All eyes are on bitcoin, especially as many traders continue to anticipate a breakout above the $100,000 mark. This anticipation has led to a <a target="_blank" href="https://www.newsbtc.com/bitcoin-news/54-bitcoin-inactive-2-despite-500-price-jump/” target=”_blank” rel=”noopener nofollow”>peak activityespecially among bitcoin whales. Interestingly, bitcoin whales are making bold claims amid the anticipation, with on-chain data pointing to an accumulation of over 40,000 btc in just 96 hours among this cohort of holders.

This interesting accumulation coincides with bitcoin price hitting a high of $99,645 in the last 24 hours, adding further impetus to the narrative of a possible all-time price milestone.

Examining the holding patterns of bitcoin whales

Recent bitcoin price dynamics have put the spotlight on bitcoin whales. Ali Martinez, a well-known cryptocurrency analyst, <a target="_blank" href="https://x.com/ali_charts/status/1860313534959091768″ target=”_blank” rel=”noopener nofollow”>drew attention to the notable activity of bitcoin whales on the social media platform

While highlighting Santiment data, Martínez revealed that bitcoin whales have purchased more than 40,000 btc worth approximately $3.96 billion in the last 96 hours. Notably, the bitcoin whales Santiment references in this metric consist of addresses containing between 100 and 1000 btc.

This aggressive accumulation comes at a critical time for bitcoin, with prices near the long-awaited $100,000 mark. This whale activity typically reduces the available supply of bitcoin on the open market, which is expected to continue to drive up the price of bitcoin.

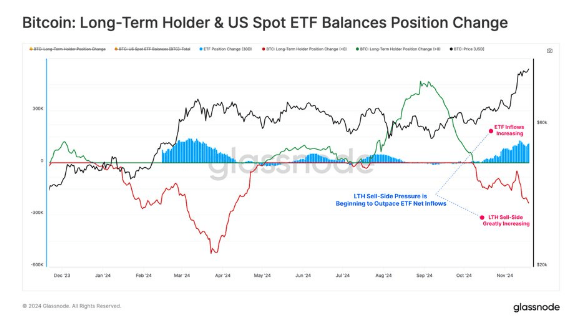

Despite the increase in whale accumulation, Glassnode on-chain data suggests that long-term holders <a target="_blank" href="https://www.newsbtc.com/bitcoin-news/bitcoin-lths-start-taking-profits-metrics-reveal-whales-are-actively-spending/” target=”_blank” rel=”noopener nofollow”>have increased their profit taking tandem. Notably, long-term holders have sold more than 128,000 btc since the beginning of October.

However, this profit taking by long-term holders has so far been offset by demand for US spot bitcoin ETFs. These ETFs have acted as a counterweight, absorbing almost 90% of the bitcoin sold by long-term holders.

One possible explanation is that long-term holders are abandoning their bitcoin self-custody and are instead diverting their holdings into spot bitcoin ETFs to benefit from their regulatory clarity. According to data from SoSoValue, US bitcoin Spot ETFs witnessed consecutive days of inflows over the past week to take total inflows to $3.38 billion, which is the largest weekly inflow since its launch in January 2024.

What's next for bitcoin price?

Looking ahead, bitcoin price is definitely on track to surpass $100,000 in the coming days. However, it remains to be seen <a target="_blank" href="https://www.newsbtc.com/bitcoin-news/bitcoin-mvrv-metric-signals-market-heating-up-heres-what-investors-should-know/” target=”_blank” rel=”noopener nofollow”>what happens after that. Tony Severino, crypto analyst <a target="_blank" href="https://newsbtc.com/news/bitcoin/bitcoin-price-mirrors-2017-100000/” target=”_blank” rel=”noopener nofollow”>has speculated that bitcoin's price peak could double within two weeks to two months after surpassing $100,000. This prediction is based on bitcoin's price performance after it first surpassed the $10,000 price level in 2017.

On the other hand, veteran analyst Peter Brandt suggests that there could be some kind of selling pressure among the bulls once the price of bitcoin surpasses $100,000.

“What I had in mind here is the possibility that bulls will sell their btc below $100.00 thinking they will buy a correction that doesn't come, and then turn bearish if bitcoin rises to $120,000 believing the price must go down,” said. <a target="_blank" href="https://x.com/PeterLBrandt/status/1860044866849505712″ target=”_blank” rel=”noopener nofollow”>saying.

However, the current cryptocurrency market landscape is primed for a continued rise in the price of bitcoin in the coming weeks and months.

Featured image of DALL-E, TradingView chart

NEWSLETTER

NEWSLETTER