Bitcoin (BTC) price topped $22,500 on January 20 and has been able to defend that level ever since, racking up gains of 40.5% in the month of January. The move accompanied improvements in the stock market, which also rallied after China lifted COVID-19 restrictions after three years of strict pandemic controls.

E-commerce and entertainment companies lead the market so far this year. Warner Bros (WBD) added 54%, Shopify (SHOP) was up 42%, MercadoLibre (MELI) was up 41%, Carnival Corp (CCL) was up 35% and Paramount Global (PARA) posted a 35% gain year-to-date. moment. Corporate earnings continue to attract investor buzz and attention after oil producer Chevron posted the second-biggest annual profit ever, at $36.5 billion.

More importantly, analysts expect Apple (AAPL) to post a mind-boggling profit of $96 billion for 2022 on February 2, vastly surpassing the $67.4 billion profit reported by Microsoft (MSFT). Strong earnings also help validate current stock valuations, but don’t necessarily guarantee a brighter future for the economy.

A more favorable scenario for risky assets came largely from a decline in leading economic indicators, including homebuilder surveys, trucking surveys and hiring purchasing managers’ index (PMI) data, according to Evercore ISI Senior Managing Director, Julian Emmanuel.

According to research from financial services firm Matrixport, US institutional investors account for about 85% of recent buying activity. This means that the big players “are not giving up on crypto.” The study considers returns that occur during US business hours, but expects altcoins to outperform relative to Bitcoin.

On one hand, Bitcoin bulls have reason to celebrate after its price rallied 49% from the $15,500 low on Nov. 21, but bears still have the upper hand on a longer time frame as BTC is down 39% in 12 months.

Let’s look at Bitcoin derivatives metrics to better understand how professional traders are positioning themselves in current market conditions.

Demand for Asia-based stablecoins approaches the FOMO region

The USD Coin (USDC) premium is a good indicator of demand from China-based retail cryptocurrency traders. Measures the difference between China-based peer-to-peer transactions and the US dollar.

Excessive buying demand tends to push the gauge above 100% fair value, and during bear markets, the stablecoin’s market supply is flooded, causing a discount of 4% or more.

The USDC premium currently sits at 3.7%, down from the 1% discount of two weeks earlier, indicating much stronger demand to buy stablecoins in Asia. The indicator shifted gears after the 9% rally on January 21, sparking excessive demand from retailers.

However, one must dive into the BTC futures markets to understand how professional traders position themselves.

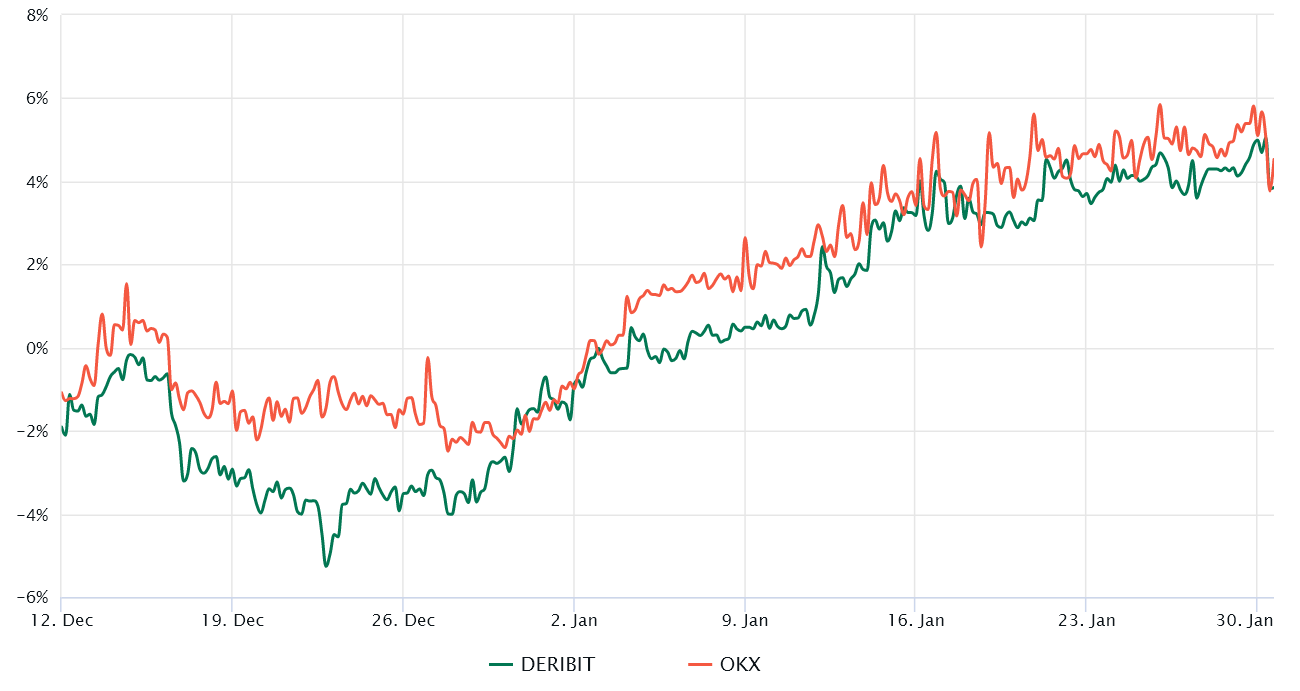

The futures premium has been neutral since January 21.

Retail traders often avoid quarterly futures because of the difference in prices from the spot markets. Meanwhile, professional traders prefer these instruments because they avoid the fluctuation of funding rates in a perpetual futures contract.

The annualized 3-month futures premium should trade between +4% and +8% in healthy markets to cover costs and associated risks. Therefore, when futures trade below said range, it shows a lack of confidence from leveraged buyers, which is generally a bearish indicator.

The chart shows positive momentum for the Bitcoin futures premium after the basic indicator breached the 4% threshold on Jan. 21, the highest in five months. This movement represents a drastic change from the bearish sentiment presented by the discount (backwardation) of futures present until the end of 2022.

Related: Bitcoin price is up, but BTC mining stocks could remain vulnerable throughout 2023

Traders are watching to see if the Fed broadcasts plans to pivot

While Bitcoin’s 40.5% gain in 2023 looks promising, the fact that the tech-heavy Nasdaq Index is up 10% in the same period raises suspicions. For example, the street consensus is a lynchpin of the Federal Reserve’s interest rate hike campaign sometime in 2023.

Demand for Bitcoin derivatives and stablecoins surpassed panic levels, but if the Fed’s expected soft landing occurs, the risk of a recessionary environment will constrain stock market performance and hurt the appeal of “inflation protection.” “Bitcoin.

Currently, the odds favor the bulls, as leading economic indicators show a moderate correction, enough to ease inflation, but not especially worrisome, as strong corporate earnings confirm.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER