After its last halving event,bitcoin” target=”_blank” rel=”nofollow”> bitcoin It sent a positive signal to the entire cryptocurrency market. Historically, this large drop in supply has been linked to significant price increases, which has inspired hope among investors.

Related reading

The halving, which reduced the rate of new bitcoin creation, has actually slowed the flow of new bitcoins into the market. This sudden drop in supply, coupled with growing interest from institutions and wider usage, is likely to push bitcoin prices higher.

Many investors are closely watching this dynamic and expect a similar trend in the near future; previous halvings have sometimes followed significant price rebounds.

bitcoin: Investors' attitudes change

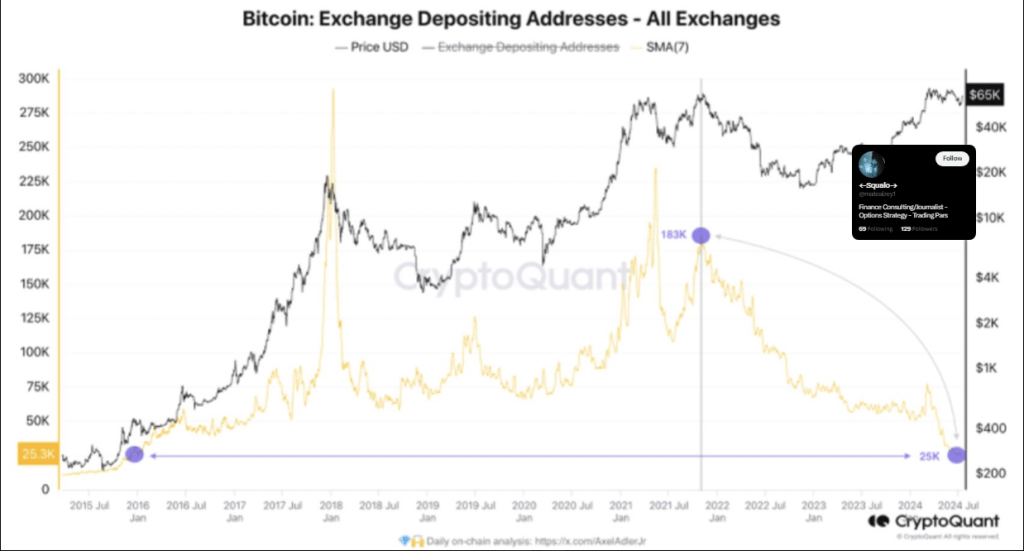

The substantial decrease in the number of new deposit addresses on cryptocurrency exchanges marks a clear trend in the bitcoin market. Data from the well-known analytics tool bitcoin?utm_source=twitter&utm_medium=sns&utm_campaign=quicktake&utm_content=axeladlerjr” target=”_blank” rel=”nofollow”>Cryptoquantity shows that only 25,000 bitcoin deposits exist instead of the recently recorded 70,000. This decrease in selling pressure denotes a shift in investor behavior towards holding rather than trading their Bitcoins.

<blockquote class="twitter-tweet”>

Investors are not willing to sell twitter.com/hashtag/bitcoin?src=hash&ref_src=twsrc%5Etfw” rel=”nofollow”>#bitcoin

“A lower willingness to sell assets could lead to a reduction in the supply of bitcoin on the market, which, with constant or increasing demand, can cause price increases.” – By twitter.com/AxelAdlerJr?ref_src=twsrc%5Etfw” rel=”nofollow”>@AxelAdlerJr

Full post https://t.co/HdipPeIh6h image.twitter.com/jhNDHiSKst

— CryptoQuant.com (@cryptoquant_com) twitter.com/cryptoquant_com/status/1815646396097147053?ref_src=twsrc%5Etfw” rel=”nofollow”>July 23, 2024

According to CryptoQuant analyst AxelAdlerJr, this decrease in selling pressure denotes a shift in investor behavior towards holding rather than trading their Bitcoins.

This behavior shows that the market is mature. As investors have more faith in the long-term value of bitcoin, they are transacting less and spending more steadily, which could make the market less volatile and more stable. This trend shows that buyers are starting to see bitcoin as an asset with value, not just a way to speculate, which is good news for the cryptocurrency.

Institutional trust and market psychology

As more and more investment firms pour money into bitcoin, everything has changed. Large investment firms and institutional investors provide legitimacy and security to the market, which can affect the way ordinary people think about investing. Big players can inspire confidence and long-term thinking among smaller investors.

This dynamic is greatly reinforced by behavioural economics. The activities and confidence levels of additional institutional investors entering the market can affect individual investor sentiment. This phenomenon can generate a positive feedback loop whereby increased confidence stimulates further investment.

Related reading

An important statistic that highlights this shift in investor sentiment is the decline in deposit addresses. This implies that, in anticipation of better future prices, investors are less willing to sell their bitcoins. This line of thinking, supported by both lower supply and higher demand from institutional and individual investors, fits with the growing belief that the price of bitcoin will continue to rise.

Featured image from Pixabay, chart from TradingView

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>