Bitcoin (BTC) returned to $29,000 on April 5 as data showed whale orders were guiding price action.

Analysis: BTC Price Momentum Remains a ‘Bear Market Rally’

Data from Cointelegraph Markets Pro and TradingView it followed BTC/USD when it reached $28,780 on Bitstamp.

The pair continued to rally from one-week lows below $27,300 at the start of the week, courtesy of rumors about cryptocurrency exchange Binance and its CEO, Changpeng “CZ” Zhao.

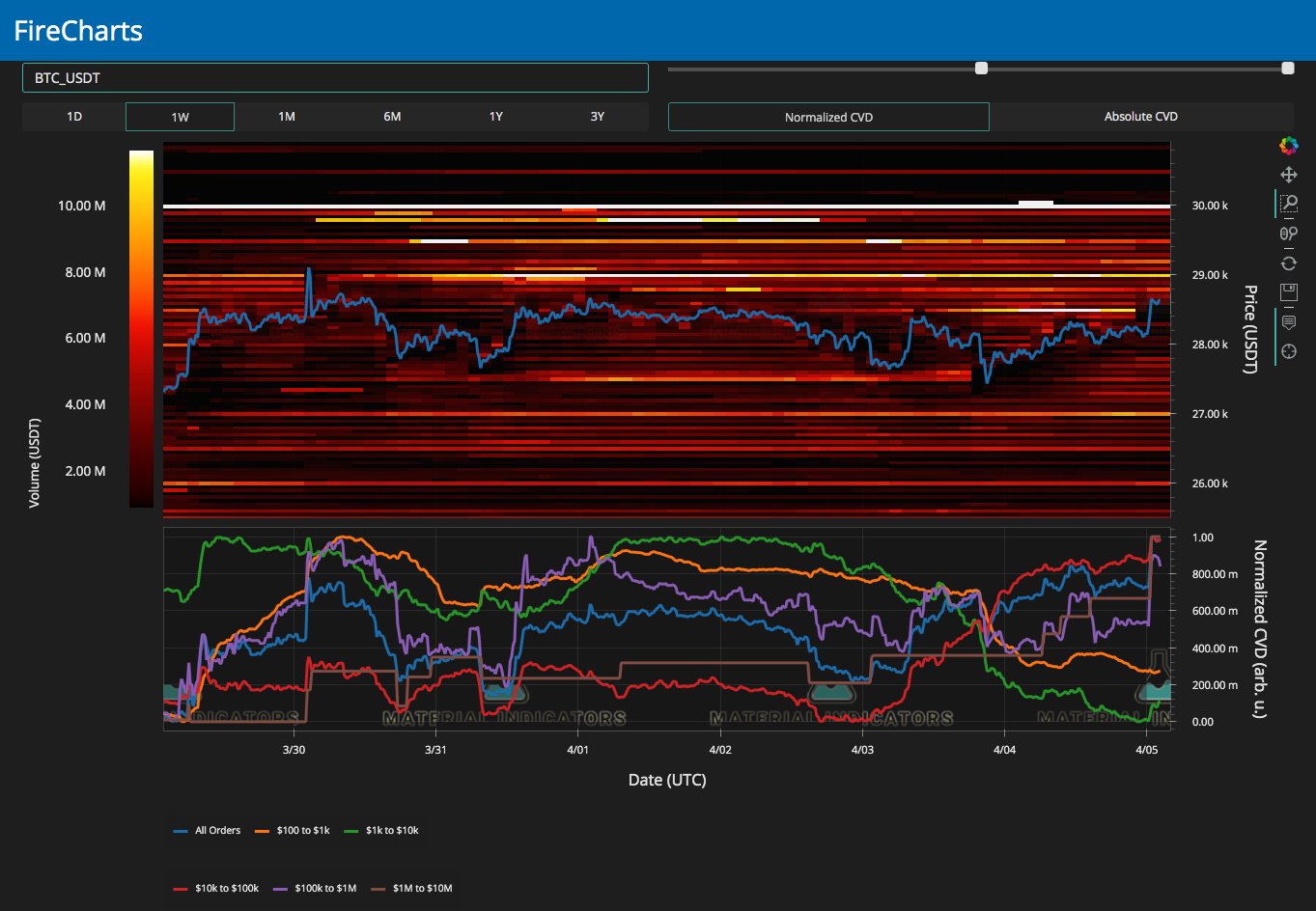

After rallying to $28,000, Bitcoin saw further momentum when Binance order book data showed high-volume “whale” traders were buying.

$BTC Binance Point

Keep an eye on the $28K area, those stacked buy walls will support the market buy here or pull back later.The offer is constantly filling up on these grips.

6K BTC bought in the last 1H candle pic.twitter.com/Dv7YzggCDu

— Skew Δ (@52kskew) April 5, 2023

This was not all it seemed to the bulls, however, the monitoring resource Material Indicators warned, as those same traders could be artificially pushing the market to sell closer to $30,000.

“Probably a choreographed attempt to increase the distribution range in the short term,” part of the attached comment. fixed.

“Personally I’m still treating this as #BearMarketRally until proven otherwise.”

a later print of the order book with liquidity levels showed that the spot price was being consumed in a dense cloud of requests, which could leave newcomers stranded who chose to go long on BTC believing that the advantage can continue.

Others were more hopeful that $30,000 could be a real challenge after being absent from the chart for nearly a year.

Among them was Michaël van de Poppe, founder and CEO of the trading firm Eight.

“Bitcoin seems eager to break the crucial $30K barrier, while altcoins are also waking up,” he said. said Twitter followers on the day.

“If Bitcoin does make that breakout, we will likely see a significant breakout across the board in altcoins as confidence returns to the markets.”

Related: Crypto winter may affect mental health of hodlers

Analytical account IncomeSharks was similarly bullish on altcoins, in particular, opting to trade BTC exposure for alternatives at current prices.

“I’ve been waiting all year for this,” he announced.

“If we can sustain this and keep pushing up, be prepared to not care what Bitcoin does and does multiple X’s on alts. Part of me selling some $BTC at $28,000 is that I want more exposure to alternatives.”

The day before, popular Crypto trader Tony had agreed that liquidity was “moving away” from Bitcoin in short time frames.

ETH Must Hold Crucial Range High

With that, the largest altcoin Ether (ETH) seemed poised for a $2,000 attack at the time of writing, having gained almost 5% in the last 24 hours.

Related: BTC Price Double Top Formation? 5 things to know about Bitcoin this week

Analyzing moves in ETH/USD, now at eight-month highs, trading suite DecenTrader noted that funding rates had already been hinting at the upside potential to come.

#ethereal The funding rate works perfectly as a leading indicator for multiple bullish moves. https://t.co/zypZt1kq5M pic.twitter.com/oYadIkIN44

— Descentrator (@descentrator) April 5, 2023

“The goal now is for Ethereum to stay above the $1,840 range high”, Crypto Tony aggregate in his own ETH/USD analysis.

“If we start to close lower, we have a deviation and we know what that means.”

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER