bitcoin (btc) continues to hover around its highest levels in 18 months and bullish btc price predictions are coming: How far can the bull market go and how fast?

From a drop all the way to $20,000 and six figures in a few months, there’s a lot of variety when it comes to what bitcoin could do next, with November traditionally being one of its most volatile months.

The mood among cryptocurrency traders and analysts has improved over the past month after “Uptober” generated gains of nearly 30% in the price of btc.

Cointelegraph looks at five of the most popular targets for 2024 and beyond. Stock-to-Flow may not have become a reality, at least for now, but $250,000 is still on the radar.

Matrixport predicts $45,000 in two months

A lot can happen in bitcoin in a short space of time, and with less than two months until 2024, there is plenty of time for new btc price volatility to take hold.

Before the close of the annual candle, some say, btc/USD will be higher than today, to the tune of another 30%.

That prediction came from Matrixport, the cryptocurrency trading company founded by Jihan Wu, co-founder of bitcoin mining giant Bitmain.

Related: 4 Signs bitcoin Is Starting Its Next Bull Run

in a blog entry In late October, Matrixport doubled its year-end price target of $45,000 that it originally revealed in January. It was based on a handful of internal models, and Matrixport also successfully predicted bitcoin gains in October.

“bitcoin is breaking through July’s $31,500 resistance level, showing that $45,000 can be reached by the end of the year,” he summarized.

btc/USD is currently trading at around $34,500, according to data from Cointelegraph Markets Pro and TradingViewmeaning the year-end level requires another 30% boost.

BitQuant: New all-time high before halving, $250,000 after

For many, the halving is a defining moment in every bitcoin price cycle, but one well-known commentator believes new all-time highs will arrive even before then.

In September, BitQuant stated that btc/USD would surpass its current peak of $69,000 before April 2024.

He told X subscribers:

“No, bitcoin will not peak before the halving. Yes, it will reach a new all-time high before the halving. No, btc is not going to reach $160,000 because the magnitude of each setback is large. This means it will peak after the halving, in 2024. And yes, the price target is around $250,000.”

Both the all-time high and the post-halving $250,000 target came courtesy of Elliott Wave charts, with bitcoin mimicking the behavior of previous cycles.

BitQuant, however, left room for a total of four “pullbacks” on the way to the quarter-million mark.

“There will be a pullback before reaching a new all-time high, followed by another pullback around $125,000. Furthermore, there will be two more setbacks after the halving, which are not demonstrated here,” he stated. aggregate in X interactions.

Three btc price models, a $130,000 target zone

bitcoin all-time high predictions aren’t just coming from individual market participants – btc price models are also turning bullish.

Last month, Cointelegraph reported on a variety of forecast tools focusing on an area around $130,000 per bitcoin.

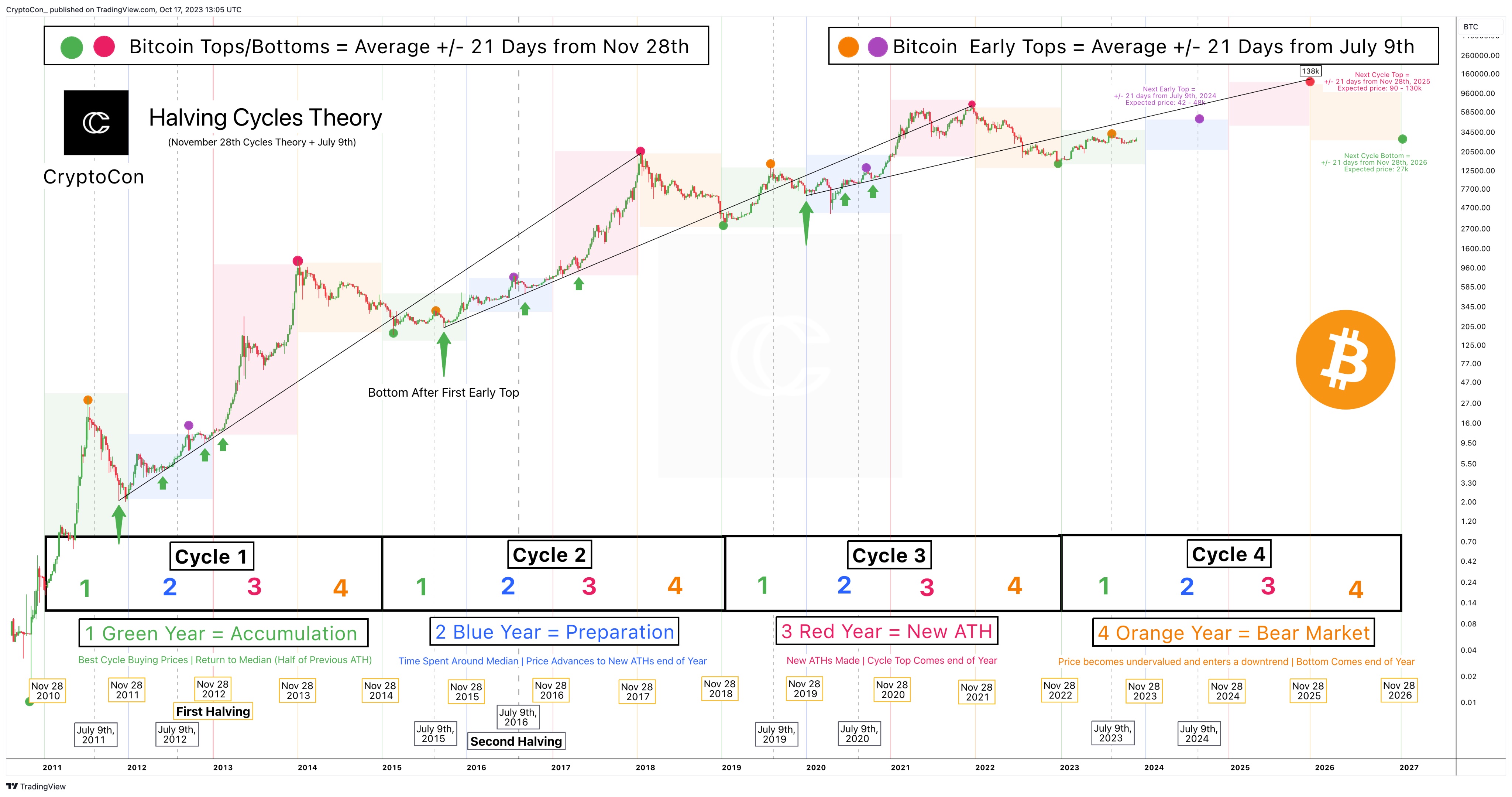

These come from popular analyst CryptoCon, who, however, believes that a six-figure btc price may take two years to become a reality.

“I’m prepared for lower prices, but the stars are aligning at 130k for bitcoin this cycle!” he wrote in an X thread about the model data.

The concept also revolves around halving events, and the next peak should come about four years after the move to $69,000 in November 2021.

The million dollar question

It’s no secret that some believe a $1 million btc price is just a matter of time.

Related: New btc Price Breakouts Have bitcoin Traders Confirm Targets as High as $48,000

This year, Cathy Wood, founder, CEO and CIO of asset management company ARK Invest, teamed up with former BitMEX CEO Arthur Hayes to double down on seven-figure bitcoin.

When this might happen is understandably a matter of debate, but changing macroeconomic tides have emboldened what remains a bold btc price prediction.

In October, Hayes maintained that the path to $1 million per bitcoin was “in full effect” thanks to macro reality.

“If people lose faith in the bond market and in this artificial fiat construct that we have created over the last 80 to 100 years – this global economy and how it has been structured – if we lose confidence in that, then the amount of money that is intended to look for an alternative will be something we have never seen before,” he said in a interview with Blockworks’ “On The Margin” podcast on November 1st.

For his part, Wood bitcoin–btc-is-digital-gold-as-deflation-hedge” target=”_blank” rel=”noopener nofollow”>saying in an interview with Bloomberg on Nov. 3 that she would “without a doubt” choose bitcoin over gold as a hedge against inflation.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER