bitcoin (btc) hit lows below $41,700 after the Dec. 15 Wall Street open, as btc price action generated fresh selling pressure.

bitcoin resists SEC's Coinbase rejection

Data from Cointelegraph Markets Pro and TradingView showed that btc/USD sank more than $1,300, or 3.2%, on the day.

The largest cryptocurrency, freshly recovered from the previous day's sudden volatility, failed to hold firm at $43,000 as bitcoin bulls were denied bullish continuation.

The btc price weakness accompanied the news that the United States Securities and Exchange Commission had rejected a request from major exchange Coinbase to rework the rules for cryptocurrencies.

“Today, the Commission denied a Rulemaking Petition filed on behalf of Coinbase Global, Inc.,” a statement from SEC Chairman Gary Gensler read.

“I was pleased to support the Commission's decision for three reasons. First of all, existing laws and regulations apply to crypto securities markets. Second, the SEC also addresses crypto securities markets through rulemaking. Thirdly, it is important to maintain the Commission's discretion in setting its own regulatory priorities.”

The SEC is already involved in the current crypto market narrative thanks to expectations that it will approve the first US bitcoin spot price exchange-traded funds (ETFs) in early 2024.

in a crypto-regulation-video” target=”_blank” rel=”noopener nofollow”>interview In an interview with Bloomberg on December 13, Gensler acknowledged recent legal proceedings related to the agency's repeated rejections of bitcoin spot ETF applications.

The SEC, he said, “does things according to our authorities and how the courts interpret our authorities, and that's what we'll do here too.”

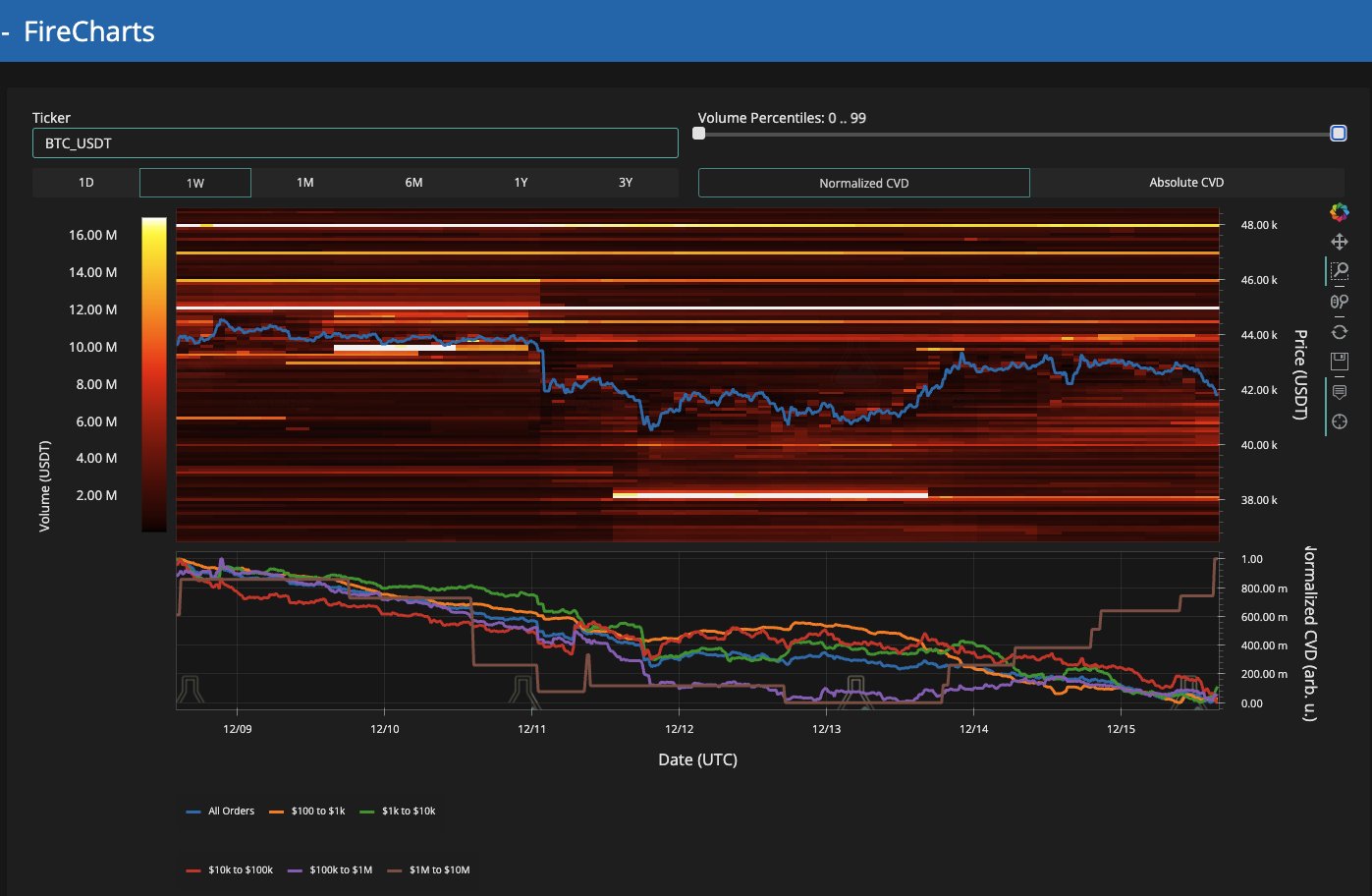

Analyzing the latest setup on the order books, popular trader Skew pointed to rising supply support that intensified at $41,000.

“From here it will be interesting to increase the depth of the offer around $41,000. Active offer of around $44,000”, part of a mail on X (Twitter) noted.

Further analysis highlighted that the low time frame exponential moving averages, or EMAs, are now back in play.

$btc 4H

Price is competing with the 4H EMAs again and the RSI is currently below 50, a major close is approachingthose spot offers align with the 4H 100EMA and 18D EMA

~ systematic offers https://t.co/L89Nl6pW12 pic.twitter.com/G6CD5zCfXy— Skew Δ (@52kskew) December 15, 2023

btc price rises on Fibonacci showdown

Meanwhile, Keith Alan, co-founder of trading resource Material Indicators, revealed an ongoing struggle to convert a key weekly level into support.

Related: US Dollar Hits 4-Month Low as bitcoin Trader Predicts 10% Drop Ahead

This came in the form of the 0.5 Fibonacci retracement line near $42,500, one of several key hurdles to overcome on the way to all-time highs of $69,000.

If we look at the #Fibonacci levels from the ATH to the macro low for bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin We are testing support within the Golden Pocket. That is bullish if the .5 Fib holds and leads to a break above the .618 level, but at the moment there seems to be a battle to hold… pic.twitter.com/b5J6ajKbjh

—Keith Alan (@KAProductions) December 15, 2023

Material indicators further showed that high-volume traders increased buying activity at the time of writing.

“Mega whales are buying and trying to recover $42,000,” summarized part of X's comment.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.