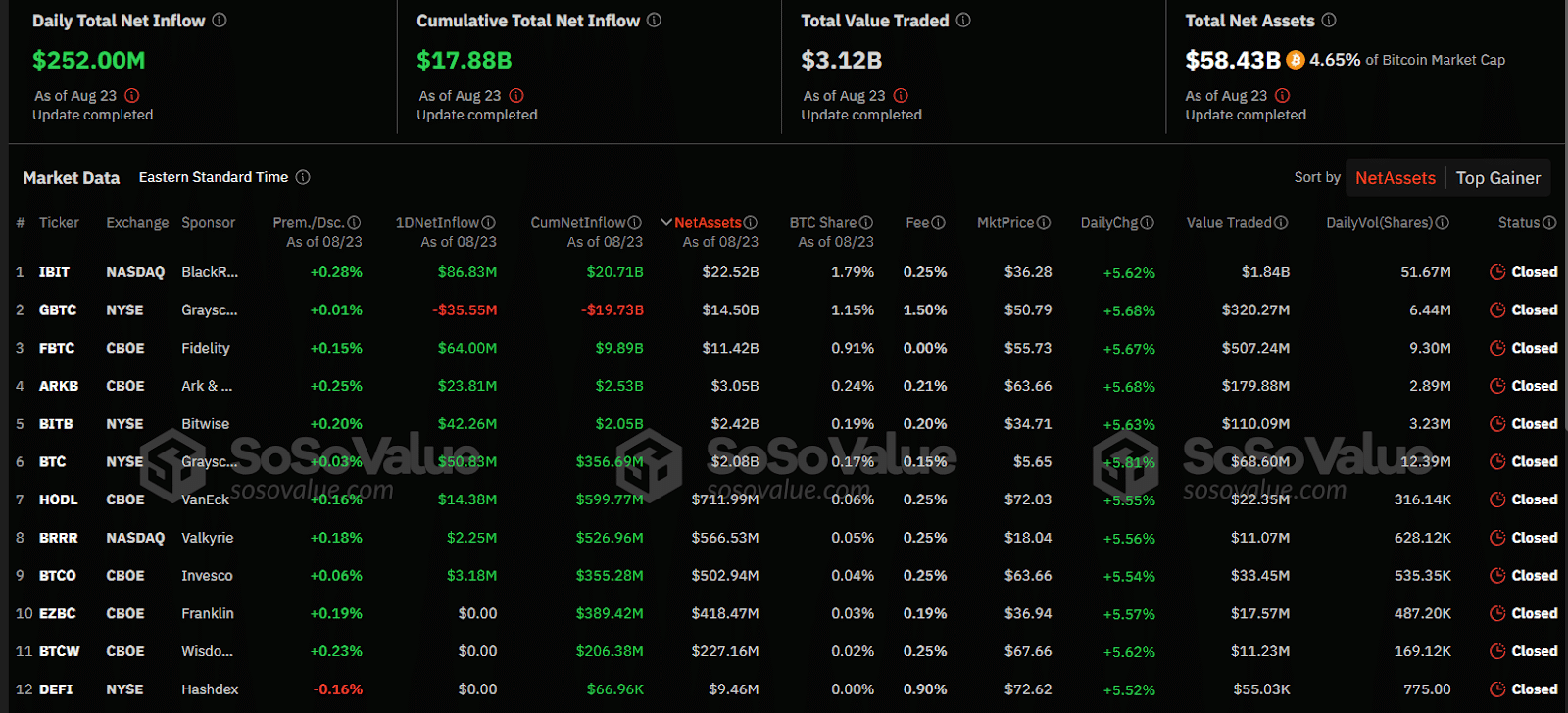

bitcoin ETFs (exchange-traded funds) in the United States recorded net inflows of more than $250 million on August 23, the highest level in five weeks, led by investment products belonging to BlackRock and Fidelity.

According to data from Bland ValueBlackRock’s IBIT and Fidelity’s FBTC saw the largest inflows. Grayscale’s GBTC was the only product to see outflows of $35 million, although its bitcoin mini-fund saw $50 million in inflows.

Bitwise says bitcoin ETFs lead institutional adoption despite retail traders holding majority of assets under management

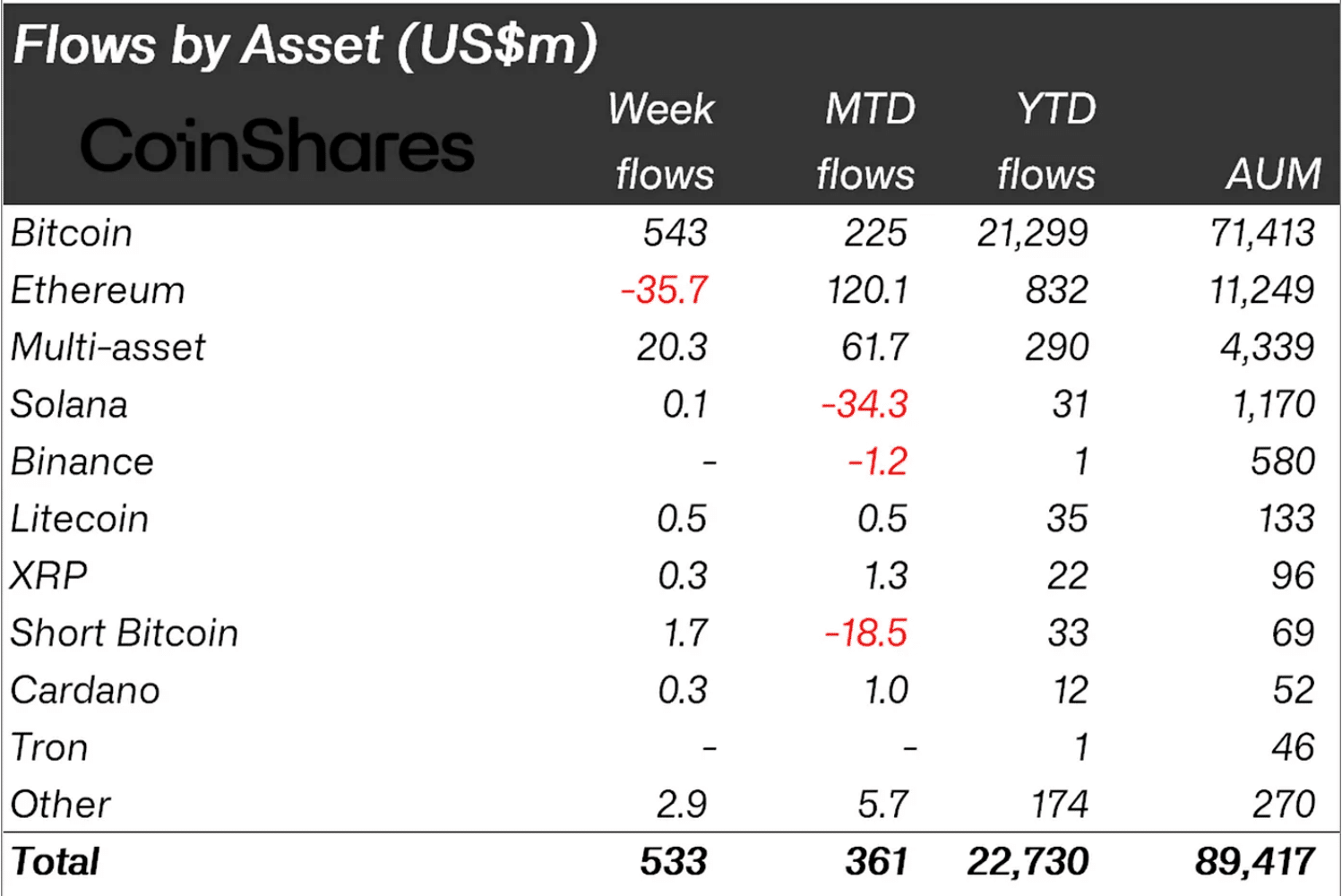

Coinshares Data shows that bitcoin-related ETPs (exchange-traded products) were the best performers among all cryptocurrency investment products, totaling $543 million last week. The bulk of this inflow came from BlackRock’s IBIT, which recorded $318 million during this period.

Bitwise chief investment officer Matt Hougan said in an Aug. 21 thread on x that bitcoin ETFs are the “fastest-growing ETFs of all time.” After the investment products raised more than $17.5 billion since launching in January, the funds are on track to “break the previous record,” held by the Nasdaq-100’s QQQ, he added.

<blockquote class="twitter-tweet” data-width=”550″ data-dnt=”true” wp_automatic_readability=”11.446153846154″>

2/ bitcoin ETFs are the fastest-growing ETFs of all time. They have attracted $17.5 billion in net flows since their launch in January. This is on track to break the previous ETF record, held by the Nasdaq-100 QQQ, which raised about $5 billion in its first year. It’s not even close.

—Matt Hougan (@Matt_Hougan) twitter.com/Matt_Hougan/status/1826258118332039235?ref_src=twsrc%5Etfw”>August 21, 2024

Most of the interest in spot bitcoin ETFs is coming from retail investors, Hougan said in the thread. While around 79% of current bitcoin ETF assets under management (AUM) are held by retail traders, x.com/Matt_Hougan/status/1826258125227503940″>saying that bitcoin ETFs are “by far the leaders in terms of institutional adoption.”

btc rises on hopes of a September interest rate cut

Federal Reserve Chairman Jerome Powell's comments, “The time has come to tighten policy,” signaled the Fed's confidence that inflation is returning to target and prompted bitcoin Price The US dollar has recovered and broken through the resistance level of $62,000. As a result, the market now expects a possible rate cut at the next FOMC meeting, which will take place on September 17. bitcoin/”>CoinMarketCap Data shows the leading cryptocurrency is up more than 8% over the past week to trade at $63,386 as of 11:25 p.m. EST.

Despite the dovish tone, Bank of America (BofA) notes that Chairman Powell did not indicate the need for 50 basis point cuts, but rather suggested gradual cuts, and that such cuts would be likely only if recession risks increase significantly.

Related news

PlayDoge (PLAY): The Latest ICO on the BNB Chain

- Virtual 2D Doge Pet

- Play to Win Meme Coin Fusion

- Participation rewards and in-game tokens

- SolidProof audited – playdoge.io

Join our Telegram Channel to keep up to date with breaking news coverage.

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>

NEWSLETTER

NEWSLETTER