bitcoin (btc) attempted to hit 18-month highs through Nov. 21 as order book activity gave one analyst a feeling of deja-vu.

Whale Games Evoke bitcoin‘s Q1 2023

Data from Cointelegraph Markets Pro and TradingView showed that btc price momentum was increasing to reach a high of $37,770 the previous day.

bitcoin, now hovering around $37,400, remained in a range that also characterized the second week of the month.

However, for on-chain monitoring resource material indicators, the market looked more like the first quarter of this year, the period that marked the start of bitcoin‘s recovery from post-FTX lows.

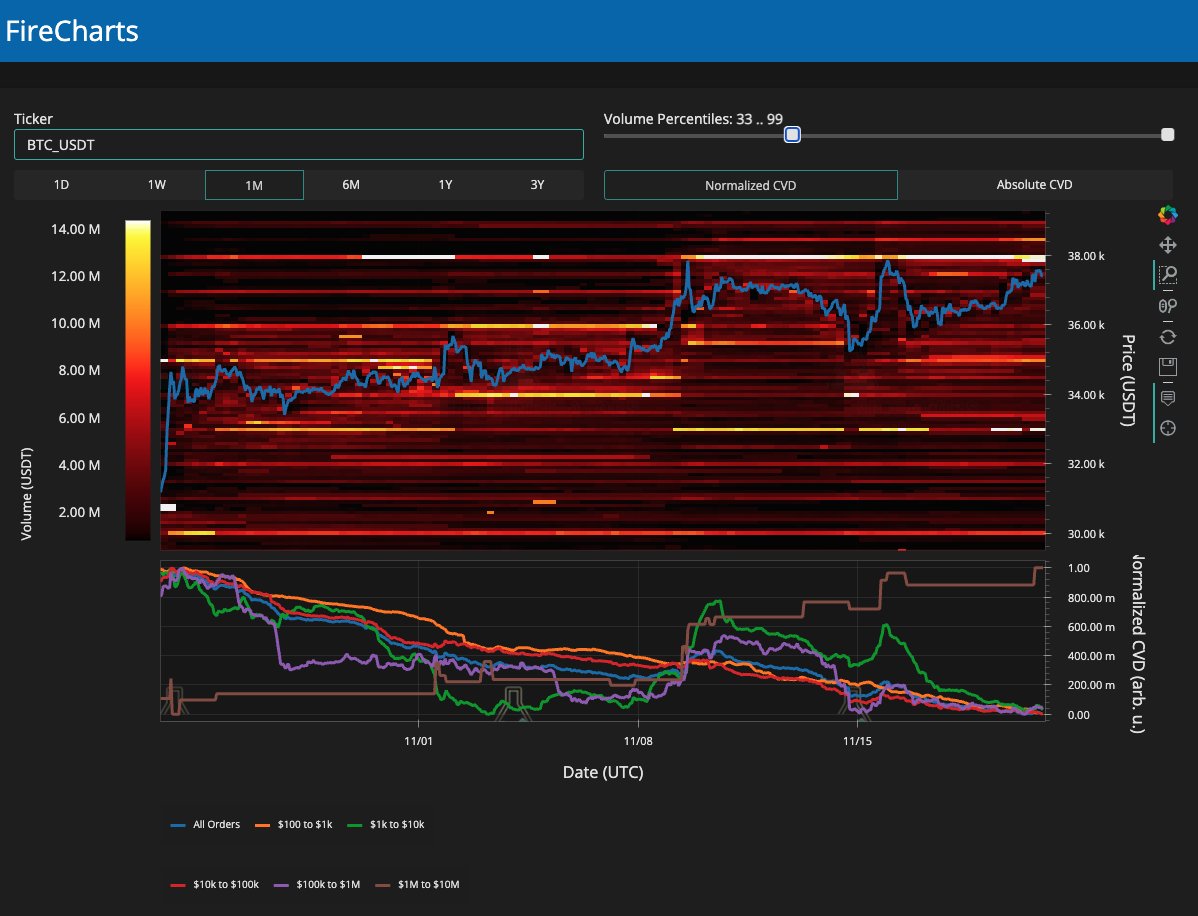

Analyzing order book data, it suggested that a major liquidity provider it informally called “Notorious BID” at the time could be shaping supply support once again.

Specifically, the liquidity of the offering had come and gone by $33,000 “7 times in the last 30 days,” said X subscribers.

“I can’t confirm if this is the entity I called Notorious BID in the first quarter, but I can tell you that we have seen this game before.”

An accompanying snapshot of btc/USDT liquidity also showed sellers lining up at $38,000 and immediately below.

Among whales, the largest order class (between $1 million and $10 million) was the only active cohort, while others unanimously decreased exposure throughout the week.

Commenting on the situation, Material Indicators co-founder Keith Alan argued that the entities behind the buy orders could be more organized than simple high-volume speculators.

The $33k supply wall disappeared AGAIN and Brown MegaWhales bought resistance at the local high AGAIN.

If you think megawhales have problems with time, reread the thread I shared from @MI_Algos.

It is unknown how long they will keep this game going. Of course, I have my theory about… pic.twitter.com/sEZuvSgWIs

-Keith Alan (@KAProductions) November 20, 2023

‘Quick failure’ could follow $40,000 hit

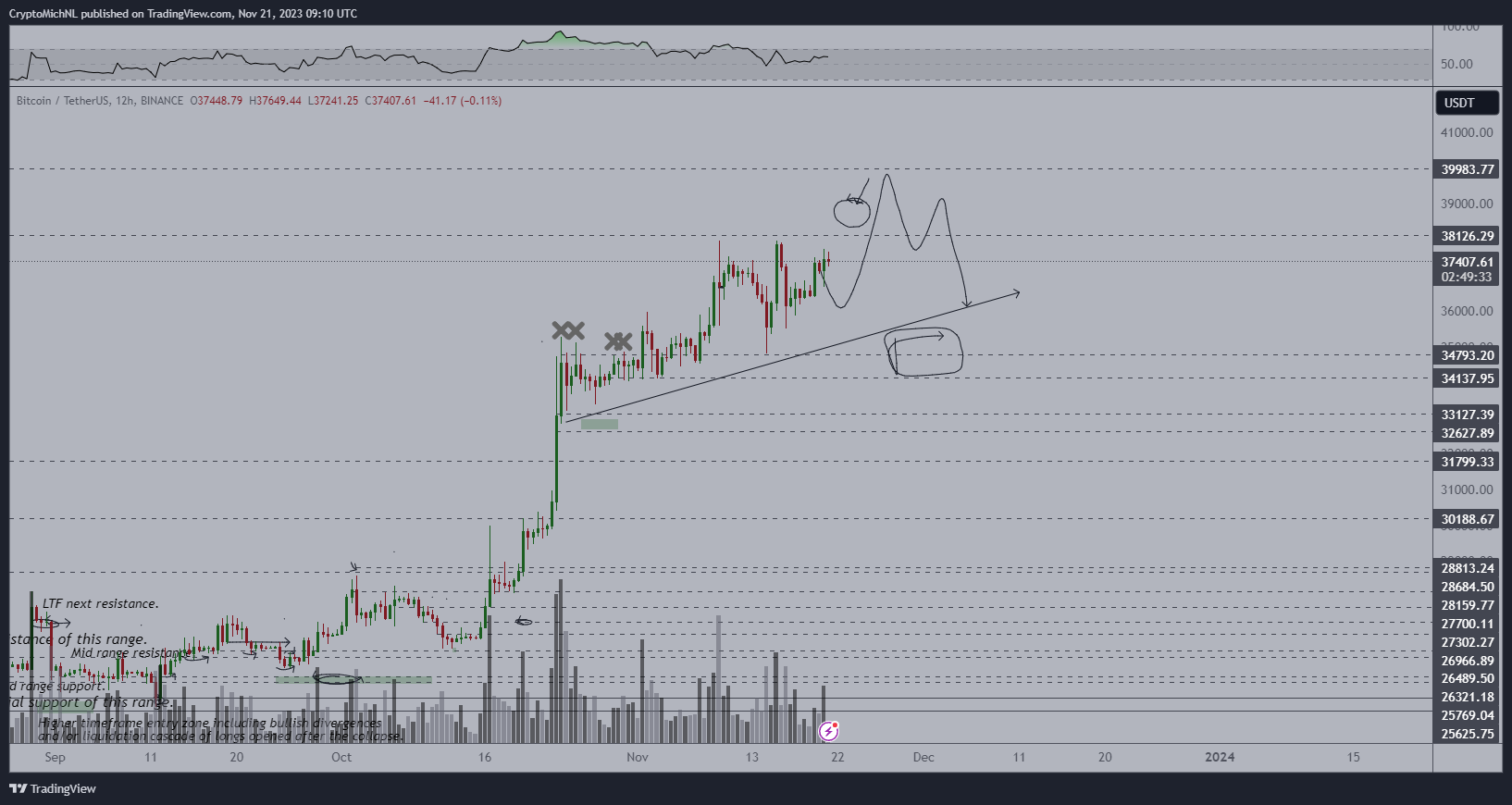

Meanwhile, predicting what might come next, Michaël van de Poppe, founder and CEO of trading firm Eight, refused to take $40,000 off the table.

Related: 70% btc idle for a year: 5 things you should know about bitcoin this week

“bitcoin continues to go higher and higher. Making higher lows and attacking resistance for the fourth time,” he said. commented at night events.

“I wouldn’t be surprised by a breakout to $40,000 and then a quick breakout again. Keep buying sauces!

Popular analyst Matthew Hyland warned that the Relative Strength Index (RSI) could risk generating a bearish divergence with the price if the latter fails to break above the current 18-month highs just below $38,000.

At the time of writing, the bulls were still unable to gather the necessary momentum.

bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin everything is still going according to plan

Price and RSI are rising

Both will need to reach higher highs to avoid any opportunity for a bearish divergence.

Will continue to update this situation: https://t.co/yNCi1fBuz2 pic.twitter.com/1XxPhiDd28

– Matthew Hyland (@MatthewHyland_) November 21, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER