A bitcoin user paid 83.7 bitcoin (btc), worth $3.1 million, in transaction fees for transferring 139.42 btc. The $3.1 million transaction fee is the eighth highest in bitcoin‘s 14-year history.

The btc wallet ADDRESS bc1qn3d…wekrnl attempted to transfer 139.42 btc to bc1qyf…km36t4 on November 23, only to pay more than half the actual value in transaction fee. The destination address received only 55.77 btc. Mining pool Antpool captured the absurdly high mining fee on block 818087.

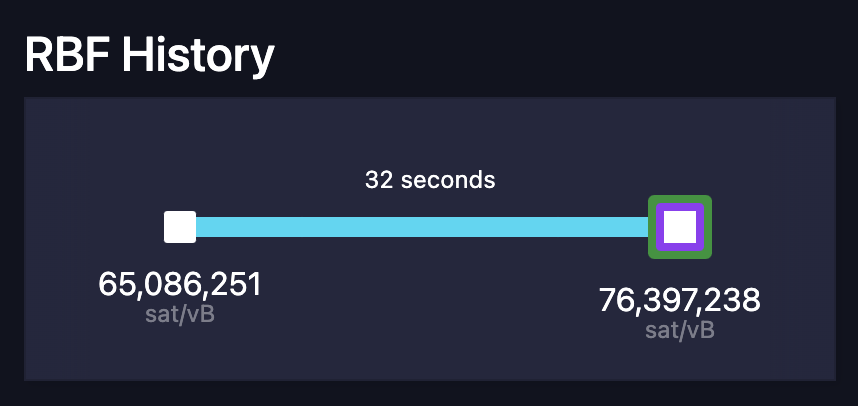

Users on social media suggested that the sender may have selected the high transaction fee, but the replace-for-fee (RBF) node policy and the sender’s unawareness also appear to have played a role. RBF allows an unconfirmed transaction in the mempool to be replaced by a different transaction that pays a higher transaction fee so that it is deleted sooner. The mempool is where all btc transactions are queued before being approved and added to the bitcoin blockchain.

A mempool developer who calls himself Mononaut on X (formerly Twitter) saying The user behind the transfer probably didn’t know that RBF orders cannot be cancelled. The user may have repeatedly replaced the rates in the hope of canceling them. RBF history indicates that the last replacement increased the fee by another 20%, adding 12.54824636 btc in fees.

This is not the first time a bitcoin user has accidentally submitted an absurdly high transaction fee for a single bitcoin transaction. In September, bitcoin exchange platform Paxos accidentally posted a $500,000 transaction fee for a $2,000 btc transfer. In that incident, the F2Pool miner who verified the transaction returned the $500,000 accidental transaction fee to Paxos.

However, this is the largest bitcoin transaction fee ever paid in dollar terms, knocking September’s $500,000 Paxos transfer off its unfortunate podium. The largest fee in terms of bitcoin was paid in 2016 when someone accidentally sent 291 btc in transaction fees.

Related: Binance DOJ settlement offers glimmer of hope for cryptocurrency industry

Mononaut told Cointelegraph that although the current case of an accidental transaction fee has similarities to the Paxos case, the possibility of Antpool returning the funds would depend on its own payment policies, “which could have implications for the obligations that have to share the transaction fees. with its miners.”

Antpool has yet to comment on the issue and has not yet responded to Cointelegraph’s requests for comment.

Magazine: Deposit Risk: What Do crypto Exchanges Really Do With Your Money?