Bitcoin (BTC) hit key liquidity for the third time on Jan. 29 as the weekly and monthly closes loomed.

Bitcoin Trader: $25,000 “On Demand”

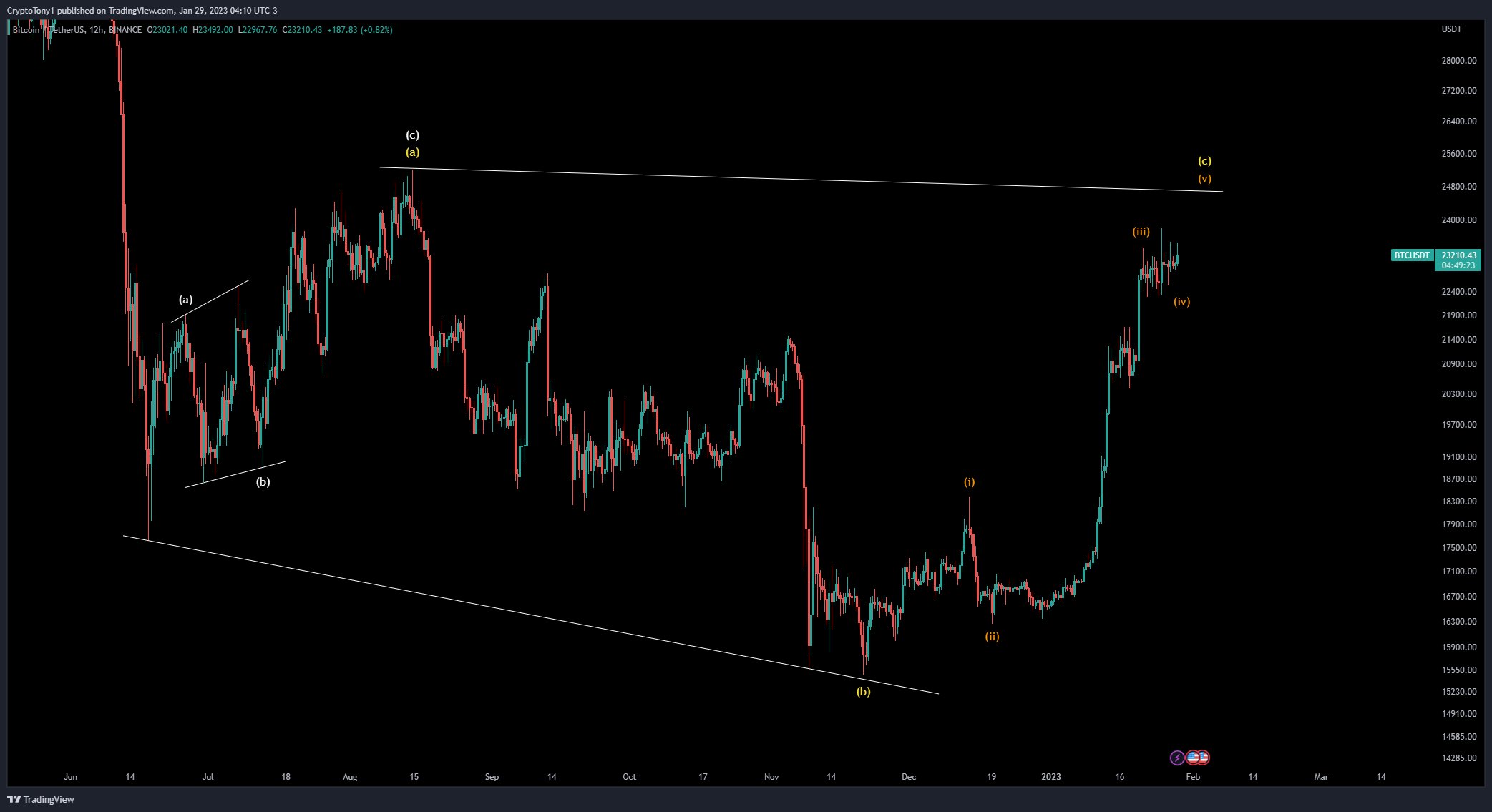

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD briefly reached $24,498 on Bitstamp overnight.

Though short-lived, the move marked the pair’s third attempt to push sell-side liquidity above $23,400 in recent days.

In each case, the bulls seemed to lack the momentum to reclaim new support levels. At the time of writing, the status quo remained the same, with Bitcoin trading just below liquidity at $23,250.

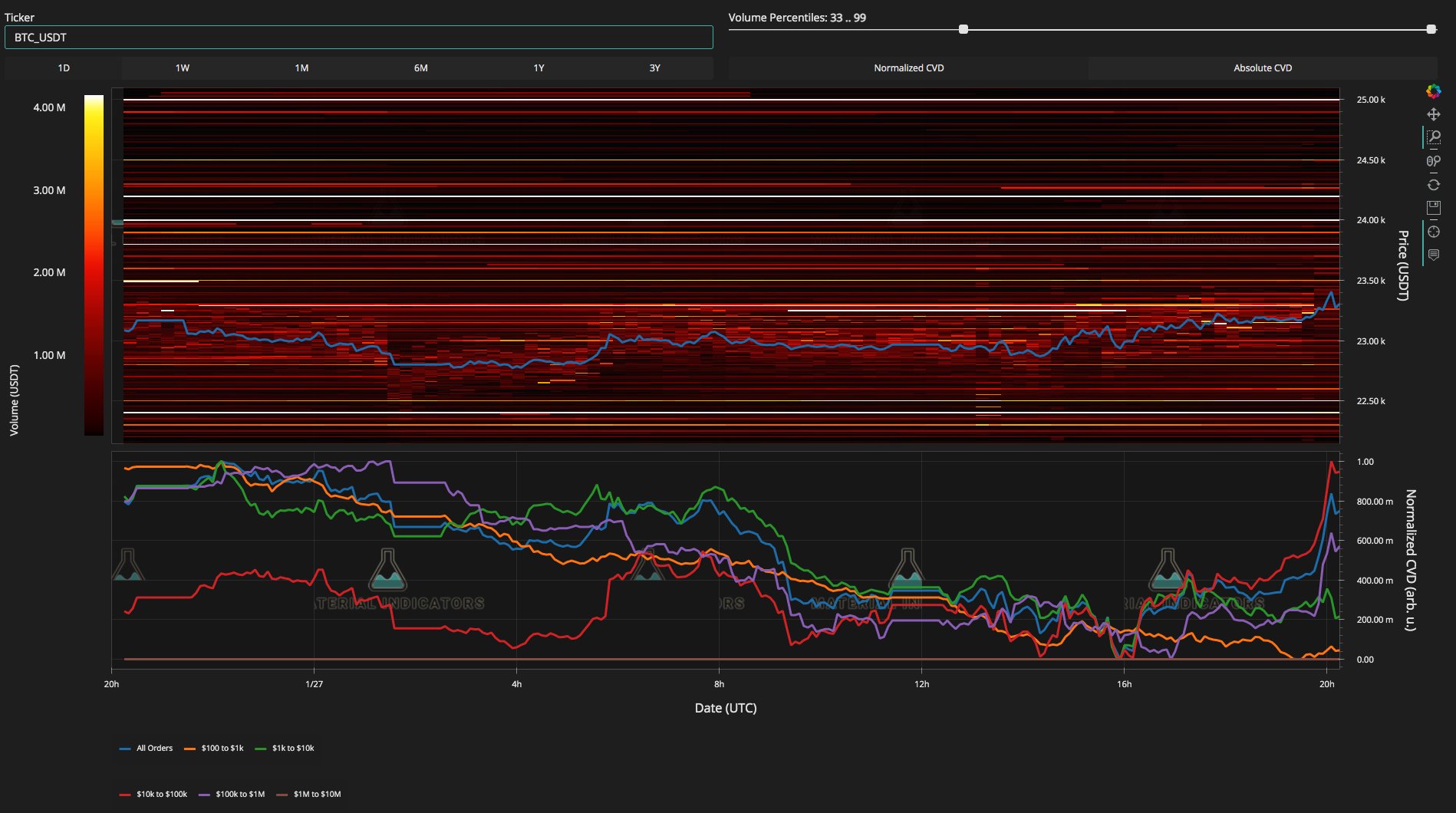

Previous Binance Order Book Data uploaded to Twitter by monitoring the Resource Material Indicators demonstrated the firepower needed to neutralize the bears.

As of Jan 27, resistance was building up at $23,200, $24,500, and $25,000, however the latter is still on traders’ radar as a potential next target.

“$25,000 Target in Sight,” a Confident Crypto Tony saying Twitter followers in the comments of the day.

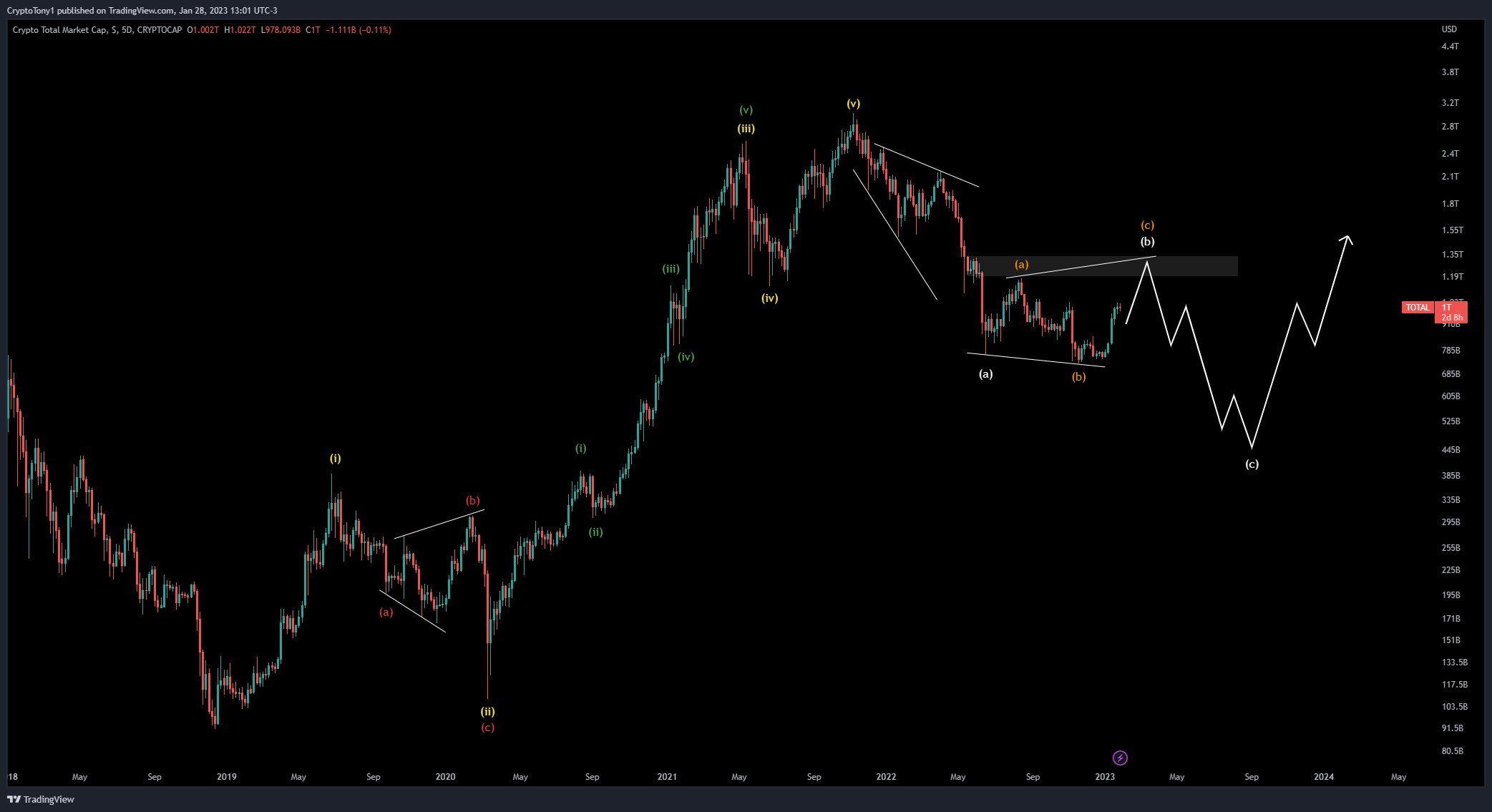

Crypto Tony was also expecting a move higher in altcoins, with the total crypto market capitalization set for a new stress test above the $1 trillion mark.

“Still looking for a decent move over the next few weeks BUT watch out when we start to touch the $1.2 – $1.33 trillion market cap resistance level. This is a significant level and I expect strong resistance here,” he said. wrote it’s january 28

However, like others, Crypto Tony remained cautious on longer time frames, keeping the door open for a new macro low to appear in Bitcoin and altcoins sometime in 2023.

Among them is fellow commentator Il Capo de Crypto, who, in a to update on the day, he avoided technical analysis to claim that BTC was still “short and strong.”

“Interesting week ahead,” he added.

The best January in a decade?

At current prices, BTC/USD looked set to close out the week at its highest levels since mid-August 2022.

Related: Bitcoin ‘so bullish’ at $23K as analyst reveals new BTC price metrics

With the ramifications of the FTX crash absent from the charts, January gains stood at 39.8% at time of writing, the bulk of Bitcoin. profitable January since 2013.

In addition to the monthly close, next week we will see further potential macroeconomic triggers out of the United States as the Federal Reserve decides on its latest interest rate hike.

This and more will appear in the next issue of the Cointelegraph Markets newsletter, published on January 30. Sign up to receive it for free below.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER